The possibility that the citizens of the UK will vote to leave the EU is worrying (HM Treasury 2016, Bank of England 2015.) Brexit is one of the many crises currently affecting the European integration project, but it is different. It is different because it raises fundamental questions about the integration project. Brexit ask questions about the value of being in the Union, about the value of membership, about the value of being integrated and interconnected in the world, about the dynamics and distribution of its benefits and costs, and about the type of integration that can sustain (or hopefully even increase) the benefits we have seen since the 1950s. These benefits from deep integration have been largely taken for granted and consequently their analysis has not been advanced, discussed, debated, improved or scrutinised enough. The time is ripe for doing so.

Previously (Campos et al. 2014), we showed that the benefits from EU membership are large and substantially outweigh the costs. We warned that the attendant econometric evidence was (and still is) disconcertingly thin. We use a novel methodology to estimate that per capita incomes would have been approximately 12% lower without EU membership. Focusing on the 1980s and 2004 enlargements, we reported that per capita incomes would have been smaller for every country, except Greece. We have subjected these results to various robustness checks with two being particularly noteworthy. One is that we use a differences-in-differences framework to assess the statistical significance of these estimates. These tests were carried for all countries, enlargements and all three time windows we report (the first five and the first ten years after joining, as well all the whole period of membership), and we find our estimates to also be significant statistically. The second substantial sensitivity check was to ignore the country pool selection and randomly generate the country donors for the counterfactuals. In simpler terms, the method we use optimally chooses the countries that enter our counterfactuals in a weighted fashion. One may worry that when there is a very good match (and very few countries are selected), these few countries drive the results. Recognising that a good match is what the method is striving for, we decided to randomise this choice and study the behaviour of the ensuing estimated benefits. We found the stability of our estimated benefits to be remarkable for both rich and poorer countries.

A legitimate concern is that poor countries may benefit more than rich countries – indeed, that advanced economies (like the UK) have little to gain from being a member of the EU. In other words, a critic may charge that our results are driven by the fact that the enlargements of the 1980s and 2004 were ‘poorer country’ enlargements and their ‘per capita income gaps at entry’ were hefty. The per capita income gap at entry is the percentage difference between the average per capita income of existing members and that of candidate countries in US dollar PPP for the official accession year. We calculate that candidate countries in 1973 had on average 96% of the per capita income of existing members; in the 1980s this was 63%; in 1995 it was 103%; while in 2004 it was 45%. Larger gaps should be associated with sizeable catch-up benefits from integration. To put it bluntly, it may be easy to see why Portugal and Latvia, for example, benefit so much from joining the EU, but it may be harder to see how, say, Sweden or the UK could possibly benefit as much. This column shows that richer countries also benefit considerably but they may do so differently: while the benefits from EU membership to poorer countries tend to be mostly in terms of per capita income, for richer countries these benefits tend to mostly in terms of productivity.

Is this a rich man’s world?

