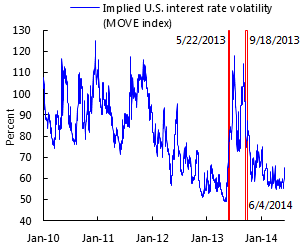

The use of unconventional monetary policy in major central banks prompted a reduction in long-term yields and a sharp fall in the term premium. This helped to restore market functioning, strengthen financial intermediation, and support growth. However, the prolonged period of low interest rates increased leverage, created incentives to search for yield, and led to excessive credit and duration risk, bringing financial stability issues to the forefront during the spring of 2013. The May 2013 Fed announcement of possible tapering of purchases revealed potential challenges with normalization of monetary policy.1 The associated increase in market volatility was likely a side effect of an unanticipated policy turning point, following one-sided market positioning in which expectations about future interest rates – and implied volatility – were falling rapidly. Market positioning suggestive of excessive risk-taking has emerged again during recent months in the context of a still low term premium.

Figure 1. Implied volatility (basis points)

Source: Bloomberg, LP.

The role of real and money shocks for spillovers

Against this backdrop, Chapter 2 of the 2014 IMF Spillover report assesses the impact of higher yields in key advanced economies (AEs) for emerging economies (EMs), by disentangling underlying shocks, analyzing their transmission, and contrasting potential scenarios going forward.2

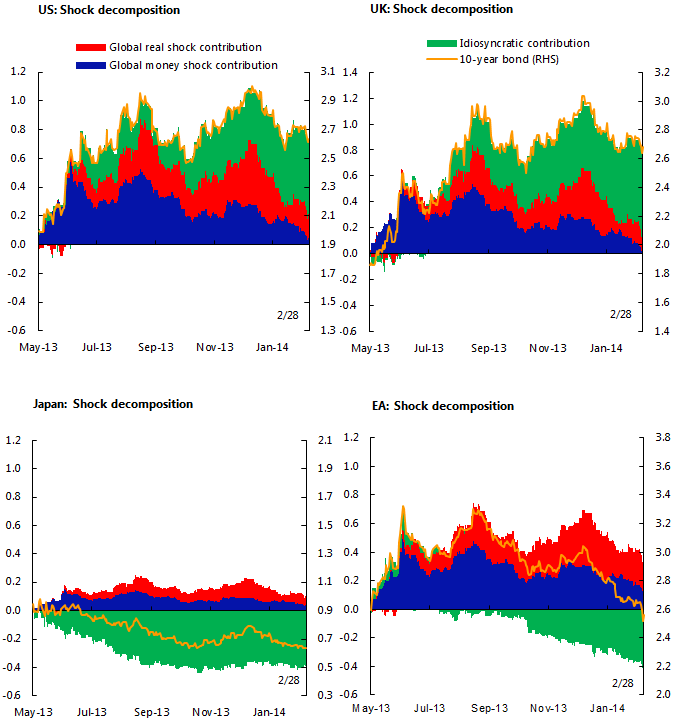

To separate the key drivers of yields, bivariate vector autoregressions (VAR) with sign restrictions are used. The intuition behind the identification scheme is simple: while positive (tightening) money shocks push up yields and depress stock prices, positive ‘real’ shocks (better prospects) increase both yields and stock prices.3 Extracting the common components from money and real shocks of the individual S4 countries (the Eurozone, Japan, the UK, and the US) allows a decomposition of their respective yield increases into idiosyncratic and common money and real factors (Figure 1). This decomposition reveals that common factors have played a similar role in the US, the UK, and the Eurozone, with a sizable positive common money shock during the taper episode. In Japan and the Eurozone, country specific factors counter-balance upward pressure, suggesting that an asynchronous exit from monetary accommodation will likely take place going forward.

Figure 2. Drivers of S4 ten-year bond yields

Sources: Bloomberg L.P.; and Haver Analytics.

