Teaser from original column posted on 15 August 2014

Six years after the Crisis and the recovery is still anaemic despite years of zero interest rates. Is ‘secular stagnation’ to blame? This column introduces an eBook that gathers the views of leading economists including Summers, Krugman, Gordon, Blanchard, Koo, Eichengreen, Caballero, Glaeser, and a dozen others. It is too early to tell whether secular stagnation is really secular, but if it is, current policy tools will be obsolete. Policymakers should start thinking about potential solutions.

Economic growth is still anaemic despite years of zero interest rates.

- Is ‘secular stagnation’ to blame? What does secular stagnation really mean? And if it’s for real, what must be done?

Today, VoxEU.org launches an eBook that gathers the views of leading economists including Summers, Krugman, Gordon, Blanchard, Koo, Eichengreen, Caballero, Glaeser and a dozen others (edited by Coen Teulings and me). Collectively, the chapters suggest that something historic is afoot.

Click here to download the eBook.

Table of contents

|

Laurence H Summers

|

Reflections on the ‘New Secular Stagnation Hypothesis’

|

|

Paul Krugman

|

Four observations on secular stagnation

|

|

Robert J Gordon

|

The turtle’s progress: Secular stagnation meets the headwinds

|

|

Barry Eichengreen

|

Secular stagnation: A review of the issues

|

|

Olivier Blanchard, Davide Furceri

and Andrea Pescatori

|

A prolonged period of low real interest rates?

|

|

Richard C Koo

|

Balance sheet recession is the reason for secular stagnation

|

|

Ricardo J Caballero and

Emmanuel Farhi

|

On the role of safe asset shortages in secular stagnation

|

|

Edward L Glaeser

|

Secular joblessness

|

|

Joel Mokyr

|

Secular stagnation? Not in your life

|

|

Nicholas Crafts

|

Secular stagnation: US hypochondria, European disease?

|

|

Gauti B. Eggertsson and

Neil Mehrotra

|

A model of secular stagnation

|

|

Guntram B Wolff

|

Monetary policy cannot solve secular stagnation alone

|

|

Juan F. Jimeno, Frank Smets and Jonathan Yiangou

|

Secular stagnation: A view from the Eurozone

|

|

Richard Baldwin and Coen Teulings

|

Introduction

|

The length of the Great Recession and the extraordinary measures necessary to combat it created a widespread, but ‘ill-defined’ sense that something had changed. ‘Ill-defined’ received a name when Larry Summers re-introduced the term ‘secular stagnation’ in late 2013.

But slow growth is hardly novel; why should calling it ‘secular stagnation’ change anything? What does secular stagnation really mean? What has changed? And if secular stagnation is for real, what should be done about it?

With these questions in mind, we asked a group of leading economists to share their views, and gathered them in a VoxEU.org eBook that we release today. Judging from the almost unbelievable response, it seems that the world’s leading macroeconomists are worried that something historic is afoot.

- Larry Summers’s chapter, which opens the volume, updates and refines his thinking. The ‘new secular stagnation hypothesis’, he writes, “suggests that macroeconomic policy as currently structured and operated may have difficulty maintaining a posture of full employment and production at potential, and that if these goals are attained there is likely to be a price paid in terms of financial stability.”

- Paul Krugman states the case bluntly in his chapter: “The idea that the liquidity trap is temporary has shaped the analysis of both monetary and fiscal policy. … [T]he real possibility that we’ve entered an era of secular stagnation requires a major rethinking of macroeconomic policy.”

To varying extents, Olivier Blanchard, Barry Eichengreen, Ricardo Caballero, Richard Koo, Nick Crafts, and a dozen other contributors to this eBook agree. But not all do.

Bob Gordon, in his chapter that updates his earlier thinking, writes: “Summers and I are talking about different aspects…My analysis suggests that the gap of actual performance below potential that concerns Summers is currently quite narrow and that the slow growth he observes is more a problem of slow potential growth than a remaining gap.”

Key messages

Our authors are far from a homogenous group – they come from different continents and different schools of thought. Their contributions were uncoordinated and they do not entirely agree, but a fairly strong consensus has emerged on three points.

- First, a workable definition of secular stagnation is that negative real interest rates are needed to equate saving and investment with full employment.

