Cryptocurrencies have been a staple of news headlines in 2017. As the price of one Bitcoin has risen 12-fold in sterling terms during the course of 2017, the number of Google searches for Bitcoin has increased 14-fold. There are now more than 2,000 cryptocurrency ATMs across the globe, with the US (1,107), Canada (293), the UK (97) and Austria (91) leading the way.

A great deal has been written about Bitcoin, in many cases speculating on whether there is a bubble in its price and what might happen if and when the bubble bursts. A Google search for “Bitcoin bubble” produces 17.8 million page hits. The latest CFM-CEPR survey eschews the bubble question and asks instead whether cryptocurrencies are a threat to the financial system and therefore deserving of greater regulatory oversight by policy-makers.

Cryptocurrencies and the financial system

In 2012, a working paper published by the ECB concluded that, in the current situation, virtual currency schemes:

- do not pose a risk to price stability, provided that money creation continues to stay at a low level;

- tend to be inherently unstable, but cannot jeopardise financial stability, owing to their limited connection with the real economy, their low volume traded and a lack of wider user acceptance. (ECB 2012)

The ECB returned to the theme in a working paper in 2015:

For the tasks of the ECB as regards monetary policy and price stability, financial stability, promoting the smooth operation of payment systems, and prudential supervision, the materialisation of risks depends on the volume of virtual currency issued, their connection to the real economy – including through supervised institutions involved with virtual currencies – their traded volume and user acceptance. For the moment, all these risk drivers have remained low, which implies that there is no material risk for any of the central bank’s tasks as yet. (ECB 2015)

The main argument of the ECB and other central banks1 is that cryptocurrencies are too small and too detached from other financial markets to be a systemic risk. As reported by the Wall Street Journal, the top 1,000 or so cryptocurrencies are worth $350 billion, less than Facebook Inc., and if they all went to zero tomorrow, banks would barely notice it.2

One reason for cryptocurrencies remaining small is current technological constraints, which show up as high transaction fees and limit the use of cryptocurrencies as a medium of exchange.3 The maximum seven transactions per second capacity of Bitcoin compares with a peak processing capacity of 47,000 transactions per second at Visa. Chiu and Koeppl (2017) estimate that the current Bitcoin scheme generates a flow welfare loss of 1.4% of consumption in a general equilibrium monetary model.

A less sanguine view is that Bitcoin’s increasing market capitalisation and trading volumes reflect accelerating professionalisation of investment in cryptocurrency markets, leading to a disruption of financial markets that poses risks for the stability of prices and the financial system.

In the latest evidence that cryptocurrencies are pushing deeper into the mainstream, recent months have seen asset management company Tobam launching Europe’s first Bitcoin mutual fund and US regulators giving the green light for two of the world’s largest futures exchanges – the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) – to list futures contracts on Bitcoin.4,5

Concerns about bearing the risks of uncovered short selling in cryptocurrency markets have been expressed by the Futures Industry Association, a lobby group representing some of the world’s largest brokers, including Goldman Sachs, Morgan Stanley, J.P. Morgan and Citigroup.6

Some authors see cryptocurrencies entering the mainstream markets as beneficial to the stability of the financial system. Dyhrberg (2016) explores the financial asset capabilities of Bitcoin in GARCH models and finds that it may be useful in risk management and ideal for risk-averse investors. She classifies Bitcoin as somewhere between gold and the US dollar in terms of its use as a medium of exchange and a store of value.

Bianchi (2017) finds a similar relationship between returns on cryptocurrencies and commodities such as gold and energy, consistent with existing models in which trading is primarily driven by investor sentiment.

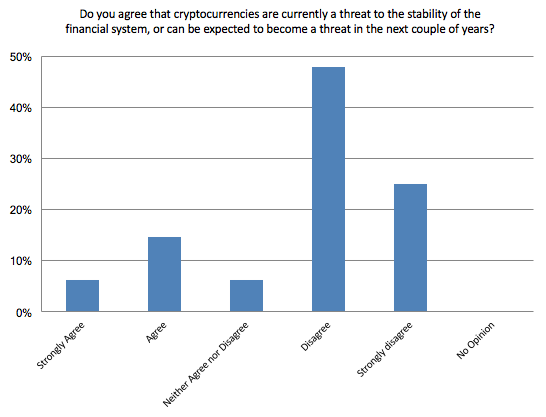

Question 1: Do you agree that cryptocurrencies are currently a threat to the stability of the financial system, or can be expected to become a threat in the next couple of years?

