The business of central banks used to be profitable – they issue cash and can invest the proceeds in the assets they like. The more cash they issued, the more they used to gain. But negative rates have upended this business model. Printing bank notes when interest rates go negative become a loss-making business.

In textbooks, ‘seigniorage’ is defined as the profits a central banks makes when it issues cash and can invest the proceeds in assets which yield interest. The public has to hold cash because it is legal tender. Seigniorage1 can thus be understood as the revenue from the monopoly of issuing legal tender. Seigniorage revenues used to be important – up to 0.5 % of GDP, enough to influence important decisions.2

Central banks can also force banks to hold reserves (so-called ‘required reserves’) without paying interest on them. These reserves are part of the monetary base and thus contribute potentially to seigniorage income. However, most central banks have abandoned this practice and decided to remunerate required reserve holdings. Negative rates have also turned this model upside down – banks are happy for any reserves they can park at the central bank without having to pay for the privilege.

Economists thus define seigniorage as the product of the amount of cash outstanding times ‘the’ interest rate. What the relevant interest rate is depends, in practice, on the type of assets the central banks holds as counterpart to the issuance of cash.

The Federal Reserve and the Bank of Japan usually invest in government securities of various maturity. In Japan, the yields on government bonds up to ten years are now negative. This implies that the normal seigniorage calculations should show a loss this year.

The Eurozone is different in that, until it started using ‘unconventional’ policy tools, the assets of the Eurosystem were mainly loans to commercial banks. The seigniorage, or monetary income, to be distributed among the NCBs thus used to be (roughly) equal to cash in circulation multiplied with the euro area wide interest rate for lending operation set the ECB times. The ECB’s lending rate has already been close to zero for some time (0.05 % since September 2014) but was set exactly to zero only in March of this year, which should lead to zero seigniorage revenues.

The deposit rate, i.e. the interest on (excess) reserves, has already been negative since June of 2014. Formally this rate should be irrelevant for seigniorage calculations since there is no obligation of banks to deposit money at the ECB (aside from a very small required reserve ratio).

Recently, the ECB has announced a new tool, the ‘targeted long-term refinancing operations’ (TLTRO), under which it will charge banks the deposit rate if they expand lending above a certain, not very demanding, benchmark. Since banks are expected to transfer most of their borrowing from the ECB towards this facility, and given that the deposit rate now stands a minus 40 basis points, the theoretical seigniorage revenues for the ECB might well turn negative this year.

Negative rates have another implication: the usual calculations of the ‘net worth’ of central banks become meaningless. A number of recent policy proposals (Siebert 2012, Vihriälä and Weder di Mauro 2014, High Level Group on EU Finances 2015) are based on a reliable stream of ECB profits, implying that the present value of the future seigniorage revenues of the ECB is rather high. All these calculations, most prominently Buiter (2008), are based on a stream of future seigniorage revenues discounted back to the present.

But with negative rates the future is no longer ‘discounted’. On the contrary, future revenues are worth more than revenues today. But an infinite sum of ever larger negative revenues is meaningless. Moreover, negative rates increase the demand for cash. This implies that in future central banks might have to pay ever more for the privilege to issue legal tender.

In the Eurozone, the cash-to-GDP ratio has already risen to 10%. In Japan, with its long history of zero rates, that ratio has gone to 16%. If negative rates persist, there is thus a danger that central banks will make ever larger losses as more and more institutes use vaults to stash liquidity in cash instead of paying the ECB, or the German government, to keep it safe. The cost of storing and insuring large amounts of cash is reportedly only 30 basis points (per annum). As long as the deposit rate at the ECB is below this threshold, one should thus expect the demand for cash to increase.

Central banks as investment bankers

The theoretical seigniorage revenues should thus disappear, and even become ever more negative with negative rates. But in reality central bank profits are holding up rather well. The reason is that as their traditional business model is destroyed by negative rates, central banks have gone in another business, namely maturity transformation of the kind usually done by investment banks. Central banks have started to leverage up their balance sheet, buying large amounts of long-term government bonds (financed by short-term deposits). This is called ‘quantitative easing’. The purpose is to force long-term interest rates down.

QE in general increases the income of a central bank, especially if earns on both sides; on its liabilities it charges a fee on the deposits of commercial banks and on its asset side it earns, or rather used to earn, a return on long-term government bonds. With German long-term rates negative, the Bundesbank loses on its investments, but the ten-year rate is still higher than the deposit rate.

