Economic fluctuations act at frequencies that range from the hourly or even minute-by-minute level – such as shifts in electricity demand due to temperature fluctuations – to shocks that last for decades or longer – such as large-scale technological changes. While economic policy can do little to change factors like the temperature at a particular time of day, it can affect the behaviour of the economy at a certain range of frequencies – for example by trying to stabilise the business cycle or encourage innovation that affects long-run growth rates.

To know where we should focus our attention in setting optimal policies, it is critical to know how averse people are to different kinds of economic fluctuations. If consumers are most averse to fluctuations at frequencies associated with the business cycle (cycles of 2–8 years), then reducing the size of business cycles should be the primary focus of stabilisation policy. On the other hand, if consumers seem less worried about business-cycle related frequencies than lower- or higher-frequency risks, then policies that affect the business cycle (e.g. monetary policy) are less important for welfare.

Consumer preferences over consumption volatility at different frequencies

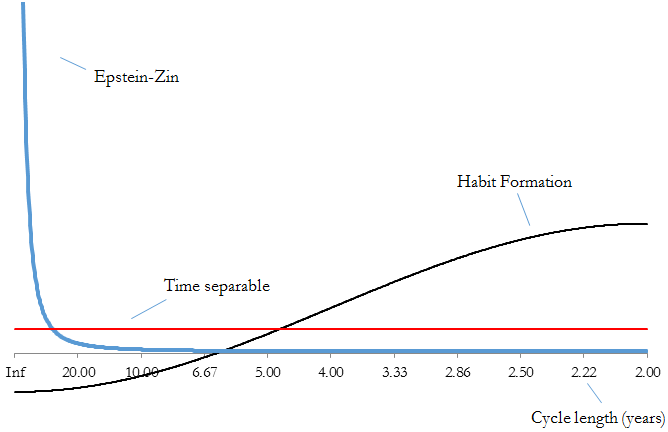

Our standard models of consumer behaviour have strong implications for how costly uncertainty is at different frequencies. For example, if consumers have habit-forming preferences – i.e. if past consumption is a complement for current consumption, as in Constantinides (1990) and Abel (1990), for example – they are relatively more averse to high-frequency fluctuations in consumption than to lower-frequency shocks. For a person with habit-forming preferences, a shift in consumption that happens slowly over many years – such as would result from a long-term change in average economic growth rates – is much easier to swallow than a similarly sized shift in consumption that must take place over a single day. Consequently, consumers with these preferences are more willing to pay for insurance (in practice, by adjusting their investment portfolios) for high- than for low-frequency shocks.

To help make this intuition more concrete, Figure 1 plots what we refer to as spectral risk prices in Dew-Becker and Giglio (2013). Spectral risk prices represent how much money people are willing to pay to avoid shocks to their consumption growth at different frequencies. The black line shows that under habit formation, a person’s aversion to consumption shocks smoothly increases with the frequency of the shock, with the highest-frequency shocks being the most painful (i.e. people are willing to pay a lot to insure against them). The red line, on the other hand, is totally flat and shows that when consumers have preferences over consumption that are completely independent across time, they are equally averse to shocks at all frequencies.

Although time-separable and habit-forming preferences are relatively simple to understand, they are less commonly studied in the recent literature, especially in work that focuses on asset pricing. To help match the behaviour of asset markets, consumers are now often modelled as having the generalised recursive preferences of Kreps and Porteus (1978) and Epstein and Zin (1989). Under Epstein–Zin preferences, long-run risks play a large role in the economy. Figure 1 shows just how large this role is (blue line). The prices of fluctuations at the lowest frequencies are orders of magnitude higher than those at relatively higher frequencies – people are most fearful of permanent or quasi-permanent shocks to consumption growth. In fact, under a standard calibration of the model, half the mass of the frequency-specific pricing function in Figure 1 lies on cycles of 230 years or more.

Figure 1.

Note: the figure reports the prices of risks at different frequencies under different utility specifications. The price of risk corresponds to the aversion with respect to fluctuations at that frequency. The graph reports long cycles (low frequencies) on the left, and progressively shorter cycles (higher frequencies) moving to the right.