- Second, the key worry is that secular stagnation makes it much harder to achieve full employment with low inflation and a zero lower bound on policy interest rates.

- Third, while it is too early to tell whether secular stagnation is going to materialise in the US and Europe, economists and policymakers should start thinking hard about what should be done if it does. Doing so is a no-regret option.

If stagnation will be really secular and the real interest rate remains low or even negative for long time, the old macroeconomic toolkit will be inadequate. And the extraordinary monetary and fiscal measures in place today may not be available next time.

Europe should be especially worried

A final point concerns the US–Europe imbalance in the secular stagnation debate. “Europeans should be much more afraid than Americans,” Nick Craft notes. “The depressing effects of slower growth of productive potential will probably be felt more keenly in Europe.” Juan Jimeno, Frank Smets, and Jonathan Yiangou also make similar arguments in their chapter. Europe’s lack of market flexibility reduces investment demand. Its demographic prospects increase its supply of savings. Today’s low investment demand could therefore become persistent if Eurozone productivity and labour-market performances remain weak. However, the US should worry about its labour-force participation. Glaeser talks about “Eurosclerosis in the United States”. He writes: “Today, the [participation] rate has fallen to 16%. ... [I]f past recoveries provide any guide, a greater share of prime aged males will be jobless at the end of the recovery than at the beginning of the recession.”

Secular stagnation: What it is and why it matters

Seventy-six years ago, Alvin Hansen introduced the term ‘secular stagnation’ in a speech that was insightful, forward-looking, and entirely wrong. He worried that low birth rates and the end of America’s farmland expansion would generate under-investment, deficient aggregate demand, and slow growth. The following 35 years catapulted the US to global economic dominance on the back of a baby boom, soaring investment, flourishing aggregate demand, and rapid growth.

With some temerity, Larry Summers resurrected the notion. Deceleration of growth’s driving forces could produce chronic gaps between US potential and actual output – and do so in a way that standard monetary and fiscal policy would have difficulty addressing. “We may well need, in the years ahead,” Summers said in 2013, “to think about how we manage an economy in which the zero nominal interest rate is a chronic and systemic inhibitor of economic activity, holding our economies back below their potential.”

The term secular stagnation struck a chord. As Barry Eichengreen puts it in his perceptive contribution to this eBook: “The idea that America and the other advanced economies might be suffering from more than the hangover from a financial crisis resonated with many observers.” The resonance did not produce harmony.

Secular stagnation – or SecStag for short – means different things to different people.

- To some, like Bob Gordon and Ed Glaeser, the real concern is slow growth for decades to come. Gordon writes: “[T]he source of the growth slowdown is a set of four headwinds, already blowing their gale-force to slow economic progress to that of the turtle. These four barriers to growth are demographics, education, inequality, and government debt.”

- To others, like Ricardo Caballero and Emmanuel Farhi, it is a ‘safety trap’. Regulators force institutional investors to invest in triple-A assets, while the supply of these assets has gone down by 50% due to the financial crisis, pushing the real interest rate down. They refer to this as a safety trap to emphasise the similarity and difference with a conventional liquidity trap. Both involve severe asset shortages, zero nominal interest rates, wealth destruction, deficits in aggregate demand, and recessions.

But as mentioned above, most of our authors view secular stagnation as a situation where low real interest rates, low inflation, and the zero lower bound prevent authorities from maintaining the economy at its full-employment growth potential. Very low real interest rates are a key symptom.

Slow growth and the SecStag debate

Persistent slow growth and secular stagnation are intertwined. The point rests on two premises: (i) Macro 101 tells us that steady-state capital growth (investment demand) equals the sum of productivity and labour-input growth, and (ii) the supply of savings is fairly unresponsive to interest rates. Growth deceleration may thus require negative real rates until savings behaviour transits to the new low-growth reality (see the Eggertsson and Mehrotra chapter).

Prima facie case for secular stagnation

It will be difficult to know, in real time, that we are facing secular stagnation. One can believe either Gordon – claiming that the growth slowdown is structural – or Summers blaming aggregate demand – the low real interest rate should worry policymakers anyway. If the Eurozone economy stays long enough in the doldrums with zero policy rates, the case for SecStag will be convincing. But even another 5 years of anaemic growth might not be enough to convince key policymakers. Of course by then it will be too late. A generation of young Europeans will have had their careers and lifetime earnings damaged.

