In the past two decades, international trade has fundamentally changed. In the wake of enhanced market access and advances in communication technologies, for a wide range of goods and services the different stages of production have become increasingly fragmented and dispersed across the globe (e.g. Baldwin 2016). These production arrangements are often referred to as global value chains (GVCs).

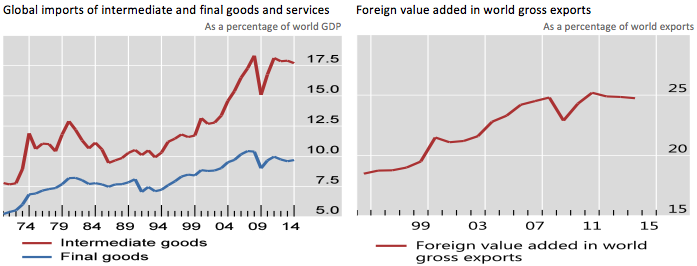

With firms able to coordinate more efficiently the various stages of production throughout GVCs, intermediate trade in goods and services has risen rapidly. Between 1995 and 2007, the ratio of intermediate trade relative to final goods and services trade increased from 1.25 to 1.75 (Figure 1, left-hand panel). This trend is also visible in the measure of value added trade (right-hand panel), which is calculated following Johnson and Noguera (2012) and corrects for the double-counting of gross trade flows when inputs cross borders multiple times.

Figure 1. GVCs have grown substantially since the early 1970s

Sources: Johnson and Noguera (forthcoming); Powell (2016); World Input-Output Database.

On a priori grounds, one would expect the growth of GVCs to influence inflation dynamics. Expanding GVCs can strengthen the channels through which wage and price pressures spread across borders. The direct channel is through price pressures for imported inputs (a channel shown to explain a substantial share of the international co-movement of inflation in Auer et al. 2017); the indirect, and arguably even more important, one is through stronger competition in each of the increasing number of links along the supply chain (i.e. through greater market contestability). As a result, this tighter integration could also make domestic inflation more sensitive to global measures of economic slack. Structurally, higher interconnectedness allows firms to bypass local bottlenecks more easily by sourcing from abroad. Cyclically, diminishing global slack could give local producers more room to raise prices without fear of losing market share to importers.

In a recent study, we find evidence in support of this hypothesis (Auer et al. 2017). Specifically, we find that growing participation in GVCs explains the relative importance of domestic and global economic slack in influencing domestic inflation, both across countries and over time. We do so in a panel setting covering 17 countries over the period 1982–2006. Our measure of the relative importance of domestic and global slack is from Bianchi and Civelli (2015), and is calculated in the spirit of the analysis in Borio and Filardo (2007). Global slack is constructed as the trade-weighted sum of slack abroad. Since the trade weights differ across countries, the resulting global slack measures are country-specific.

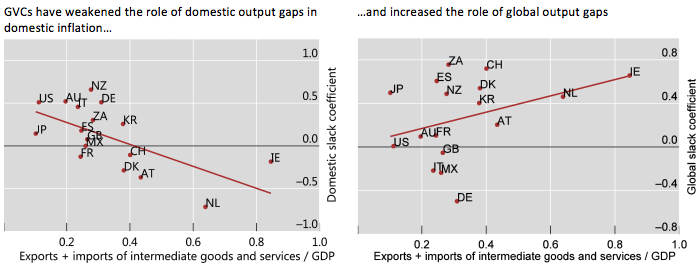

Figure 2 portrays the relationship across countries. The horizontal axis plots a measure of the participation in GVCs (the ratio of intermediate trade in goods and services to GDP); and the two vertical axes show estimates of the sensitivity of inflation to domestic and global output gaps, respectively. These are averaged over time for each individual country. We see that, on average over the period, in countries with greater participation in GVCs inflation is less sensitive to the domestic output gap (left-hand panel) and more sensitive to its global counterpart (right-hand panel). The links are statistically and economically significant. For example, the estimates indicate that, all else equal, in an economy with a 0.1 higher intermediate trade-to-GDP ratio than its peers, inflation would also be around one-third of a percentage point higher for any 5-percentage point increase in the global output gap.

