Investigating the patterns of exchange rates, interest rates, and international reserves during 1970-1999, Calvo and Reinhart (2002) inferred the prevalence of the “fear of floating”. Countries that say they allow their exchange rate to float mostly do not. Instead, frequently the authorities are attempting to stabilise the exchange rate through direct intervention in the foreign exchange market and in open market operations. The fear of floating may also explain the massive hoarding of international reserves during the last ten years by emerging markets and other developing countries, though alternative explanations include the precautionary and/or mercantilist motives (Aizenman and Lee 2007, 2008), as well as the reincarnation of the Bretton Woods system (Dooley et al. 2004).

In recent research, we investigate the degree to which the fear of floating guided the adjustment of emerging markets to the unfolding global financial crisis (Aizenman and Yi 2009). This crisis presented daunting challenges to emerging markets – the “flight to quality,” deleveraging, and the rapid reduction of international trade began inmid-2008, testing their adjustment capabilities. While in many earlier crises, emerging markets were forced to adjust mostly via rapid exchange rate depreciation, the sizable hoarding of international reserves during the late 1990s and early 2000s provided these countries with a richer menu of choices. A prime concern of our study is the degree to which the large earlier hoarding of international reserves “paid off,” by allowing emerging markets to buffer their adjustment by drawing down their international reserves.

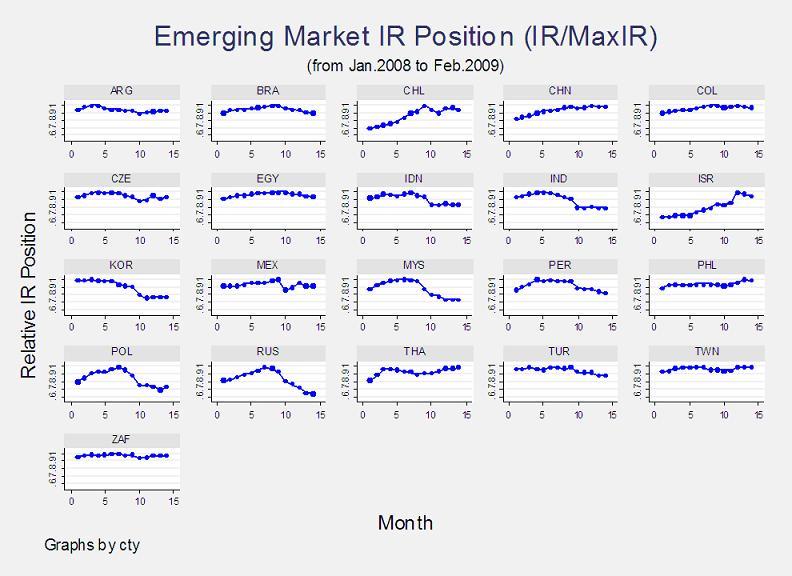

We investigate the adjustment of 21 emerging markets during the window of the crisis, and found a mixed and complex picture.1 Figure 1 presents the countries’ monthly international reserves (IR), measured relative to their peak from January 2008 until February 2009. Regression analysis shows that emerging markets with a large primary commodity export, especially oil export, tended to experience large reserve losses in this global crisis. Countries with a medium level of financial openness and a large short-term debt ratio also lost on average more of their initial holdings. Most of the countries that suffered large international reserve losses started depleting them during the second half of 2008, and many have still not returned to pre-crisis levels.

Intriguingly, only about half of the emerging markets relied on significant depletion of their international reserves as part of the adjustment mechanism. We proceeded by dividing our sample into two groups: countries with sizable reserve losses, and countries that did not lose reserves or quickly recovered them. We define the first group as countries that lost at least 10% of their international reserves during the period of July 2008- February 2009, relative to their peak. Among 21 emerging markets, nine countries are in the first group.2

Figure 1. Emerging markets’ international reserves relative to peak holdings, Jan 2008 – Feb 2009

To gain further insight, we compare the pre-crisis demand for reserves as a share of GDP of countries that experienced sizable depletion of their holdings to that of countries that didn’t, and we find different patterns between the two groups. Trade-related factors (trade openness, primary goods export ratio, especially large oil export) seem to be much more significant in accounting for the pre-crisis reserve-to-GDP ratio of countries that experienced a sizable depletion of their reserves in the first phase of the crisis. These findings suggest that countries that internalised their large exposure to trade shocks before the crisis used their reserves as a buffer stock in the first phase of the crisis. Their reserves losses followed an inverted logistical curve – after a rapid initial depletion of reverses, they reached within seven months a markedly declining rate of reserve depletion, losing not more than one-third of their pre-crisis holdings. In contrast, for countries that refrained from a sizable depletion of their reserves during the first phase of the crisis, financial factors account more than trade factors in explaining their initial reserves-to-GDP level. The patterns of using reserves by the first group, and refraining from using reserves by the second group, are consistent with the “fear of losing reserves”. Such a fear may reflect a country’s concern that dwindling reserves may signal greater vulnerability, triggering a run on its remaining reserves. This fear is probably related to a country’s apprehension that, as the duration of the crisis in unknown, depleting international reserves too fast may be sub-optimal – it exposes the country to the risk of abrupt adjustment if the crisis turned out to be deeper and more enduring than it initially believed.