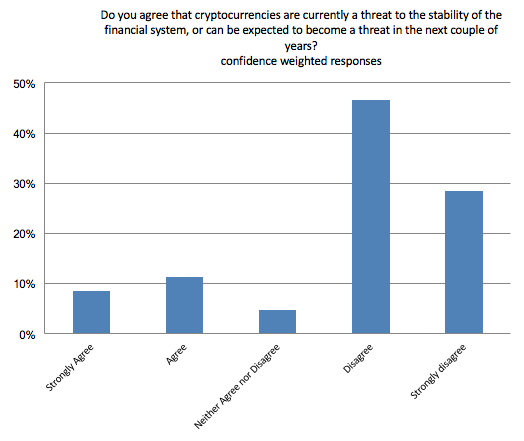

Forty-eight panel members answered this question. A large majority did not see cryptocurrencies as posing a threat to financial stability either now or in the next couple of years: 73% of respondents either disagree or strongly disagree with the statement; 21% either agree or strongly agree; and 6% neither agree nor disagree. Those who disagree are the most confident in their assessments, raising the proportion of panel members disagreeing or strongly disagreeing to 75% when responses are weighted by self-reported confidence.

A common argument of those who disagree with the statement is that the total value of cryptocurrencies is too small to be a systemic risk to financial stability. As Robert Kollman (Université Libre de Bruxelles) puts it, ‘Despite recent growth, the market cap of cryptocurrencies remains modest, compared to the size of “conventional” financial markets. Hence, cryptocurrencies do not seem to represent a threat to financial stability – for now.’

Jordi Galí (Universitat Pompeu Fabra) is similarly relaxed, neither agreeing or disagreeing with the statement, while contending that ‘It depends on the volumes they end up representing relative to the size of the economy and the characteristics (e.g. degree of leverage) of their holders. In their current state they seem largely innocuous for financial stability.’

Many of those who disagree with the statement believe that the financial system is largely insulated from developments in cryptocurrency markets. Michael McMahon (University of Oxford) thinks cryptocurrencies are ‘still too small and lacking in widespread ownership, especially among large investment groups, to be a serious risk to the overall financial system’; and Ethan Ilzetzki (London School of Economics, LSE) asserts that at this point ‘Bitcoin and other cryptocurrencies remain a toy for a very narrow segment of investors and are detached from the financial system and the real economy.’

A note of caution is sounded by Wouter den Haan (LSE), who in agreeing with the statement recalls that ‘The LTCM crisis has taught us that it takes just one key financial institution taking on large risky positions to put the system at risk.’

In justifying why they disagree with the statement, Richard Portes (London Business School) argues that ‘cryptocurrencies have few attributes of money’; and Ricardo Reis (LSE) points out that ‘Bitcoin is inadequate as a currency.’ The latter sees cryptocurrencies as no more a threat to financial stability than gold, saying that ‘Like gold, [Bitcoin] fluctuates wildly in value and it is subject to fads and manias. As long as regulators treat it as a highly speculative investment, like so many other investments out there, then it should pose as much risk to the financial system as so many of these do.’

Those who agree with the statement stress the unprecedented uncertainties surrounding the future of cryptocurrencies. Etienne Wasmer (Sciences Po, Paris) worries that ‘this is radical uncertainty, nothing close in history as far as I can tell’, while Stefan Gerlach (BSI Bank, Switzerland) warns that ‘Cryptocurrencies are currently not a threat to the financial system but could very well become a serious concern in the near future if they become more important.’

Some of those who disagree with the statement accept that cryptocurrencies may eventually threaten the stability of the financial system. While David Smith (Sunday Times) believes that cryptocurrencies only have limited ability to damage the financial system now, ‘That will change, though not over the next two years.’ Tony Yates (longandvariable blog) is similarly unconvinced of the current threat but suggests that, ‘I doubt the situation would change much in two years. Perhaps in ten.’

Jürgen von Hagen (Universität Bonn) has a different reason for strongly disagreeing with the statement, maintaining that causation may run from instabilities in the financial system to the use of cryptocurrencies rather than the other way around. He does not consider cryptocurrencies as a threat to stability, writing ‘The financial system is still based on currencies issued by central banks. Cryptocurrencies would become attractive if central bank issued currencies became very unstable. Their widespread use in the financial system would be a result not a cause of instability.’

