The causes of the global decline of interest rates have been discussed intensively in existing literature (Bean et al. 2015, Rachel and Smith 2015). There is a broad consensus that an increase in the propensity to save, above all for demographic reasons, provides a primary explanation for this development. The argument has been made by prominent economists like Larry Summers (2015), who regards a “chronic excess of saving over investment” as “the essence of secular stagnation” (Summers 2015), and by policymakers such as Mario Draghi (Draghi 2016). Already in 2005, Ben Bernanke had identified a “global saving glut” as a principal explanation for low interest rates in the US (Bernanke 2005).

Real analysis versus monetary analysis

The theoretical framework for this view is provided by the loanable funds theory. In this theory of finance, a standard commodity is used for consumption, investment, and as a means of finance. Saving is the source for investment, as the abandonment of consumption makes the standard commodity available for investment. A higher propensity to save increases the supply of funds and reduces the interest rate. If the zero lower bound (ZLB) for interest rates is reached, a chronic excess of saving over investment may occur.

Most economists regard the loanable funds theory as an adequate representation of the financial system in a modern economy. However, there are a growing number of academics criticising the LFT because of its systematic neglect of money as a means of finance (Borio and Disyatat 2011, 2015, Lindner 2012, 2013, Bertocco 2014, Terzi 2016). This criticism dates back to John Maynard Keynes:

“Most treatises on the principles of economics are concerned mainly, if not entirely, with a real-exchange economy; and - which is more peculiar- the same thing is also true of most treatises on the theory of money. (...) The theory which I desiderate would deal, in contradistinction to this, with an economy in which money plays a part of its own and affects motives and decisions and is, in short, one of the operative factors in the situation, so that the course of events cannot be predicted, either in the long period or in the short, without a knowledge of the behaviour of money between the first state and the last. And it is this which we ought to mean when we speak of a monetary economy”. (Keynes 1973: 408-411).

The differences between a ‘real analysis’ and a ‘monetary analysis’, as Schumpeter (1954) puts it, are as fundamental as the differences between the Ptolemaic and the Copernican world views (Bofinger and Ries 2017). This can be demonstrated with the basic ‘flow of funds’ analysis.

The effects of saving

In the real analysis, ‘financial funds’ are composed of the standard commodity. In the monetary analysis, they are made up of liquid money holdings (sight deposits). Therefore, in the monetary analysis household saving does not release new funds for investment, it simply redistributes existing financial funds from firms to households. If a household decides to save by postponing the purchase of a new car, for example, the money holdings of the household are higher, the money holdings of the car manufacturer are lower. With constant aggregate money holdings, there is no reason for interest rates to decline. The saving of the household also increases its net wealth and net financial assets. It decreases the corresponding items of the corporate sector, which will not lead to a higher propensity to invest.

The negative macroeconomic effects of saving in the monetary analysis can be also demonstrated by the identification of excess saving (“Saving > Investment”) with an excess of global aggregate supply over global aggregate demand. Adding consumption to “Saving” and “Investment” yields gives that “Saving + Consumption > Investment + Consumption”, with “Saving + Consumption” being identical to aggregate income or aggregate supply, and “Investment + Consumption” being identical to aggregate demand.

According to this simple logic, ‘excess saving’ should be associated with weak global growth rates. But in the years from 2012-2017, for which Larry Summers identified not only “chronic excess savings” but also a “secular stagnation”, global growth was higher on average than it was in the 1980s and 1990s. In the years from 2002 to 2007, the period for which Bernanke discovered a 'global saving glut', the highest global growth rates of the whole period from 1980 to 2017 were recorded.

The differences between the dominant causal mechanisms displayed by the IS/LM-AS/AD model

The theoretical gulf between the real analysis and the monetary analysis paradigms can be demonstrated with the canonical IS/LM-AS/AD model. Most of its users, and even prominent textbook authors (e.g. Mankiw 2013), do not seem to be aware that it is fully consistent with the monetary analysis and therefore incompatible with the loanable funds theory. The diametrically opposed 'dominant causal mechanisms' (Rodrik 2015) concern, above all, the effects of saving and investment and the role of banks and financial markets.

In the real analysis, investment requires funds that are released by savers. Saving creates investment. In the monetary analysis, investment is financed with money that is created by banks or provided by individuals holding liquid money balances. Investment generates higher incomes and additional saving.

In the real analysis, saving directly affects the financial market. In the monetary analysis, saving affects the IS-curve but has no direct impact on the financial system represented by the LM-curve.

In the real analysis, banks depend on deposits to supply loans. Deposits create loans. In the monetary analysis, banks create deposits by making loans. The LM-curve assumes that banks can create a multiplicity of money balances if they are provided with offered a certain amount of monetary base.