How can we tell SecStag has materialised?

- A key tell-tale is low real interest rates.

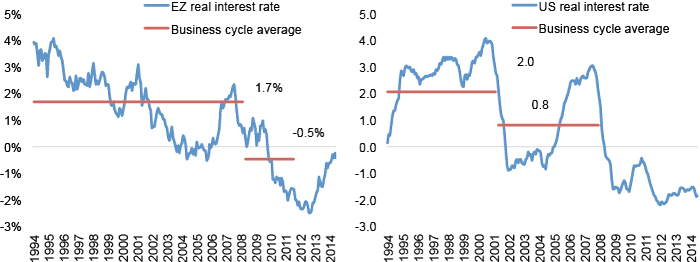

When real interest rates are very low in times of normal growth, even moderately adverse shocks can throw monetary policy up against the zero lower bound. Figure 1 shows the US and EZ real rates. From 1994 to present, they have fluctuated but generally trended downwards (the lines show the peak-to-peak averages).

For recent years, the policy rates have been near zero, so the real rates are being driven by inflation rates. The start of a pernicious cycle – not unlike Japan’s lost decade – can be seen in the EZ data. As inflation falls, at least in part due to the lacklustre growth, monetary policy becomes tight as the real rate rises. This in turn can slow growth and bring inflation down further.

Figure 1. Trends in real interest rates, US and EZ

Sources: Eurostat and FRED online database. EONIA and Fed Funds minus core inflation.

But there are many reasons for real interest rates to be low. How do we know that these low rates are associated with secular trends in investment and savings? Unfortunately, the most obvious places to look for answers are not available. We cannot look for savings–investment imbalances since market forces tend to keep them in line year by year.

- What we need to do is look for quasi-exogenous factors that shift savings supply outwards, and/or shift investment demand inwards.

Standard macroeconomics views personal savings behaviour as driven by lifetime consumption smoothing. When deciding how much to save for retirement and kids, people think ahead about how long they’ll work and how much they’ll earn. Plainly, saving rises when the working life gets shorter as a share of total life. The age profile of the workforce also matters, since people save most in years when they earn the most. On all three counts, the facts on years at school, retirement age, and population age-profiles suggest that the European savings schedule has shifted out and will continue to do so for years to come.

The numbers can be quite large. For instance, calculations in our introductory chapter suggest that the required stock of German savings rose by something like 75% of German GDP between 1990 and 2010. Similar numbers apply to other countries. That’s a big outward shift in the savings supply curve.

On the investment demand side, standard macroeconomics focuses on the amount of new capital needed to equip workers. In the Solow growth model, for instance, the capital stock is expected to grow at the growth rate of labour productivity plus the growth rate of hours worked. Table 1 (which is extracted from Nick Crafts’ chapter) shows that all the advanced economies face much slower employment growth (due to demographics) according to the OECD’s projections. The OECD is more optimistic on the technology side – projecting that European innovation will take off while US and UK innovation slow down. At best, these productivity projections suggest what might happen if pro-growth reforms are implemented, or as Crafts puts it, the OECD seems to “favour hope over experience”.

Taken together, these two quasi-exogenous factors suggest that Europe’s investment demand schedule will shift in massively in the decades to come – and even more so without the pro-growth reforms that would be needed to raise productivity growth.

Table 1. Drivers of investment demand (%)

| |

Employment growth |

Labour productivity growth |

|---|

| |

1995-2007 |

2014-2030 |

1995-2007 |

2014-2030 |

| EZ |

1.3 |

0.2 |

1.0 |

1.5 |

| US |

1.2 |

0.5 |

2.0 |

1.9 |

| France |

1.1 |

0.3 |

1.1 |

1.9 |

| Germany |

0.4 |

-0.5 |

1.2 |

1.6 |

| UK |

1.0 |

0.6 |

2.3 |

2.0 |

Sources: The Conference Board Total Economy Database and OECD.

What must be done?

