There is broad consensus that small and medium-sized enterprises (SMEs) are particularly vulnerable to credit crunches as they have limited access to alternative sources of financing that could compensate for bank credit contraction. However, it is often neglected that a main source of alternative financing is trade credit, that is, delayed payments for the purchase of inputs. Trade credit is widely used by SMEs and therefore could constitute a relevant buffer to the squeeze in bank credit.

Although there is a vast literature on trade credit and its determinants, there are only a few studies on its behaviour during financial crises. Love et al. (2007) and Love and Zaidi (2010) study trade credit during financial crises in the 1990s in Asia and Mexico. They find that during those crises, SMEs faced unfavourable terms in trade credit relations and experienced a lengthening of the payments for their receivables. However, their results are related to a small set of countries and, moreover, the datasets used did not allow for a simultaneous analysis of the behaviour of large and small firms. Indeed, one paper focused on SMEs, and the other on large firms.

In a recent paper, we analyse the issue using a large dataset of firms in 31 European countries, covering the period of the Great Recession (Coricelli and Frigerio 2016).

The liquidity squeeze on SMEs

Our focus is on net trade credit, the difference between receivables and payables. Indeed, net trade credit directly affects the liquidity position of firms. Furthermore, such a net credit indicator permits us to measure the redistribution of liquidity across firms. Our main objective is to identify whether SMEs benefited or lost through such redistribution.

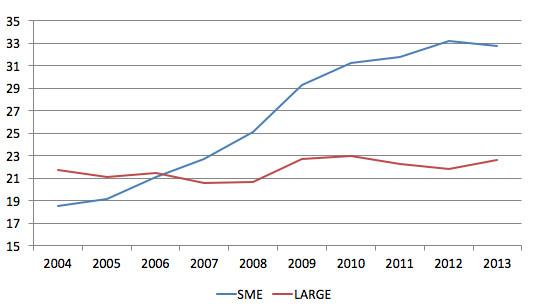

As shown in Figure 1, European SMEs significantly increased their net trade credit to sales ratio during the Great Recession. The lines in Figure 1 measure the days of delay in payment for sales, net of the delay of payments on the purchase of inputs. During the Great Recession, SMEs experienced an increase of more than 50% in such delay in payments.1 Therefore, trade credit did not provide any buffer to the contraction in bank loans. In fact, through increased net trade credit, SMEs suffered a squeeze in their liquidity.

Figure 1. Average ratio of net trade credit to sales (NTCS) by year

Source: our elaboration on AMADEUS data.

Nevertheless, the fact that net trade credit provided by SMEs increased during the Great Recession is not sufficient to conclude that SMEs suffered the liquidity squeeze through trade credit because they were small in size. This is relevant in order to justify policies that target SMEs.

Identifying a ‘size’ effect is not trivial, as there could be characteristics of SMEs that influence their specific position as net lenders or net borrowers independently from a direct size effect. Two characteristics are particularly relevant. The first, which we call technological, is related to the position that SMEs occupy along the production chain. The increase of the net trade credit to sales ratio for SMEs may be a consequence of their higher ‘upstreamness’ – that is, their higher distance from final customers. If this were the case, the role of firm size would be only an indirect result of technological differences (Antras et al. 2012). In our analysis, we control for this channel by using the upstreamness indicator in the regression analysis.

The second characteristic could be associated with the fact that SMEs tend to hold higher cash reserves, precisely because they anticipate the risk of facing future financing constraints that they would not be able to bypass. As a result, SMEs could have entered the financial crisis with higher liquidity, which was then redistributed through the production chains. This channel can be controlled in the empirical analysis by using the pre-crisis ability of firms to generate cash flow as a potential determinant of net trade credit.

Identifying the ‘size’ effect

We find that both the technological channel and the liquidity channel play a role. However, the position in the production chain tends to explain the level but not the change in net trade credit. Furthermore, firms with higher ability to generate cash-flow tend to provide larger net credit. However, these two channels do not eliminate the role of a ‘size’ effect. The size variable appears highly significant in the regression analysis and reveals that SMEs displayed a large increase in their net credit during the Great Recession. We then try to understand how the size effect operates and postulate that firm size determines the bargaining power of firms in their credit relationship with other firms. We combine enterprise-level data with input-output tables to construct an indicator of relative bargaining power in inter-enterprise relations. We assume that firms have higher bargaining power if they are large relative to their supplier or customer firm. We find that such relative bargaining power is highly significant as a determinant of the dynamics of net trade credit during the Great Recession.

Effects on SMEs performance

Did such increase in net credit have a negative effect on the real performance of SMEs?

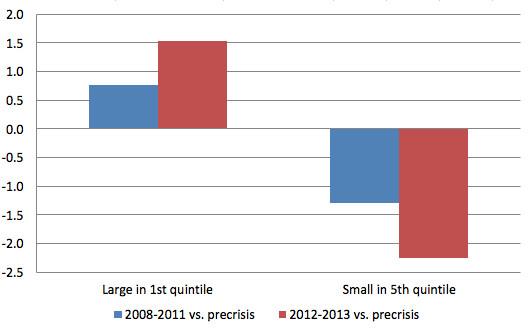

Indeed, the liquidity squeeze on SMEs through trade credit had significant adverse effects both on investments and on employment and wages. Looking at both the initial period of the crisis and the years 2012-13, we find a large quantitative effect of trade credit on investment performance, with a gap of more than 4 percentage points between the SMEs in industries with the largest increase in net trade credit and large firms in industries with the smallest increase (Figure 2). Similarly, an increase of one standard deviation in net trade credit produces a reduction of 12 percentage points in the wage bill and of 0.6% in employment, indicating that the adverse real effects of increasing net trade credit on labour market variables are also quantitatively relevant.

Figure 2. Imputed changes in investments

Source: our elaboration on AMADEUS data.

Concluding remarks

The evidence provided in our analysis suggests that in the context of the anaemic recovery of the real economy in several European countries, policies aimed at alleviating the liquidity squeeze on SMEs, due to the worsening of their position in the inter-enterprise credit market, should be high on the policy agenda.

Authors’ note: A thorough discussion of policy options is contained in our policy paper for the Restarting Long-term finance in Europe project, directed by Colin Mayer and jointly developed by Assonime and CEPR.

References

Antras, P, D Chor, T Fally and R Hillberry (2012) “Measuring the upstreamness of production and trade flows”, American Economic Review, 102(3): 412–16.

Coricelli, F and M Frigerio (2016) “Inter-enterprise credit and adjustment during financial crises: The role of firm size”, CEPR Discussion Paper 11680.

Love, I and R Zaidi (2010) “Trade credit, bank credit and financial crisis”, International Review of Finance, 10(1): 125–147.

Love, I, L A Preve and V Sarria-Allende (2007) “Trade credit and bank credit: Evidence from recent financial crises”, Journal of Financial Economics, 83(2): 453–469.

Endnotes

[1] Note that both SMEs and large firms have positive net receivables. This is due to the fact that the enterprise sector as a whole is a net creditor to outside sectors such as the government and the household sector.