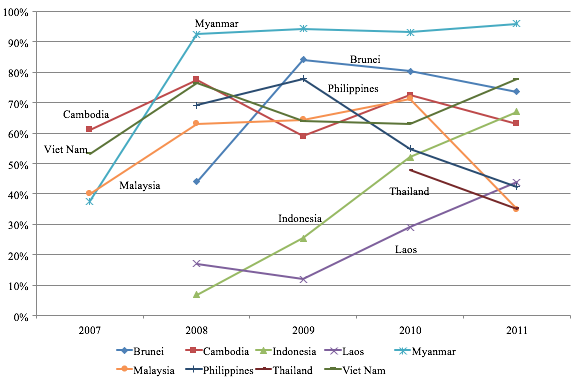

Free trade agreement (FTA) tariff rates are not necessarily used in all of the international transactions between the member countries of an FTA – some exporters keep utilising most-favoured nation (MFN) rates even when exporting to importers in FTA member countries. Indeed, FTA utilisation rates – defined as the share of trade under FTA schemes out of total trade of products eligible for these schemes – are generally less than 100%. For example, Figure 1 shows utilisation rates of the Association of South East Asian Nations (ASEAN)-Korea FTA, or AKFTA, for exports from each ASEAN country to Korea during the 2007-2011 period. In this period, the average utilisation rate of AKFTA in those exports is just 26.7%, indicating that AKFTA rates are not used in a major part of those exports.

Figure1 AKFTA utilisation rates

Source: Authors’ calculations based on data from the Korea Customs and Trade Data Institute (KCTDI).

How do we interpret this surprising evidence? The existence of rules of origin has been pointed out as one of the major obstacles preventing exporters from using FTA schemes and thus keeping FTA utilisation rates incomplete. Exporters must comply with rules of origin to qualify for FTA tariffs. In other words, products exported under an FTA need to be ‘originated’ among the FTA member countries. For instance, a product is not regarded as being originated if most intermediate inputs come from FTA non-member countries and produced value added is not enough. Therefore, depending on the production structure, exporters cannot necessarily comply with rules of origin and are not allowed to use the FTA scheme. In addition, even if exporters meet rules of origin, the application of the rules is a large burden for them. For instance, exporters have to recheck their production structures in detail and prepare a large number of documents before obtaining the certificate of origin from the customs office. Thus, if exporters think that the ‘preference margin’ – which is defined as the difference between MFN rates and FTA rates, and is the obvious benefit from utilising FTAs – is not large enough to offset the cost of cumbersome application works, they would not optimally use FTA schemes. Consistent with this view, many researchers have found that a larger preference margin and less restrictive rules of origin contribute to enhancing FTA utilisation (e.g. Cadot et al. 2006, Francois et al. 2006, Manchin 2006, Bureau et al. 2007, and Hakobyan 2015).

When researchers consider the determinants of FTA utilisation, they mainly focus on real variables such as the tariff margin, the restrictiveness of rules of origin, and exporters’ productivity. Monetary aspects have received little attention. In contrast, we consider nominal exchange rates that are supposed to affect FTA utilisation rates through compliance with rules of origin. In a recent paper, we conduct a detailed analysis on the effect of exchange rates on FTA utilisation (Hayakawa et al. 2017). We consider the regional value content rule among various types of rules of origin. The regional value content rule determines goods’ country of origin by examining whether the total values of the inputs imported from non-member countries (‘non-originating inputs’) comprise less than a certain share (e.g. 60%) of prices in export products. Specifically, the ‘value-added ratio’, which is used as a measure to determine goods’ country of origin in practice, is defined as:

This formulation of the value-added ratio is called the build-down method. In the calculation of the value-added ratio, non-originating input price and export product price are denominated in the exporter’s currency. Thus, exchange rates affect this ratio, the compliance of RVC rule, and, in turn, FTA utilisation.