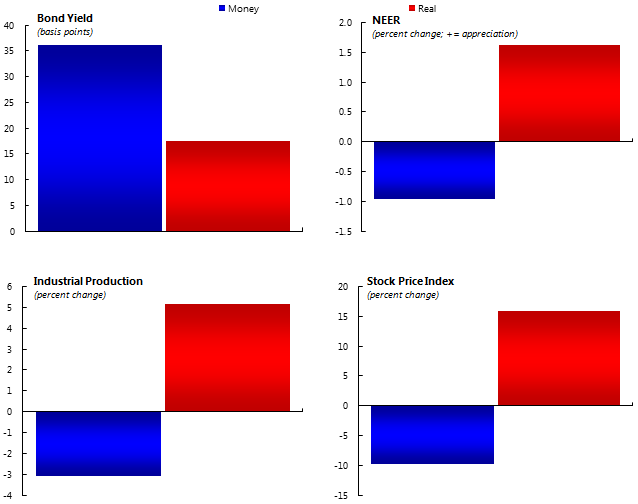

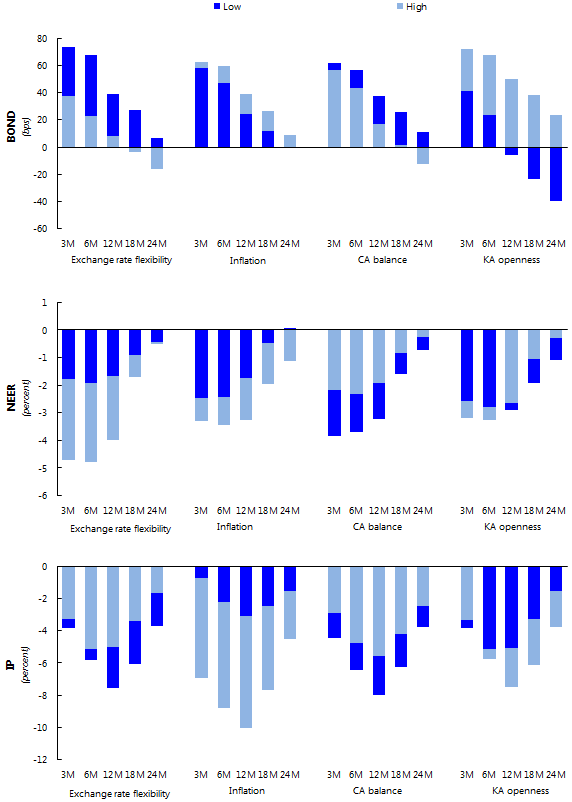

Based on panel vector autoregressions, the common real and money shocks from S4 economies are found to have very different spillover implications on several key variables in other countries (Figure 2). Money shocks predict a significant co-movement in long-term bond yields. As capital flows out of EMs, currencies depreciate, stock prices fall and, industrial production declines.4 Real shocks imply a much lower co-movement of yields. Capital inflows push the exchange rate of EMs up supporting higher stock market prices and industrial production. Hence, real shocks have an overall benign spillover on EMs while money shocks have adverse spillovers on EMs.

Figure 3. Spillovers to EMs from S4 shocks (average responses in the first 12 months to initial 100 basis points shock)

Source: IMF staff calculations.

Note: NEER = nominal effective exchange rate; S4 = systemic four (euro area, Japan, UK, US).

1Responses to both shocks are significant over several months following the shock.

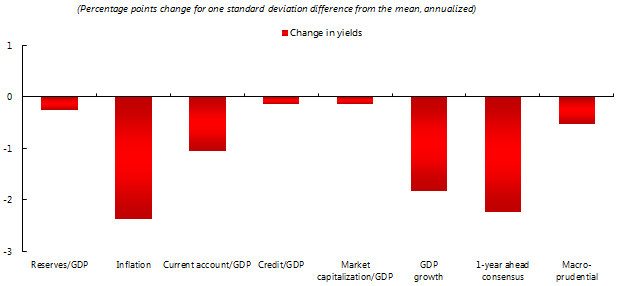

The average responses may mask variation across countries as policies can act as shock absorbers or amplifiers.5 Event study results, based on U.S. monetary events, reveal that in emerging economies with relatively strong fundamentals, yields have generally reacted less to spillovers (Figure 3).6 Higher reserves, lower inflation, a higher current account balance, deeper financial markets, and stronger underlying growth all help mitigate adverse spillovers from tighter global financial conditions.7 VAR results corroborate these findings with respect to the role of fundamentals (Figure 4) and also suggest that countries with floating exchange rate regimes – by allowing their currencies to adjust – can buffer the global money shock. The more limited impacts on domestic financial conditions and exchange rate depreciation boost net exports and mitigate the negative impact on industrial production. Money shocks have larger effects on yields in countries with more open capital accounts.

Figure 4. Effect of fundamentals on EM bond yields, two-day change

Sources: IMF staff calculations; and Mishra and others (forthcoming)

Figure 5. Average EM response to S4 shocks

Source: IMF staff calculations.