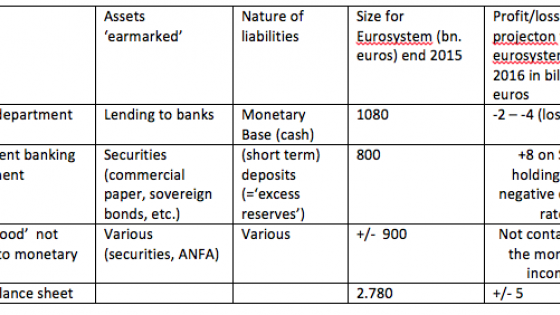

One should thus split the balance sheet of a central bank in two conceptually very different parts:

- The issuing department (which issues legal tender); and

- The investment banking department, which issues short-term deposits to buy longer-term and/or more risky assets, which usually yield much more than a central bank has to pay on its short-term debt.

The revenues (= profits since there are no costs, except the printing of bank notes) of the issuing department correspond to theoretical seigniorage: 'the' interest rates times cash in circulation. (Required reserves on which interest is paid net out of the calculation.)

The profits of the investment banking department are equal to the difference between what the central bank pays in its liabilities (short-term deposits of commercial banks) and what it earns on the securities it has invested in. The profits of the investment banking department are not certain. If the short-term refinancing costs increase losses can arise quickly.

Following central bank revenues in the Eurozone

One has to be careful in looking for seigniorage and the investment banking profits in the case of the ECB. The Eurozone is a special case in central banking accounting.

There exists a complicated system of calculating and distributing the profits from central bank activities in the Eurozone. The ECB is the place where all decisions are taken, but not the place where most profits arise. The ECB is a legal entity, separate from the NCBs, with which together it forms the ‘Eurosystem’. The NCBs actually implement most monetary policy operations, i.e. they are the legal counterparts for banks when they borrow ‘from the ECB’ or when ‘the ECB’ buys government bonds. For ‘normal’ monetary policy operations, this does not matter. All income (occasionally losses, when a bank fails and its collateral proves insufficient) is added up to calculated what is called the (Eurozone-wide) ‘monetary income’. This sum is then distributed among the NCB pro rata their capital shares. The ECB proper usually gets a small cut from the total. But in general this does not matter since the NCB, in turn, owns the capital of the ECB in the same proportions.

The revenues of the issuing department correspond roughly to what the Eurosystem calls 'monetary income', which is then distributed to the NCBs (and then to their respective governments). With negative rates one gets of course negative seigniorage if one just multiplies base money with 'the' interest rate.

Table 1 below shows a schematic split of the balance sheet of the Eurosystem. Identification of the investment banking activities is made next to impossible by the fact that the NCB still execute many national functions which transit through their balance sheets, but have nothing to do with monetary policy. Table 1 is based on the available data for the only two items on the consolidated balance sheet of the Eurosystem which are clearly identified as being related to monetary policy.

Table 1 Profit centres in Eurozone central banking

Source: Own calculations based on ECB data.

Figure 1 shows the evolution of the two profit centres of the Eurosystem over time. It is apparent that during ‘normal’ times the issuing department dominates. The relative proportions change radically when the ECB starts to adopt unconventional measures and (recorded) investment banking profits soared when the ECB started to buy bonds in 2011/12.

Figure 1 ECB – Eurosystem income (billions of euros)

Source: Own calculations based on ECB data.

The investment banking department is now the real profit centre in the Eurozone (as elsewhere in countries at, or close to the zero lower bound). In 2015, the revenues of the issuing department of the Eurosystem were only €500 million, which would not even cover the operating costs of the ECB in Frankfurt, which amounted to over €600 million (the total operating costs of the entire Eurosystem – the ECB plus NCBs – amount to over €2 billion).

One has to keep in mind that the official monetary income calculations are misleading. The Eurosystem booked a particularly large profit on its bond holdings in 2012. This was the year government of Greece defaulted on its bonds in an operation euphemistically called ‘Private Sector Involvement’. The ECB had bought about €60 billion of Greek bonds, but miraculously did not make any loss on them because it had previously ‘agreed’ with the Greek government that all the bonds held by the Eurosystem (i.e. the NCBs) were exchanged with other bonds with identical financial conditions, but bearing a different identification number. In the PSI operation, all bond series where subject to an ‘offer’ of a large haircut. Only the bond series held by the ECB were exempted from the haircut.