Cryptocurrencies and economic policy

Bitcoin is currently classified as a commodity in the United States, so its trading is covered by the Commodity Exchange Act and overseen by the Commodity Futures Trading Commission. In common with other commodities such as gold or oil, there is no traditional management structure behind cryptocurrencies. They are typically launched through an ‘initial coin offering’ (ICO), which allows investors to purchase cryptocurrencies in advance, an arrangement similar in spirit to an initial public offering (IPO) but bypassing the rigorous capital-raising process required by venture capitalists or financial intermediaries.

Bianchi (2017) ultimately sees holding Bitcoin as investing in the blockchain technology, since it shares more similarities with equity investment in a company than investments in traditional fiat currencies.

The UK and other EU governments are responding to concerns that cryptocurrencies are being used for money laundering and tax evasion. In the UK, the Treasury will bring regulation on cryptocurrencies in line with anti-money laundering and counter-terrorism financial legislation. Anonymity will be lost as traders are forced to disclose their identities.

The EU plan will require online cryptocurrency trading platforms to carry out due diligence on customers and report suspicious transactions.7 In her speech at the conference to mark 20 years of independence of the Bank of England, Christine Lagarde proposed the International Monetary Fund as the ideal platform to coordinate regulatory policy on new models of financial intermediation (Lagarde 2017).

If the current interest in cryptocurrencies is a precursor to their wider use as alternatives to the dollar, the pound, the euro and the yen, then this may threaten the monopoly on money creation that is held by policymakers. Central banks cannot print Bitcoins, so if the world switches away from fiat currencies, then they would be unable to print money to stimulate the economy. Conventional monetary policy would be ineffective, as would quantitative easing.

According to this argument, increased regulation of cryptocurrencies is needed so that central banks do not lose control of the money supply. Tony Yates,8 who was formerly a Bank of England economist, as well as former president of the Bundesbank Axel Weber9 doubt that this would a problem, arguing instead that cryptocurrencies will fail to take off because they lack any ‘lender of last resort’ function. There will always be boom and bust in cryptocurrencies, unlike for fiat currencies backed by central banks as lender of last resort.

Supporters of cryptocurrencies argue that the lack of regulation has been instrumental in their successes to date, often presenting cryptocurrencies as the digital version of the 19th century gold standard when no attempt was made to equate the supply of money with demand.

A working paper from the Bank of Finland in 2017 concludes that Bitcoin cannot be regulated and does not need to be regulated in any case (Huberman et al 2017). Regulation is appropriate for monopolies run by management organisations, but not for monopolies run by protocols. Speaking at a press conference in October 2017, ECB president Mario Draghi reasoned that cryptocurrencies are not mature enough to be considered for regulation, although they should be critically assessed for risk.10

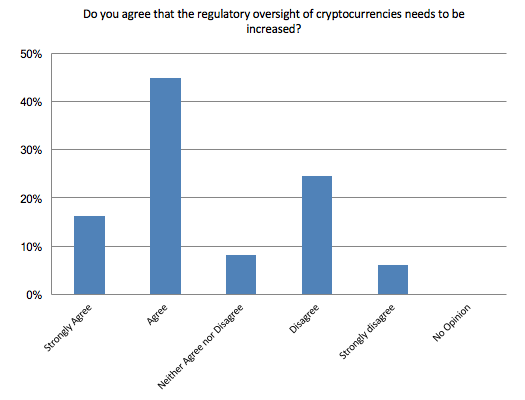

Question 2: Do you agree that the regulatory oversight of cryptocurrencies needs to be increased?

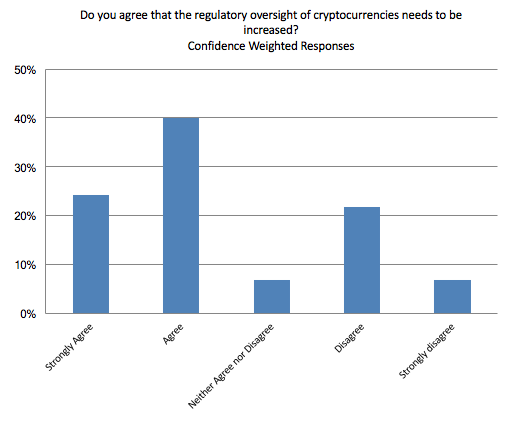

Forty-nine panel members answered this question. A clear majority wished to see greater regulation of cryptocurrencies: 61% of respondents either agree or strongly agree with the statement; 31% either disagree or strongly disagree; and 8% neither agree nor disagree. Those who agree are most confident in their assessments, raising the proportion of panel members agreeing or strongly agreeing to 73% and decreasing the proportion disagreeing or strongly disagreeing to 29% when responses are weighted by self-reported confidence.