Note: CA = current account; IP = industrial production; KA = capital account; NEER = nominal effective exchange rate; S4 = systemic four (euro area, Japan, UK, US). For each variable, a "low" value refers to the 20th percentile and a "high" value to the 80th percentile value of the respective fundamental's distribution in the sample.

Simulating the cost of a bumpy exit

Informed by the empirical analysis, we conduct scenario analysis using the IMF G20MOD, focusing on the role of policies in source and recipient economies in mitigating spillovers ahead.8,9 The first scenario reflects upside risks, assuming a faster than expected recovery in economic activity in the US and the UK (a ‘real’ shock).10 The second scenario reflects a bumpy exit with a ‘money’ shock emanating from the US and the UK.11

Under the upside scenario, global growth would benefit from a stronger than expected recovery in the US and the UK. In this scenario despite the yield increase, world GDP is higher, as better prospects in advanced economies offset the adverse effects from the endogenous (in response to better growth) yield increase. Specifically, GDP in the Rest of the World (RoW) will remain above the baseline until 2017 and cumulative RoW GDP will be almost 1.6% higher than in the baseline by 2019. While all countries in the sample would experience a positive demand shock, the scenario suggests that countries with the strongest trade linkages to the US and the UK would benefit the most.12

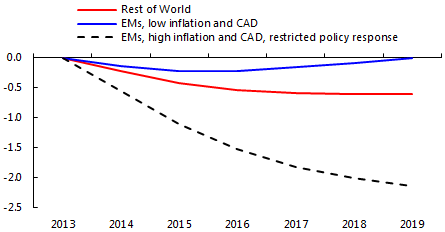

In the bumpy exit scenario, at the peak (2015) the average of the US and the UK GDP would be 0.6%, with the RoW GDP 0.2% below the baseline. Overall, the GDP loss in the RoW would be about 0.6% relative to the baseline by 2019. Recipient countries with sound fundamentals (i.e., with the current account deficit and the inflation rate are the median for EMs) can mitigate spillovers. These countries, which are assumed to have policy space to react to the external shock by lowering domestic policy rates, would be much less affected: GDP is only temporarily below baseline and there would be no permanent loss by 2019, compared to 2.25% in countries with weak fundamentals and no policy space. Balance sheet effects and financial markets liquidity issues – which are not captured in the simulations – can potentially amplify adverse spillovers. If in addition to the term premium increase in the US and the UK, short term market rate spreads increase – possibly due to miscommunication or misperception of policy intentions – the RoW GDP would further decline by about 0.25% by 2019.13

Figure 6. Real GDP loss (cumulative percent deviation of real GDP level from baseline

Source: IMF Fund staff estimates.

1/ High inflation and CAD countries are Brazil, India, Indonesia, Russia, South Africa

and Turkey; low inflation and CAD countries are China, Mexico and Saudi Arabia.

Policies for managing a graceful exit

The analysis suggests that the appropriate policy responses will vary across countries, as spillovers will depend on underlying drivers of tighter financial conditions. In source economies, evolving central bank objectives, uncertainty about cyclical positions, and large balance sheets place a premium on communication. In this context, central banks’ communications should focus on policy trade-offs rather than targets and/or the timing of policy moves, and the role of financial stability considerations in central bank decisions should be explained. This could help prevent extreme market positioning and a buildup of excessive leverage and credit risks.

In recipient economies, sound policy frameworks and fundamentals can mitigate spillovers. Countries should strike the right balance between letting the exchange rate act as a buffer and intervening. The exchange rate is a key shock absorber in EMs. Having said that, intervention should not be ruled out to avoid rapid depreciations that can create macroeconomic or financial stability issues, especially in countries with adequate reserves and an exchange rate that is not overvalued.

References

BIS (2014), “84th Annual Report”, 1 April 2013–31, March 2014, Bank of International Settlement.

Chen, J, T Mancini-Griffoli, and R Sahay (forthcoming), “Spillovers from US Monetary Policy on Emerging Market Economies: Different this Time?”, IMF Working Paper, (Washington: International Monetary Fund).

Eichengreen, B, and P Gupta (2014), "Tapering Talk: the Impact of Expectations of Reduced Federal Reserve Security Purchases on Emerging Markets", Policy Research Working Paper Series 6754, (Washington: World Bank).

Georgiadis, G (forthcoming), Determinants of Global Spillovers from US Monetary Policy.