More specifically, suppose that the exporter’s currency depreciates relative to the importer’s currency. Given the empirical evidence of firms’ pricing-to-market where exporters stabilise the price in terms of importers’ currency, at least part of these exchange rate changes should be reflected in export prices denominated in exporters’ currency. The depreciation of the exporter’s currency against the importer’s currency raises unit export prices in terms of the exporters’ currency and improves the value-added ratio. As a result, this depreciation makes it easier for exporters to meet the regional value content rule. A similar mechanism may also operate in other types of rules of origin. For example, the change-in-tariff classification rule requires export products to have a different tariff classification from their non-originating inputs. For the change-in-tariff classification rule, the so-called ‘de minimis’ rule is often available as a bailout measure, as it allows non-originating inputs to have the same tariff classification if those inputs occupy only a certain small share in the prices of export products (e.g. 10%). Thus, the share of non-originating inputs also plays a role in compliance with the change-in-tariff classification rule.

We observe this effect of exchange rates on the utilisation rate of the AKFTA FTA. Specifically, through examining AKFTA utilisation on a product-level in exports from ten ASEAN countries to Korea during the 2007-2011 period, we find statistically significant evidence that a depreciation of the ASEAN exporter’s currency against the importer’s currency (the Korean won) enhances AKFTA utilisation rates. In particular, the positive effects from exchange rates are found to be larger in the case of regional value content rules than in non-regional value content rules, at least partly implying that exchange rates affect preference utilisation rates through changing the value-added ratio, which plays a key role in regional value content rules in AKFTA. Our findings suggest that exporters can fail to meet rules of origin accidentally when exchange rates fluctuate and the value-added ratio changes. Similar official notice is announced by the Japan Chamber of Commerce and Industry that exporters should periodically check changes in exchange rates (e.g. monthly) and confirm whether or not they still meet rules of origin.

This evidence deepens our understanding of the effects of exchange rates on trade. In general, it is believed that a depreciation of the domestic currency leads to an increase in exports under the Marshall-Lerner condition through lower prices in terms of importers’ currency relative to prices of products from other countries. The above effect on FTA utilisation implies that the trade creation effect of a currency depreciation is not limited to such a direct channel between FTA member countries. Since trade values mostly increase when switching from MFN schemes to FTA schemes due to the latter’s lower tariff rates, a depreciation of the domestic currency may increase more than when only considering the above typical effect through relative price changes.

Also, it has implication for how to design rules of origin. While the above discussion is based on the build-down method, the computation formulation in regional value content differs across FTAs. For instance, the net cost formulation, which is defined as

is employed as a measure to determine the origin of automobiles in the Trans-Pacific Partnership (TPP). The net cost is ‘total cost’ minus ‘sales promotion, marketing and after-sales service costs, royalties, shipping and packing costs, and non-allowable interest costs. This net cost measure is less sensitive to changes in exchange rates than the value-added ratio because the net cost measure does not include the export price, changes in which are the source of the exchange rates’ effect on the value-added ratio. As a result, the effect of exchange rates on FTA utilisation should be smaller when the net cost method rather than the value-added method is employed. In other words, the use of the net cost method would free exporters from the fear of exchange rate fluctuations and encourage stable use of FTA schemes by exporters.

Editors' note: The main research on which this column is based appeared in a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Bureau, J C, R Chakir and J Gallezot (2007), “The utilisation of trade preferences for developing countries in the agri-food sector”, Journal of Agricultural Economics 58, 175–198.

Cadot, O, C Carrere, J De Melo and B Tumurchudur (2006), “Product-specific rules of origin in EU and US preferential trading arrangements: An assessment”, Word Trade Review 5, 199–224.

Francois, J, B Hoekman and M Manchin (2006), “Preference erosion and multilateral trade liberalization”, World Bank Economic Review 20, 197–216.

Hakobyan, S (2015), “Accounting for underutilization of trade preference programs: U.S. generalized system of preferences”, Canadian Journal of Economics 48, 408–436.

Hayakawa, K, H S Kim and T Yoshimi (2017), “Exchange Rate and Utilization of Free Trade Agreements: Focus on rules of origin”, Discussion Paper 17-E-007, Research Institute of Economy, Trade and Industry (RIETI).

Manchin, M (2006), “Preference utilisation and tariff reduction in EU imports from ACP countries”, The World Economy 29, 1243–1266.