Figure 2. GVCs make inflation less domestic and more global across countries

Notes: The two panels portray the cross-country relationship between the sum of exports and imports of intermediate goods and services over GDP (horizontal axis), on the one hand, and the sensitivity of inflation to the domestic or global slack, respectively (vertical axis), on the other. For further information, see Auer et al. (2017).

Source: Auer et al. (2017).

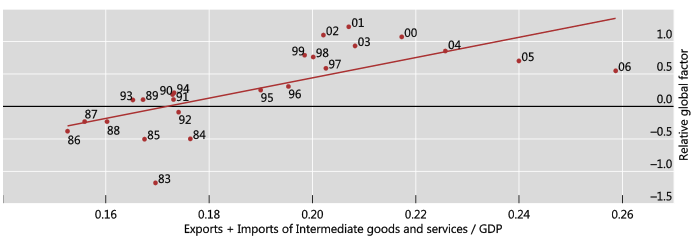

Figure 3 portrays the relationship over time. Here, the horizontal axis plots the same measure of participation in GVCs but averaged across countries in a given year, and the vertical axis shows the corresponding average of the estimated relative impact of the global and domestic output gaps – the difference between the two regression coefficients – shown individually in Figure 2. The regression line is positive and statistically significant. In other words, on average across countries the growth of GVCs, since the 1980s has coincided with the growing importance of global factors in driving domestic inflation.

Figure 3. GVCs make inflation less domestic and more global over time

Notes: The graph shows the relationship between the sum of exports and imports of intermediate goods and services over GDP (horizontal axis) and the relative global factor (vertical axis), each averaged across 18 countries for each of the years from 1983 to 2006. For further information, see Auer et al. (2017).

Source: Auer et al. (2017).

The strong relationship between participation in GVCs and the globalisation of inflation also emerges in a full panel analysis that controls for aggregate fluctuations and country characteristics and performs a number of robustness checks. Specifically, in our paper we show that the relationship is robust to the inclusion of country and time fixed effects, the exclusion of outliers, the choice of various subsamples, and the use of alternative measures of participation in GVCs.

A further finding of our analysis concerns conventional measures of trade and financial openness used in previous studies. We find that the ratio of total trade to GDP, or that of international assets and liabilities to GDP, has only marginal statistical power in explaining the globalisation of inflation once the role of GVCs is accounted for.

Our findings point to the need for further theoretical and empirical research into the nexus between globalisation and inflation, especially into the role of GVCs. On the theoretical side, they raise questions about approaches that model inflation as largely a country-centric phenomenon. On the empirical side, they suggest that it might be possible to develop more informative measures of global slack that reflect differences in the sectoral value added content of trade rather than simply in gross trade.

The monetary policy implications of a greater role for global factors in determining domestic inflation could be far-reaching. After all, these factors are beyond the control of any individual central bank, raising questions about the calibration and effectiveness of anti-inflation strategies. Any such implications are too important to be ignored.

References

Auer, R, C Borio and A Filardo (2017), “The globalisation of inflation: the growing importance of global value chains”, BIS Working Papers, no 602, January. Also available as CEPR Discussion Paper no 11905, March.

Auer, R, A Levchenko and P Sauré (2017), “International inflation spillovers via input-output linkages”, BIS Working Papers, no 623, March 2017. Also available as CEPR Discussion Paper no 11906, March.

Baldwin, R (2016), “The Great Convergence: information technology and the new globalization”, Belknap, November.

Bianchi, F and A Civelli (2015), “Globalization and inflation: evidence from a time varying VAR”, Review of Economic Dynamics 18(2)2: 406–33.

Borio, C and A Filardo (2007), “Globalisation and inflation: new cross-country evidence of the global determinants of domestic inflation”, BIS Working Papers, no 227, May.

Johnson, R and G Noguera (2012), “Accounting for intermediates: production sharing and trade in value added”, Journal of International Economics 86(2).

Johnson, R and G Noguera (forthcoming), “Fragmentation and trade in value added over four decades”, The Review of Economics and Statistics.

Powell, J (2016), “The global trade slowdown and its implications for Emerging Asia”, speech at the CPBS 2016 Pacific Basin Research Conference, San Francisco, California, 18 November.