The most common reason for agreeing with the statement is a concern that the anonymity of cryptocurrencies promotes nefarious activities. Fabrizio Coricelli (Paris School of Economics) is worried about the ‘likely use of Bitcoin for recycling revenues from illegal transactions’; while Franck Portier (University College London) advocates greater oversight of cryptocurrencies because ‘as cash, they are used for tax evasion and criminal activities.’

For Nicholas Oulton (LSE), cryptocurrencies should be subject to additional supervision because ‘One strand of current policy is to crack down on money laundering and tax evasion through tax havens. So it would seem odd to let cryptocurrencies get around these restrictions.’

There is some support for increased regulatory oversight to preserve the effectiveness of monetary policy, although this is far from being a widespread belief among respondents. Sylvester Eijffinger (Tilburg University) agrees with the statement because he sees cryptocurrencies as ‘undermining the monopoly of money creation by the central banks and [leading to] the ineffectiveness of conventional and unconventional monetary policy.’

But Pietro Reichlin (Università LUISS G. Carli) disagrees, arguing that the power of monetary policy may not be affected by cryptocurrencies because ‘Central Banks (or governments) are the only authorities able to provide the fiscal backing required to offer safe assets and generate lender of last resort type of policies.’ He concludes that more oversight is unnecessary ‘as long as Bitcoin holders are aware of what [the] risks are.’

Thorsten Beck (Cass Business School) also disagrees with the statement, but recommends a cautious approach in which ‘regulators should carefully watch the development’ and there is ‘careful monitoring of “this space”.’

A different argument for disagreeing with the statement is provided by Jon Hassler (Stockholm University), who is worried that ‘there is a risk that regulatory oversight may create a perception that cryptocurrencies are legitimate investments. They should not be perceived like that.’

Jürgen von Hagen (Universität Bonn) goes further in defending cryptocurrencies by asking ‘What is the point of a privately issued currency regulated by the government? Such currencies are created to avoid the supposed evil effects of government regulation on monetary and financial stability.’ Francesco Lippi (Università di Sassari) doubts that regulation would be possible in any case, concluding that ‘None of the arguments… proves more regulation is desirable, nor that it would be effective.’

References

Bianchi, D (2017), ‘"Cryptocurrencies as an Asset Class: An Empirical Assessment".

Chiu, J and T Koeppl (2017), “The Economics of Cryptocurrencies – Bitcoin and Beyond”.

Dyhrberg, A H (2016), “Bitcoin, Gold and the Dollar – A GARCH Volatility Analysis”, Finance Research Letters 16: 85-92.

ECB (2012), “Virtual currency schemes”.

ECB (2015), “Virtual currency schemes – a further analysis”.

Huberman, G, J D Leshno and C Moallemi (2017), “Monopoly without a Monopolist: An Economic Analysis of the Bitcoin Payment System”, Bank of Finland Research Discussion Paper.

Lagarde, C (2017), “Central Banking and Fintech – A Brave New World?”, speech at the Bank of England conference, 29 September.

Endnotes

[1] https://www.theguardian.com/technology/2017/nov/29/bitcoin-world-economy-bank-of-england-jon-cunliffe-price

[2] https://www.wsj.com/articles/is-it-time-to-regulate-bitcoin-1512409004

[3] https://www.bloomberg.com/view/articles/2017-11-14/bitcoin-s-high-transaction-fees-show-its-limits

[4] https://www.ft.com/content/fa3897da-ceac-11e7-9dbb-291a884dd8c6

[5] https://www.reuters.com/article/us-bitcoin-futures-contracts/cboe-cme-to-launch-bitcoin-futures-contracts-idUSKBN1E10KC?il=0

[6] https://www.ft.com/content/5ee5fda2-daa7-11e7-a039-c64b1c09b482

[7] https://www.theguardian.com/technology/2017/dec/04/bitcoin-uk-eu-plan-cryptocurrency-price-traders-anonymity

[8] https://ftalphaville.ft.com/2017/06/07/2189849/guest-post-the-consequences-of-allowing-a-cryptocurrency-takeover-or-trying-to-head-one-off/

[9] https://www.financemagnates.com/cryptocurrency/news/ubs-chairman-bitcoin-currency-will-fail-has-no-lender-of-last-resort/

[10] https://www.cnbc.com/2017/10/19/cryptocurrencies-are-not-mature-enough-ecb-chief-mario-draghi.html