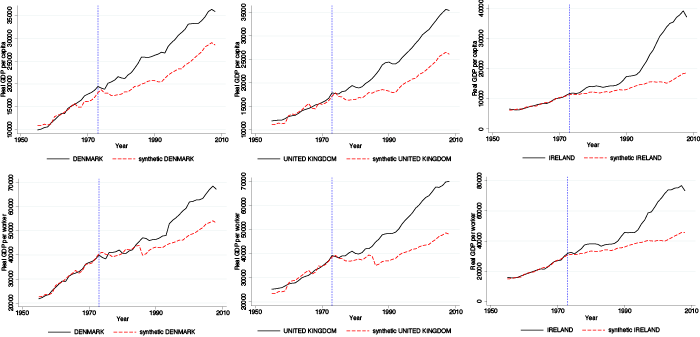

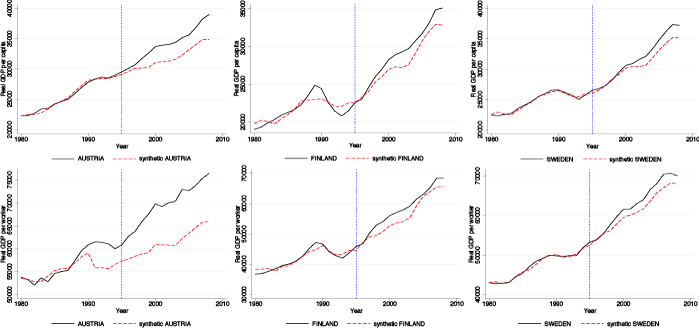

In a recent paper, Campos et al. (2014), we use the synthetic counterfactuals method (SCM) pioneered by Abadie and Gardeazabal (2003) to estimate, on a country-by-country basis, the benefits from joining the EU in terms of economic growth and productivity. Figures 1 and 2 show SCM results for the 1973 and 1995 EU enlargements.1 The dark line is for actual per capita GDP (or labour productivity), and the red line for the estimated synthetic counterfactual.

Figure 1. Actual and synthetic real per capita GDP and real per worker GDP in the 1973 EU enlargement

SCM estimates the effect of a given intervention (in this case, EU membership) by comparing the evolution of an outcome variable for a country affected by the intervention vis-à-vis that for an “artificial control group” (Imbes and Wooldridge 2009, p. 79). The latter is a weighted combination of other units (countries) chosen so as to match the treated country, before intervention, for a set of predictors of the outcome variable. Using SCM we estimate what would have been per capita GDP if a given country had not become a member of the EU.

In the summer of 1961, Denmark, Ireland, and the UK submitted official applications for accession to the European Communities.2 When France vetoed the UK application, the other candidates withdrew (Bache et al. 2011). Applications were resubmitted and, in 1969, accepted with accession in 1973 (vertical dotted line in Figure 1). The results suggest that per capita GDP would be considerably lower in these countries had they not joined the EU in 1973. The actual and the synthetic series are reasonably close before 1973 (more so for labour productivity than per capita GDP), while they since diverge, indicating that there was little anticipation of the effects from EU membership.3 In addition, the difference between actual and synthetic does not diminish, suggesting that the benefits from membership seem more likely to be permanent than temporary. The dynamics of these benefits is noteworthy. For example, the benefits from EU membership for the UK (although substantial throughout) may have slowed down in later years, while for Ireland they seem to have accelerated instead. This suggests that the UK benefited more from the single market while Ireland did benefit mostly from the common currency.4

There seems to be evidence of anticipation effects, particularly for Austria. It is widely acknowledged (e.g., Bache et al. 2011) that delays in EU accession of the three 1995 countries are largely explained by their neutrality during the Cold War (e.g., they were never NATO members). Austria officially applies for accession as early as 1989 (which seems, interestingly, reflected in our SCM results), Sweden in 1991, and Finland in 1992.

Figure 2 suggests that the countries that joined in 1995 may not have benefited as much from EU membership as did the 1973 class. Why are benefits relatively large for 1973, and relatively small for 1995?

- We conjecture that this is because the 1973 countries designed, implemented, and benefited from the single market (1986-1992) and – especially in the case of Ireland – from the common currency (as well as from attendant advances in financial integration).

- The main impediment for the 1995 countries to join was political (the Cold War), and their benefits from EU membership seem mostly in terms of labour productivity (and less in terms of per capita GDP).

Future research should investigate fully the reasons for the relatively worse performance of the 1995 class. One line of inquiry we deem worth pursuing stresses institutions. If the bulk of the benefits the EU provide is to encourage institutional change, then one would expect the potential gains that membership could generate in Austria, Finland, and Sweden in 1995 to be indeed smaller than those in Denmark, Ireland, and the UK in 1973.

Figure 2. Actual and synthetic real per capita GDP and real per worker GDP in the 1995 EU enlargements

How big are these benefits?