Economists know how to beat secular stagnation. There are really two sorts of policies here according to Summers: prevention and cure.

- Policies that stimulate productivity growth and raise labour-force participation build in buffers against the zero lower bound by boosting persistent investment demand.

Such pro-growth policies are uncontroversial in the policymaker world, even if they are politically difficult to implement. The main cure is more controversial, even if it is logically obvious.

- If negative real interest rates will be needed frequently and policy rates are bound to the positive real line, why not raise the inflation target to, say, 4% as suggested by Krugman (2014) and Blanchard et al. (2010)?

Theory and evidence tell us that stable inflation is critical, but there is no clear reason why the inflation target should be 2% instead of 4%. And the spectre of the US and Europe suffering Japan-like lost decades argues strongly for a higher target rate.

The main argument against this cure is the German disgust of its 1923 hyperinflation. Reflecting a view held strongly in parts of the Eurozone, Wolff writes: “I would advise against changing the ECB’s inflation target … such a step would severely undermine trust in a young institution … [and] would constitute a break in the contract under which Germany subscribed to the monetary union.” Germany’s respect for its own history has made the world a better place to live in. It should therefore not be denounced lightly. However, respect for history is something different from sound economic reasoning.

However, monetary policy alone is unlikely to ‘cure’ the problem.

- Conduct prolonged countercyclical fiscal policy.

As Richard Koo argues: “During [balance sheet recessions], monetary policy is largely ineffective because those with balance sheets underwater will not increase borrowing at any interest rate ... The government also cannot tell the private sector not to repair its balance sheets ... This means the only thing the government can do to offset the deflationary forces coming from private sector deleveraging is to do the opposite of the private sector, i.e., borrow and spend ...” Monetary policy alone can only solve the problem at the cost of bubbles and financial instability.

This conclusion leads almost automatically to a specific piece of policy advice for the Eurozone:

- Revise the European Fiscal Stability Treaty.

The current version obliges countries to reduce their public debt below 60% of GDP in 20 years. In some countries, this would require a massive tightening in times of excess saving. The target for the structural deficit of 1% of GDP implies a public debt between 25% and 33% of GDP, assuming the nominal growth of GDP to be 3% to 4%. This low level would aggravate excess saving and lead to a shortage of safe assets.

Concluding remarks

Secular stagnation proved illusory after the Great Depression. It may well prove to be so after the Great Recession – it is still too early to tell. Uncertainty, however, is no excuse for inactivity. Most actions are no-regret policies anyway.

“If the US experiences secular stagnation, the condition will be self-inflicted,” Eichengreen writes, making a point that applies equally to Europe. Secular stagnation would reflect a failure to address US infrastructure, education, and training needs. It would reflect a failure to repair the damage caused by the Great Recession in Europe’s financial sector. And above all, it would reflect a failure to support aggregate demand. “These are concrete policy problems with concrete policy solutions,” says Eichengreen, “It is important not to accept secular stagnation, but instead to take steps to avoid it.”

Koo is not very optimistic that the most troubled part of the world economy, Europe, will succeed in a policy change: “On the political front, the unfortunate fact is that democracies are ill-equipped to handle such recessions. For a democracy to function properly, people must act based on a strong sense of personal responsibility and self-reliance. But this principle runs counter to the use of fiscal stimulus, which involves depending on ‘big government’ and waiting for a recovery.” Whether one likes Koo’s argument or not, it helps to explain why Europe is having difficulty dropping policies that are widely disapproved among economists. However, the EU has shown a remarkable capacity to re-emerge from deep crises. Hence, we might follow the OECD and favour hope over experience.

References

Blanchard, Olivier, Giovanni Dell’Ariccia, and Paolo Mauro (2010), “Rethinking Macroeconomic Policy”, IMF Staff Position Note, SPN/10/03.

Gordon, Robert (2012), “Is US Economic Growth Over? Faltering Innovation Confronts the Six Headwinds”, NBER Working Paper 18315.

Hansen, Alvin (1938), Speech published as A H Hansen (1939), “Economic Progress and Declining Population Growth”, American Economic Review, 29: 1–15.

Krugman, Paul (2014), “Inflation Targets Reconsidered”, Paper presented to ECB Forum, Sintra Portugal.