How do changes in monetary policy affect consumption? Traditional theories emphasise the role of inter-temporal substitution: changes in interest rates affect the incentives to save rather than consume. The recent Global Crisis, however, has sparked a lively debate about whether household debt (Mian and Sufi 2014) and the characteristics of the mortgage market (Calza et al. 2013) could be (at least) as important as the intertemporal substitution channel for the ability of central banks to affect the economy.

Part of this debate, both in academic and policy circles, has been about whether having a large share of household mortgage debt on fixed rates mutes the power of policy. The UK and the US are two countries often cited in this comparison: the UK has (at least until recently) a large proportion of adjustable rate mortgages, the US the converse. But even if this mechanism does play a role, it is not a priori obvious that this is the most important aspect of the mortgage market for monetary transmission. Equally important could be the ability to freely extract equity (Kaplan and Violante 2014) and/or whether mortgagor households end up being constrained by their debt position (Eggertsson and Krugman 2012).

In a new paper (Cloyne et al. 2016), we take a fresh look at this issue using household micro data on expenditures, income, mortgage payments and balance sheet composition from the UK and US. Using a novel grouping strategy, we are able to look at heterogeneity both in the direct response of household expenditure to interest rates, and in the indirect (general equilibrium) response of household income. We show that the direct effects of interest rate changes are significantly smaller than the general equilibrium effects. As a result, the aggregate effects of monetary policy in the UK are only slightly larger than in the US, with the small difference in the responses of total expenditure being entirely driven by the significantly larger response of UK mortgage payments. Hand to mouth behaviour seems to drive the mortgagor response and the overall macro impact.1

Monetary macro with micro data

Tackling this topic requires moving beyond traditional macroeconometric methods and diving in the richness of household survey data. But unfortunately, few, if any, datasets contain information on expenditure, income, wealth, and demographics over a sufficiently long period of time. Cross-sectional data on household expenditure and income do, however, contain information on the housing tenure status; specifically, whether the household owns a home with a mortgage, owns without mortgage debt, or rents. Cloyne and Surico (2016) show that housing tenure is an effective predictor of a household’s balance sheet position.

Our approach is therefore to study the response of the mortgagors and outright owner household groups to monetary policy shocks, which we measure following the identification strategy pioneered by Romer and Romer (2004). An advantage of our micro-to-macro approach is that we are able to study the effects of monetary policy on non-durable consumption, durable expenditure, household income, and mortgage payments. We show that looking jointly at the responses of all these variables turns out to be very revealing about how the monetary transmission mechanism works.

Mortgaged households adjust spending the most

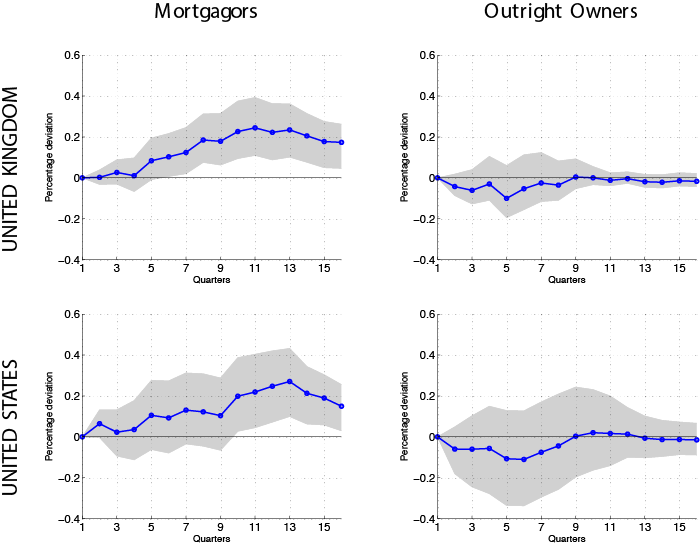

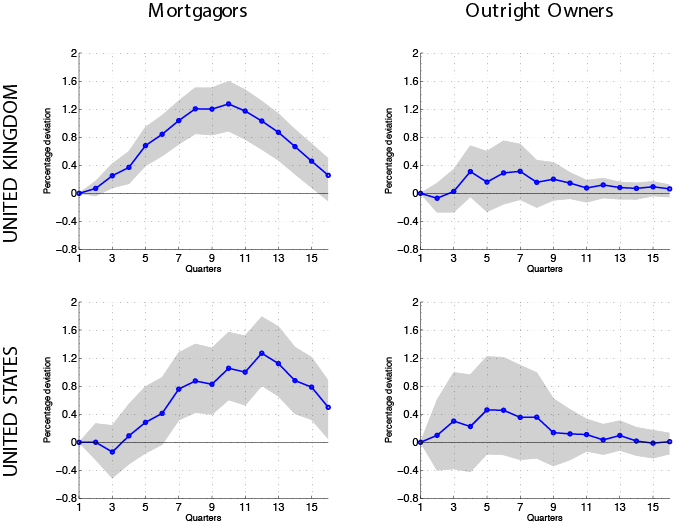

After grouping households by housing tenure, we explore the response of homeowners with mortgage debt and homeowners without debt. Figures 1 and 2 show that following a cut in the policy rate, the responses of mortgagors’ non-durable and durable expenditures are positive and significantly larger than the responses of outright homeowners.