In the real analysis, banks are not fundamentally different from other financial intermediaries. In the monetary analysis, banks create new funds, whereas financial intermediaries redistribute existing funds.

In the real analysis, there is a single equilibrium of saving and investment. In the monetary analysis, multiple equilibria displayed by the IS-curve are possible. Even in the ZLB, an excess of planned saving over planned investment is not possible. Thus, in the monetary analysis, the natural rate of interest equilibrating saving and investment is not a useful concept. This point was already made by Keynes (1936, p. 243) who preferred the term ‘optimum rate’.

It is important to note that the fundamental differences between the real analysis and monetary analysis do not depend on the degree of price flexibility or on a short-term versus long-term perspective. Firms’ reaction of lowering prices does not cause the negative primary effect of household saving on the corporate sector to vanish. The same applies to the ability of banks to create money without an inflow of deposits, which does not disappear if prices are flexible and which is definitely not a short-term phenomenon.

Weak evidence for excess saving at the global level and for the US

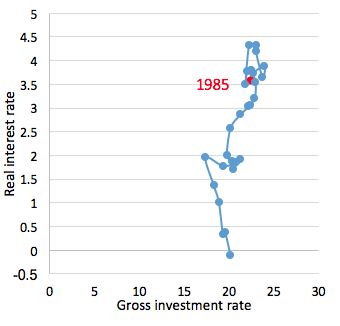

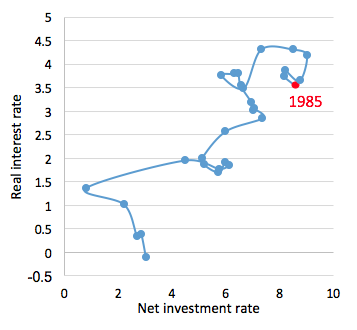

The theoretical inadequacy of the real analysis for an analysis of the actual financial system is reflected by the inadequacy of the empirical evidence based on the real analysis for low real interest rates. Utilising data on gross saving rates, one can show that at the global level the saving rate of private households has declined dramatically since the 1980s. Thus, excess saving due to demographic factors can be ruled out. What is even more striking is the fact that net saving rates, which are the relevant concept for intertemporal optimisation, have declined steadily since the 1980s. Thus, the vertical line representing the development of the real interest rate and gross saving from 1985 to 2014 (Figure 1), used by Bean et al. (2015) and Rachel and Smith (2015), becomes a diagonal line. Taken together with the fact that nominal bond rates for the G7 have never reached the ZLB, it is difficult to make the case for an increasing propensity to save.

Figure 1 Saving/investment equilibria and world real interest rate, 1985-2014

(a) G7: Gross investment and unweighted real interest rate

(b) G7: Net investment and unweighted real interest rate

Source: IMF, World Economic Outlook Database, King et al. (2014), own calculations.

The weak evidence for an increasing propensity to save also becomes obvious if one focuses on the US, for which more detailed and more comprehensive data are available. As for the G7, a pronounced decline of net investment and net saving can be identified, while the nominal bond interest rate has never reached the ZLB. Data for the US bond market make it possible to analyse financial market developments from the perspective of the monetary analysis. Using changes in the amount of outstanding bonds relative to GDP as an indicator of the bond market equilibrium, an increase in financing activity together with a decline in real rates can be identified for the period preceding the Global Crisis (Figure 2).

Figure 2 Bond market equilibria and real interest rates for the US

Source: Federal Reserve Bank of Cleveland Database, SIFMA, own calculations.

This development can be attributed to a 'financing glut', which is related to the willingness of (a) the Chinese central bank to invest the liquid dollar receipts from increasing exports in longer-term US treasuries, and (b) European banks to raise short-term US-funds and to use them for the financing of US mortgages.

In the case of China, the causal chain of the monetary analysis is diametrically opposed to the logic of the real analysis. In the real analysis, high Chinese saving has been created independently of developments in the US. In the monetary analysis, Chinese saving, above all profits from the corporate sector, were generated as a result of US consumers buying more and more Chinese products. The propensity to consume in the US was fuelled by the reduction in the US saving rate due to the housing boom and by the very low interest rates offered by the Federal Reserve.

The monetary analysis logic also makes it possible to overcome the ‘paradox of capital’ (Prasad et al. 2007). The real analysis cannot explain why capital, which is assumed to consist of the standard commodity, should flow from China to the US, where the returns of capital are supposed to be lower. In the monetary analysis, capital flows consist of money and it is not paradoxical that US-dollar payments made for consumption goods from China were recycled by the Chinese central bank into the US capital market.