Concluding remarks

Our paper suggests that there exists a clear structural difference in the pre-crisis demand for international reserves between emerging markets that were willing versus those that were unwilling to spend a sizable share of their holdings during the first phase of the 2008-9 crisis. Trade-related factors are more significant in accounting for the pre-crisis reserve level of the countries that experienced a sizable depletion of their reserves in the first phase of the crisis, in line with the buffer stock interpretation of the demand for international reserves. Countries that depleted their reserves in the first phase of the crisis, refrained from drawing their reserves below one-third of the pre-crisis level, with the majority using less than one-quarter of their pre-crisis holdings. Countries whose pre-crisis demands for international reserves were more sensitive to financial factors refrained from using them altogether, preferring to adjust through larger depreciations. These patterns may reflect the fear that dwindling reserves may induce more destabilising speculative flows. Our results suggest that the adjustment of emerging markets during the on-going global liquidity crisis has been constrained more by their fear of losing international reserves than by their fear of floating.

More work needed

These findings raise new questions. More work is needed to understand why countries differ in the weight assigned to financial versus commercial factors in accounting for their demand for reserves. Intriguingly, the average exchange rate depreciation rate from August 2008 to February 2009 was about 30% in both emerging markets that depleted their reserves and those that refrained. A hypothesis that can explain this observation is that the shocks affecting the emerging markets that opted to deplete their reserves were larger than the shocks impacting emerging markets that did not. Testing this possibility requires more data, not available presently, including the deleveraging pressures during the crisis. This hypothesis, if valid, implies that countries prefer to adjust to bad shocks first via exchange rate depreciation, supplementing it with partial depletion of their international reserves only when the shocks are deemed to be too large to be dealt only with exchange rate adjustments.

The fear of using reserves also suggests that some countries opt to revisit the gains from financial globalisation. Earlier research suggests that emerging markets that increased their financial integration during the 1990s-mid 2000s, hoarded reserves due to precautionary motives, as self-insurance against sudden stops and deleveraging crises. Yet, the crisis suggests that for this self-insurance to work, it may require levels of reserves comparable to a country’s external financial gross exposure (see Park (2009) analysing Korea’s challenges during the crisis). In these circumstances, countries may benefit by supplementing hoarding with Pigovian tax-cum-subsidy policies (Aizenman 2009). A possible interpretation for the fear of losing international reserves is the “keeping up with the Joneses’ reserves” motive – the apprehension of a country that reducing its reserves-to-GDP ratio below the average of its reference group might increase its vulnerability to deleveraging and sudden stops (see Cheung and Qian (2009) for such evidence from East Asia). These factors suggest a greater demand for regional pooling arrangements and swap lines, as well as possible new roles for International Financial Institutions. A better understanding of these issues is left for future research.

Joshua Aizenman gratefully acknowledges the support and the hospitality of the Hong Kong Institute for Monetary Research and the support of the UCSC Presidential Chair of Economics.

Footnotes

1 Our sample is composed of the countries listed in the FTSE and MSCI emerging market list. We did not include Singapore and Hong Kong because of their special economic structure, specialising in entrepôt services. In addition, due to the dramatic effect of the IMF’s aid on Hungary’s reserves changes, we excluded it from our sample (Hungary’s reserves had increased nearly by half in the two months after the IMF’s stabilisation package). Due to data availability, we did not include Morocco and Pakistan.

2 Large IR loss countries include Brazil (BRA), India (IND), Indonesia (IDN), Malaysia (MYS), South Korea (KOR), Peru (PER), Poland (POL), Russia (RUS), and Turkey (TUR).

References

Aizneman J. and S. Yi (2009). “The financial crisis and sizable international reserves depletion: From ‘fear of floating’ to the ‘fear of losing international reserves’?” NBER Working Paper 15308.

Aizenman, J. (2009). “Hoarding International Reserves versus a Pigovian Tax-cum-Subsidy scheme: Reflections on the deleveraging crisis of 2008-9, and a cost benefit analysis,” manuscript, October, UCSC.

Aizenman, J. and J. Lee (2007). "International Reserves: Precautionary versus Mercantilist Views, Theory and Evidence," Open Economies Review, 18: 2, pp. 191-214.

Aizenman, J. and J. Lee “Financial versus monetary mercantilism -- long-run view of large international reserves hoarding,” The World Economy, 31: 5, pp. 593-611.

Calvo, G. A. and C. M. Reinhart (2002). "Fear Of Floating," Quarterly Journal of Economics, 107: 2, pp. 379-408.

Cheung Y. W. and X. Qian (2009). “Hoarding of International Reserves: Mrs Machlup's Wardrobe and the Joneses” Review of International Economics, 17: 4, pp. 777-801.

Dooley, M. P., Folkerts-Landau, D., and P. Garber (2004). “The Revived Bretton Woods System: The Effects of Periphery Intervention and Reserve Management on Interest Rates andExchange Rates in Center Countries ,” NBER Working Paper 10332.

Park, Y. C. (2009). “Reform of the Global Regulatory System: Perspectives of East Asia’s Emerging Economies”, presented that the ABCDE World Bank conference, Seoul, June 2009.