For non-durables (Figure 1), the response of households with mortgage debt in the UK peaks at 0.3% after about 10 quarters but the response of households without debt is never statistically different from zero. For the US the pattern is similar, with the peak response in the left column reaching about 0.25%. The heterogeneity between housing tenure groups is starker for durables (Figure 2). The response of UK mortgagors' expenditure peaks at around 1.2%, but the reaction of outright owners' durables is statistically indistinguishable from zero. Again, the results are remarkably similar for the US.

Figure 1. Response of non-durables and services to a 25 basis point unanticipated interest rate cut by housing tenure group (90% confidence bands)

Figure 2. Response of durable expenditure to a 25 basis point unanticipated interest rate cut by housing tenure group (90% confidence bands)

What accounts for the expenditure response?

The reason for studying the US and UK is simple. If the direct effect of interest rate changes is the key part of the monetary transmission mechanism, we should see this ‘cash flow’ channel accounting for most of the response in mortgagor spending. In which case, it should vary in the two countries.2

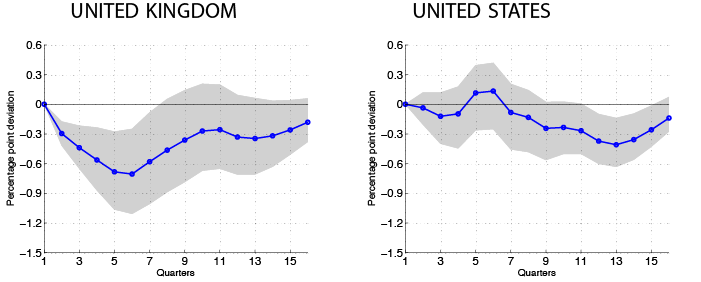

Figure 3 shows that mortgage payments in the UK do indeed move by a larger amount and more quickly than in the US. This is consistent with the notion that adjustable versus fixed rate mortgages plays some role in the transmission mechanism.

Figure 3. Response of mortgage payments to a 25 basis point unanticipated interest rate cut (90% confidence bands)

But is the direct cash flow quantitatively important in explaining the movements in mortgagor expenditure? To answer this question, we need to compare the magnitude of such an effect to the overall change in expenditure triggered by the monetary policy shock. We therefore convert the impulse response functions into dollar amounts (2007 prices). We find that the cumulative effect on mortgage payments by UK mortgagors over the four years of our impulse response period is almost 3 times larger than the response for the US households, or $166 relative to $56. But, importantly, the movement in expenditure is much larger in both countries. The movement in mortgagor expenditure over the four years is around $600 in the UK and $535 in the US.

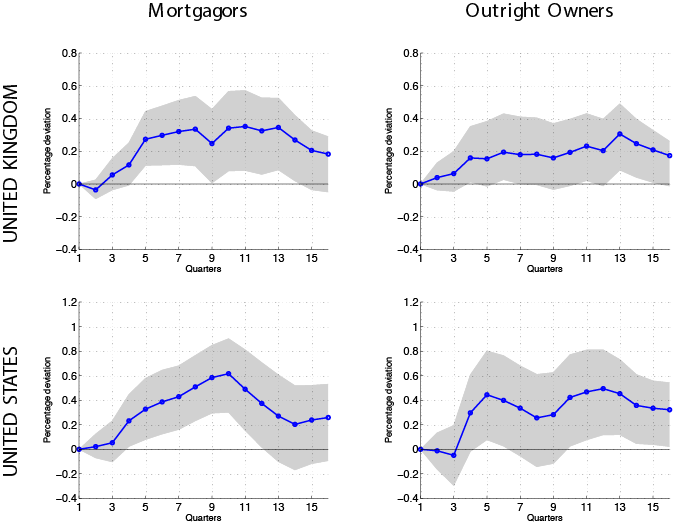

Figure 4. Response of income to a 25 basis point unanticipated interest rate cut on income by housing tenure group ( 90% confidence bands)

Although mortgage payments move differentially across the two countries, income (total income net of taxes) responds significantly and by a similar magnitude for both housing tenure groups and in both countries (Figure 4). When we convert these percentage responses into a cumulative dollar increase over the four years, we find that the effect on income is of a similar magnitude across the two countries, across the two groups, and of the same magnitude as the rise in mortgagors’ expenditures. Income rises by around $700 and $760 for mortgagors in the UK and the US, and $450 and $585 for outright owners. The relative movements of expenditure and income seem consistent with mortgagors having high marginal propensities to consume (MPC), while the outright owners have low marginal propensities to consume. This kind of asymmetry between the propensities of borrowers and savers has a long history in economics and is typically associated with some form of credit constraint facing indebted households.