In the period following the Great Recession, US bond market data indicate a pronounced 'borrowing dearth' (Figure 2). Financing activity declined together with the real interest rate. This development can be explained primarily by a drastically shrinking mortgage demand and concurrent remarkably stable bond demand of the corporate sector.

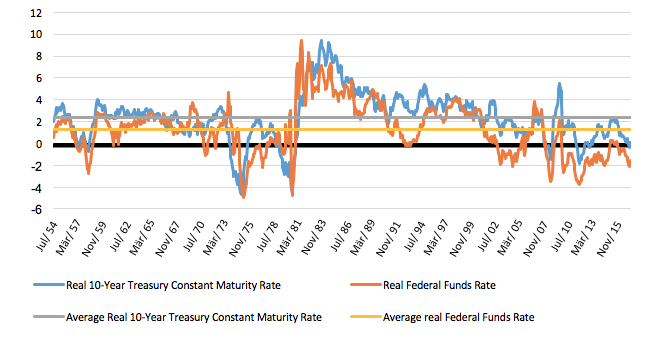

Finally, data for the period from 1954 to 2017 show that using the early 1980s as a benchmark for assessing the trend of interest rates is problematic (Figure 3). From this perspective, the high nominal and real rates in the early 1980s are simply outliers and the decline of interest rates since that period can be regarded as a reversion to the mean (Eichengreen 2014, 2015).

Figure 3 Real interest rates for US, 1954-2017

Source: Federal Reserve Bank of St. Louis Database, own calculations using the actual inflation rates.

Summary

The failure of the real analysis to provide a convincing explanation of low interest rates highlights the shortcomings of a paradigm that tries to explain financial developments without incorporating an explicit role of money. The insight that the real analysis is an inadequate theory for the world in which we live can be regarded as the core of Keynes’ intellectual revolution. It is amazing that the economists’ profession has been able to bury this achievement by claiming that the differences between the old and the new paradigm can be reconciled if one assumes different degrees of price flexibility.

References

Bean, C , C Borda, T Ito, and R Kroszner (2015), Low for long? Causes and consequences of persistently low interest rates, Geneva Reports on the World Economy 17, ICMB and CEPR.

Bernanke, B (2005), “The global saving glut and the U.S. current account deficit”, Board of Governors of the Federal Reserve System (US), Speech 77.

Bertocco, G (2014), “Global saving glut and housing bubble: A Critical Analysis”, Economia politica, 2, 195-218.

Bofinger, P, and M Ries (2017), “Excess saving and low interest rates: Theory and Empirical Evidence”, CEPR Discussion Paper 12111.

Borio, C, and P Disyatat (2011), “Global imbalances and the financial crisis: Link or no link?”, BIS Working Papers, 346.

Borio, C, and P Disyatat (2015), “Capital flows and the current account: Taking financing (more) seriously”, BIS Working Papers, 525.

Draghi, M (2016), “Addressing the causes of low interest rates”, Introductory speech held at a panel on The future of financial markets: A changing view of Asia at the Annual Meeting of the Asian Development Bank, Frankfurt am Main, Speech.

Eichengreen, B (2014), “Secular stagnation: A review of the issues”, in C Teulings and R Baldwin (eds.), Secular Stagnation: Facts, Causes and Cures, VoxEU.org eBook.

Eichengreen, B (2015), “Secular stagnation: the long view”, American Economic Review 105 (5), 66-70.

Keynes, J M (1936), “The General Theory of Employment, Interest and Money”, The Collected Writings of John Maynard Keynes, vol. 12, Donald Moggridge, 1973.

Keynes, J M (1973), “The monetary theory of production (1933)”, The Collected Writings of John Maynard Keynes, 13: 408-411.

King, M, and D Low (2014), “Measuring the ‘World’ Interest rate”, NBER Working Paper 19887.

Lindner, F (2012), “Saving does not finance Investment: Accounting as an indispensable guide to economic theory”, IMK Working Paper, 100-2012.

Lindner, F (2013), “Does Saving Increase the Supply of Credit? A Critique of Loanable Funds Theory”, IMK Working Paper, 120-2013.

Mankiw, G (2013), Macroeconomics, Worth Publishers.

Prasad, E, R Rajan, and A Subramanian (2007), “The paradox of capital”, Finance and Development, 44 (1).

Rachel, L, and T Smith (2015), “Secular drivers of the global real interest rate”, Bank of England, Staff Working Paper No. 571.

Rodrik, D (2015), Economics rules: the rights and wrongs of the dismal science, WW Norton & Company.

Schumpeter, J (1954), History of Economic Analysis, Allen Unwin, London.

Summers, L (2015), “On secular stagnation: a response to Bernanke”, Larry Summers Blog, April.

Terzi, A (2016), “A T-shirt model of savings, debt, and private spending: lessons for the euro area”, European Journal.