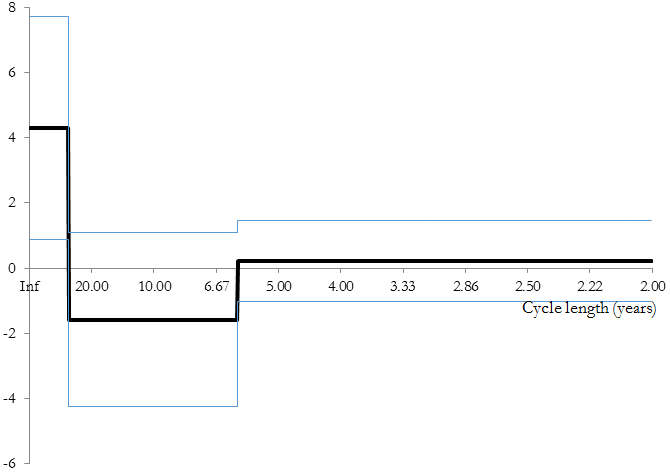

Estimating preferences from stock-market returns

While an analysis of the implications of different utility functions can be of interest to economic theorists, an obvious question to those with more applied interests is which of these characterisations of consumers’ aversion to shocks across frequencies actually describes the world. Figure 2 shows estimates of the frequency-specific risk prices based on an analysis of returns on US stocks with 95% confidence intervals (Dew-Becker and Giglio 2013). While our analysis cannot deliver estimates of risk prices at every individual frequency (which is really an infinite number of risk prices), we are able to split the range of frequencies into three bands – business-cycle frequencies between 6 and 32 quarters, and ranges above and below the business cycle. Figure 2 clearly shows that the risk prices are estimated to be highest in the low-frequency range. Consumers seem most averse to relatively long-run shocks, broadly defined, rather than high-frequency fluctuations, suggesting that Epstein–Zin preferences are a reasonable description of behaviour.

Figure 2.

Note: the figure (centre line) reports the prices of risks at different frequencies as estimated from asset markets. The graph reports long cycles (low frequencies) on the left, and progressively shorter cycles (higher frequencies) moving to the right. The thin lines represent 95% confidence intervals.

Implications for stabilisation policy

Figure 2 tells us more than simply what utility function is a better description of the behaviour of investors in the stock market, though. It shows that the fluctuations that consumers are most worried about – the ones they are most willing to pay to avoid – are very low-frequency fluctuations – economic cycles that last tens or hundreds of years. But the vast majority of the research on the stabilisation of the economy focuses on stabilising the business cycle. For example, in standard models (including New Keynesian models which study the role of monetary policies, e.g. Smets and Wouters 2007), monetary policy cannot and does not aim to affect the long-run potential of the economy at all. The Federal Reserve is viewed as simply smoothing out inflation and unemployment over the business cycle.

The pricing of risks in the stock market, as summarised by Figure 2, tells us that, in fact, smoothing out the business cycle is relatively less important to investors than trying to reduce uncertainty about long-run growth rates. If the only thing that monetary policy does is to reduce the size of the business cycle, then it is simply not that important to consumers – if business cycles were important, people would be willing to pay more to insure themselves against shocks at frequencies associated with business cycles.

But if stabilisation of the business cycle on the part of the Federal Reserve is not that important for consumer welfare, then perhaps the massive structure and budget of central banks (including nearly $700 million spent annually by the Federal Reserve System on monetary policy) could be reduced. Combined with Figure 2, mainstream macroeconomic theory suggests that the work done by the Federal Reserve is all to stabilise the economy at frequencies that consumers simply do not care about.

The potential impact of monetary policy on long-run fluctuations

Perhaps, though, the Federal Reserve’s mission can be resuscitated. In order for the central bank to matter, it must be the case that monetary policy has effects on the economy at long horizons. Kung and Schmid (2013) describe exactly this possibility. Their argument is that in recessions firms do less of the types of investment that leads to long-term economic growth. Recessions are then not just temporary downturns. They are periods when R&D spending and innovation slows. By reducing the size of business cycles, then, the Fed might also be helping to minimise losses in output at much lower frequencies. The jury is still out on whether Kung and Schmid’s model is a reasonable description of the world as it exists – we need more empirical work to know for sure. Regardless, though, the Federal Reserve’s policies only affect consumer welfare to the extent that they can smooth out very long-run fluctuations. Therefore, they should focus on the effects of their policies on those frequencies, rather than taking trend growth rates as given and limiting themselves to smoothing out output and consumption at business-cycle frequencies.

References

Abel, Andrew B (1990), “Asset Prices under Habit Formation and Catching up with the Joneses”, The American Economic Review 80: 38–42.

Constantinides, George M (1990), “Habit Formation: A Resolution of the Equity Premium Puzzle”, Journal of Political Economy 98: 519–543.

Dew-Becker, Ian and Stefano Giglio (2013), “Asset Pricing in the Frequency Domain: Theory and Empirics”, NBER Working Paper No. 19416.

Epstein, Larry G and Stanley E Zin (1989), “Substitution, Risk Aversion, and the Temporal Behavior of Consumption and Asset Returns: A Theoretical Framework”, Econometrica 57: 937–69.

Kreps, David M and Evan L Porteus (1978), “Temporal resolution of uncertainty and dynamic choice theory”, Econometrica 46: 185–200.

Kung, Howard and Lukas Schmid (2013), “Innovation, Growth and Asset Prices”, Duke University Working Paper.

Smets, Frank and Rafael Wouters (2007), “Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach” The American Economic Review 97: 586–606.