A measure of the magnitude of the economic benefits from EU membership is given by the difference between the actual per capita GDP for each country (or labour productivity) and that of its SCM artificial control group. We find substantial benefits for the 1973, and modest benefits for the 1995 enlargement. For the first ten years post-accession, per capita incomes for the former would be approximately 12% lower, while that for the latter would be about 4% lower (without EU membership). Alternatively, if we consider all years since accession, the respective figures would be about 34% for the former, and 5% for the latter. We find that per capita incomes in the UK and Denmark would have been 25% lower (if they had not joined the EU in 1973), but that the benefits for Ireland are even larger. Our estimates suggest that per capita income in Ireland would have been about 50% lower if it had not joined the EU in 1973.

Conclusions

This column presents new estimates of the economic benefits from EU membership focusing on the 1973 and 1995 enlargements. The main conclusion is that of substantial and positive pay-offs with benefits from EU membership clearly above direct costs, and with larger gains for the 1973 than for the 1995 enlargement.5 Moreover, the difference between the estimated benefits for 1973 and 1995 enlargements is considerable and, thus, should not be attributed solely to differences in per capita incomes at the time of joining. We conjecture that institutions may provide a more promising explanation of these differences if one believes that Austrian, Finnish, and Swedish institutions were better developed or aligned with the EU when these countries joined the European Union.

References

Abadie, A and J Gardeazabal (2003), “The Economic Costs of Conflict: A Case Study of the Basque Country”, American Economic Review, 93: 113–132.

Acemoglu, D, S Johnson, A Kermani, J Kwak, and T Mitton (2014), “The Value of Connections In Turbulent Times: Evidence from the US”, NBER Working Paper 19701.

Bache, I, S George, and S Bulmer (2011), Politics in the European Union, Oxford University Press.

Bank of England (2015), "EU membership and the Bank of England", October.

Billmeier, A and T Nannicini (2013), “Assessing Economic Liberalization Episodes: A Synthetic Control Approach”, Review of Economics and Statistics, 95(3): 983–1001.

Campos, N, F Coricelli and L Moretti (2014), “Economic Growth and Political Integration: Synthetic Counterfactuals Evidence from Europe”, mimeo.

Diamond, J (1997), Guns, Germs, and Steel: The Fates of Human Societies, W W Norton.

HM Treasury (2016), "HM Treasury analysis: the long-term economic impact of EU membership and the alternatives", April.

Imbens, G and J Wooldridge (2009), “Recent Developments in the Econometrics of Program Evaluation,” Journal of Economic Literature, 47: 5–86.

Endnotes

1. Campos et al. (2014) find estimated benefits to be larger for the 1973 (UK, Ireland, and Denmark) and 2004 (transition countries) enlargements, mixed for the 1980s, and modest for the 1995 enlargements, with substantial differences across countries.

2. Recall that these three countries were founding members of the European Free Trade Area (EFTA). EFTA was successful at increasing trade among its members, but not as successful as the European Community. Also note that at the time of entry, Denmark was the richest of the three, with Ireland’s per capita GDP comparable to (slightly higher than) the UK’s. In terms of GDP size, the UK was, and remains, the (much) larger economy.

3. This is generally true for all countries here, with the exception of Finland’s per capita GDP in Figure 2, but this is mostly due to the Finnish banking crisis of 1991-1993.

4. In spite of the sharp contraction of output that Ireland suffered during the Great Recession, its GDP per capita (in PPP) remains in 2014 10% higher than that of the UK (according to IMF WEO data).

5. A reason SCM is not as yet widely used is that “it does not allow assessing the significance of the results using standard (large-sample) inferential techniques” (Billmeier and Nannicini 2013, p. 987). One way of addressing this issue, based on jacknife estimation, was recently proposed by Acemoglu et al. (2014). Campos et al. (2014) propose a different approach based on the differences-in-differences estimator. Using this method, we find the impact of EU membership to be positive and statistically significant at conventional levels, for all enlargements.