International Monetary Fund (2013a), “Global Impact and Challenges of Unconventional Monetary Policies,” International Monetary Fund (Washington).

_____ (2013b), “Unconventional Monetary Policies—Recent Experience and Prospects”, International Monetary Fund (Washington).

_____ ( 2014a), “IMF Multilateral Issues Policy Report”, International Monetary Fund (Washington).

_____ (2014b), “Monetary Policy in the New Normal”, International Monetary Fund (Washington).

Matheson, T, and E Stavrev (forthcoming), “News and Monetary Shocks at a High Frequency: A Simple Approach”, IMF Working Paper.

Mishra, P, K Moriyama, P N’Diaye, and L Nguyen (2014), “Impact of Fed Tapering Announcements on Emerging Markets”, IMF Working Paper 14/109.

OECD (2014), “Spillover Effects from Exiting Highly Expansionary Monetary Policies”, OECD Economics Department Working Papers, 1116, May 2014.

Burns, A, M Kida, J Lim, S Mohapatra and M Stocker (2014), “Unconventional monetary policy normalisation and emerging-market capital flows“, VoxEU.org, 21 January.

Footnotes

1 The announcement triggered significant volatility amid a re-pricing of risk and capital flow reversals in some EMs, with the term premium in ten-year instruments increasing by about 100 basis points in the U.S. during the summer, and by a similar amount around the world.

2 IMF (2014a). See also OECD (2013a, 2013b, 2014b), IMF (2013), BIS (2014) and Burns et al. (2014).

3 See Matheson and Stavrev (forthcoming). By using long-term yields instead of short-term rates in the identification, the approach considers a broader concept of money shocks, encompassing both conventional and unconventional monetary policy shocks, but also exogenous shocks to the term premium, shifts in portfolio preferences toward higher demand for cash away from bonds and equity, and potential upward surprises in inflation unrelated to improved demand. At different times, different factors will be dominant.

4 The standard deviation of (annualized) growth in industrial production in our sample is about 4-6 times larger than the average standard deviation in EM output growth. Thus, the approximate implied output response would be 0.5 to 0.75%.

5 Based on another identification scheme, Georgiadis (forthcoming) similarly finds several fundamentals to matter for the transmission of money shocks. See also Eichengreen and Gupta (2014).

6 Events comprise FOMC Meetings and Minutes releases from January 2013 to January 2014 associated with significant yield increases and stock market declines in the U.S. (see Mishra et al. 2014).

7 See also Chen et al. (forthcoming).

8 The calibration is based on countries’ responses in the first quarter to a combined U.S.-U.K. money shock. Country specific values are obtained by allowing coefficient estimates in the panel VAR to vary with a country’s capital account openness, exchange rate regime, and level of inflation, where higher capital account openness and inflation increase – and flexible exchange rate decrease – co-movement of bond yields in the source and recipient.

9 The G20MOD is a module in the Flexible System of Global Models (FSGM). It is an annual, multi-region, general equilibrium model that combines both micro-founded and reduced-form formulations of various economic sectors. It has a fully articulated demand side, and some supply side features. International linkages are modeled in aggregate for each country/region.

10 In this scenario, monetary tightening results from an endogenous 100 basis points (bps) policy rate increase in response to a stronger than expected recovery in growth in the US and the UK. The policy response in recipient countries depends on the initial impact of the increase in external demand and the initial conditions in the economy; in particular it is assumed that there is no tightening in monetary policy in response to stronger external demand in countries with negative output gaps. Long-term interest rates are only affected by the expectations channel – i.e. no change in the term premium – which makes the impact small.

11 The scenario is modeled through an increase in term premium over the baseline. The scenario assumes an increase in the term premium of 100 bps, which directly feeds into long-term government bond yields in the U.S. and the U.K. as well as to the long-term rates faced by households and firms. The Eurozone implements unconventional monetary policy that reduces the term premium in long-term bonds in countries in the area by 25 bps, partially counteracting higher yields from the money shock. Finally, Japan continues to implement quantitative and qualitative easing, as envisaged in the baseline. Overall, this will trigger a 70 bps increase in long term yields in the RoW – the impact on long-term bond yields in individual countries will depend on identified empirical correlations described above.

12 This is consistent with the findings for the real shock, which shows a positive response of industrial production in all countries when allowing responses to vary with country characteristics.

13 Misperception is modeled as an additional increase in the short term market rate above the policy rate by 25 basis points.