The ECB had bought the bonds on the secondary market as any other market participants. But everybody else had to take a haircut of almost 80%, only the ECB was made whole. It is thus clear that under normal circumstances the Eurosystem would have made a very large loss (about €25 billion) if the Eurozone governments had not somehow ‘persuaded’ the Greek government not to default on the ECB.

Another little known ‘side agreement’ later stipulated that the profits the Eurosystem earned by buying Greek bonds at a low market price (often below 70% of face value) and later getting repaid the full face value should be returned to the Greek government. This is achieved indirectly, via the NCBs, which transfer their shares of the overall monetary income to their respective governments, which are then supposed to transfer to the Greek government the sum corresponding to the difference between the purchase price and the face value. A large part of the profits recorded in the Eurosystem over the last years thus went back to Greece.

The ECB is widely believed to have bought about €60 billion of Greek government bonds at a market value of perhaps €38 billion. This means that about €22 billion (the difference between the market and face values) of the profits of the investment banking department of the Eurosytem are only apparent and will in reality be channelled to Greece.

Another part of the investment banking profits of the Eurosystem derives from the purchases of other government bonds under the SMP, which was done under full risk sharing. Until late 2012, these purchase amounted to almost €200 billion of Italian, Spanish and Portuguese bonds. These bonds have all risen strongly in value, often above par thus increasing the ‘monetary income’ calculations. But the ECB holdings are now only around €110 billion.

The ECB’s balance sheet is now increasing again. The investment banking profits should increase again. However, with 80% of QE being undertaken by the NCB for their own account, the ECB had to redefine its monetary income. A recent decision of the ECB determines that the national bonds bought by the NCBs under the PSPP will be ‘deemed to have an income’ equal to the lending rate, i.e. zero. A large part of the future investment banking income will thus accrue to NCBs directly and will not be distributed within the Eurosystem. The amount of seigniorage one can expect for the Eurosystem in future has thus become somewhat variable and might be much lower than most people think. Experience has shown that investment banking is an inherently unstable business. One should thus be careful with proposals under which the seigniorage of the ECB is used as reliable source of income.

The old business model of issuing euro cash has become unprofitable. But in the near future the bond buying will at least lead to some more revenues going through the Eurosystem because the ‘income’ from the negative interest on the liabilities created by the PSPP will still be pooled.

The ECB has thus effectively turned the old business model of central banks around – today it earns a stream of income on its liabilities, while the returns of an increasing part of its assets go to the NCBs. This cannot be a stable arrangement.

References

Bini-Smaghi, L. and D. Gros (1999), Open issues in European Central Banking, McMillan.

Buiter, W. (2008). “Can Central Banks Go Broke?”, Centre for Economic Policy Research Policy Insight No.24, May.

High Level Group on EU finances (2015) “Seigniorage”, fiche 5,

Roubini, N. (2012) “Don’t Look to Seigniorage to Save the Euro”

Gros, D. (2004), ‘‘Profiting from the Euro? Seigniorage Gains from Euro Area Accession.’’ Journal of Common Market Studies 42 (4): 795–813.

Gros, D. (2015) “QE ‘euro-style’: Betting the bank on deflation?” Briefing Paper, European Parliament

Gros, D. and G. Vandille (1995) “Seigniorage and EMU: The Fiscal Implications of Price Stability and Financial Market Integration”, Journal of Common Market Studies 33(2), 175-196.

Siebert, A. (2012), “The Role of the ECB in Financial Assistance Programmes” European Parliament, June.

Vihriälä, V. and B. Weder di Mauro (2014), “Orderly debt reduction rather than permanent mutualisation is the way to go", VoxEU.org, 2 April.

Endnotes

[1] This is the rather feudal word still used nowadays to refer to the income of central banks, because that income is derived from the right to issue money, once the prerogative of mediaeval lords. http://www.nbbmuseum.be/doc/infosheets/fiche_information_EN_15.pdf

[2] See Gros and Vandille (1995) and Gros (2004), who examines the distribution of the ECB’s seigniorage revenue and the prospective gains accruing to the new member states from Central and Eastern Europe.