Such a constraint could reflect additional equity extraction being constrained by collateral values or transaction costs associated with accessing illiquid wealth. Further evidence to support the hypothesis of debt-constrained households can be seen using (less frequent) balance sheet data from the British Household Panel Survey (BHPS) and the Survey of Consumer Finance (SCF). We find that almost 50% of mortgagors in the UK and the US have positive illiquid wealth (net housing equity, pension funds, life insurance, and other relatively illiquid investments), but are likely to be liquidity constrained in the sense that the value of their liquid assets is less than half of their monthly income. Mortgagors’ therefore clearly fit the bill of being ‘wealthy’ and ‘hand to mouth’ at the same time (see Kaplan and Violante 2014).

What does all this tell us about monetary transmission? The fact that the expenditure differences between these housing tenure groups is similar across two countries with markedly different mortgage products (although similar ability to extract equity), suggests that the general equilibrium effect on income triggered by the interest rate change is quantitatively more important than the direct cash flow effect from the movement in mortgage repayments. In other words, while the direct change in household cash flows coming from lower repayments can account for part of the increase in mortgagors’ expenditure, most of expenditure response over 3-4 years is accounted for by the rise in income.

Figure 5. Shares of wealthy hand-to-mouth (WHTM) mortgagors.

Source: UK data: 1995, 2000, 2005 waves of the British Household Panel Survey; US data: 1995, 2000, 2005 waves of the Survey of Consumer Finances.

Could our housing tenure groups hide the importance of demographic factors in explaining the heterogeneous responses? We show this is unlikely to be the case. While housing tenure is linked to the life cycle position of a household, in our empirics we show that age differences are not able to explain the expenditure differences between the two housing tenure groups. The heterogeneity we find exists even for mortgagors and owners in the same part of the life-cycle.

How consistent is this with theory?

Our main results are that mortgagors’ exhibit hand-to-mouth behaviour despite being wealthy and that the general equilibrium effects on income are more important than the distinction between adjustable and fixed rates. We also show that these empirical findings are very consistent with the predictions of general equilibrium models where heterogeneous households face liquidity constraints (Kiyotaki and Moore 1997), possibly linked to the collateral value of the house (Iacoviello 2005), or where there are transaction costs associated with accessing illiquid wealth (Kaplan et al. 2016).

Summary

Monetary policy has sizeable heterogeneous effects on private consumption expenditures. Households with mortgage debt seem to behave in a liquidity constrained manner while households without debt appear far less sensitive to movements in interest rates. While the direct channel of monetary transmission – i.e. the movement in interest cash flows – also affects the expenditure of mortgagors, most of the aggregate effect appears to come via the stimulus to the income of all housing tenure groups. Given that mortgagors represent about 40% to 50% of population in the UK and the US, our findings highlight the key role played by debt-constrained households in the transmission of monetary policy

References

Calza, A, T Monacelli, and L Stracca (2013),"Housing Finance and Monetary Policy." Journal of the European Economic Association 11: 101-122.

Campbell, J (2012), "Mortgage Market Design." Review of Finance 17, October: 1-33.

Cloyne, James and Ferreira, Clodomiro and Surico, Paolo.(2016) "Monetary Policy When Households Have Debt: New Evidence on the Transmission Mechanism" CEPR DP11023.

Iacoviello, M (2005), "House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle." American Economic Review 95, no. 3: 739-764.

Kaplan, G, and G Violante (2014), "A Model of the Consumption Response to Fiscal Stimulus Payments." Econometrica 82, no. 4: 1199-1239.

Kaplan, G, B Moll, and G Violante (2016), "Monetary Policy According to HANK," Working Paper.

Kiyotaki, N, and J Moore (1997), "Credit Cycles," Journal of Political Economy 105, no. 2: 211-248.

Romer, C, and D Romer (2004), "A New Meassure of Monetary Shocks: Derivation and Implications." American Economic Review 94, no. 4: 1055-1084.

Endnotes

[1] Renters adjust their expenditure too, although by less than mortgagors. As their income also responds significantly to the monetary policy shock we also find a higher sensitivity of consumption to income changes for this group. Renters, who tend to be younger and on a lower income, seem to fit well the traditional stereotype of households with limited access to credit, but in our paper we focus primarily on households with mortgage debt that make up a much larger share of the population.

[2] It is worth noting that even in a country dominated by a large proportion of fixed rate deals like the US, the effect of monetary policy on mortgage payments can still have important effects on overall consumption. The reason is that at each point in time, there would always be some households refinancing on lower rates, some home movers and first time buyers entering the market.