Editors' note: This column was first published in September 2016.

This year’s ECB Sintra Forum on Central Banking turned to the international arena. Looking beyond day-to-day pressures, policymakers, academics, and market economists debated both macroeconomic and regulatory challenges for the international monetary and financial system. In this column, we summarise six of the main themes that were hotly debated in Sintra in June 2016: order or disorder in the international monetary system; availability of international safe assets; low equilibrium interest rates, imbalances and growth; external adjustment, international monetary policy spillovers and coordination; progress with international regulatory reform; and capital markets, stability and growth.

1. Order or disorder in the international monetary system

Barry Eichengreen (2016) characterises the international monetary and financial system along four dimensions, building on Williamson (1977): 1) exchange rate arrangements; 2) policies towards capital flows; 3) provision of international liquidity; and 4) the oversight of the three via international institutions and country groupings. He identifies elements of both order and disorder in each one of them and supports an incremental approach to reforming the system along the four dimensions.

First, Eichengreen argues that exchange rate regimes should move away from the “unstable middle ground” between fixing and floating. A floating exchange rate, however, should be backed by an inflation targeting monetary policy, which has proven to lead to greater exchange rate stability. Second, he suggests employing policy incentives to address the volatility of capital flows and sudden stops, providing evidence that portfolio equity flows and foreign direct investment are more stable than portfolio debt and bank-related flows. This concerns now both advanced economies and emerging market economies, because the size and volatility of gross capital flows in and out of the latter have risen faster in the last 30 to 40 years than the case for the former. (See also Obstfeld 2016 for evidence on this development and sections 4 and 6 below.) In Eichengreen’s view, changes in the tax treatment of debt, prudential regulations, and corporate governance should be used to shift international capital flows from short-term debt to long-term debt and from debt to equity. Third, global liquidity needs should be addressed by enhancing the availability of international safe assets (see next section) and part of the reforms Eichengreen suggests for the IMF.

Fourth, IMF reform could focus on international liquidity and the global safety net. As regards the former, the IMF could be authorised to limited borrowing in private capital markets for funding its liquidity-provision operations or to pooling sovereign bonds with a AAA-rating with sub-investment-grade bonds of other countries to create a “mezzanine tranche” of liquid international assets. As regards the latter, an important problem for countries is the stigma associated with accessing IMF resources, which leads to late or under-use of existing resources. Eichengreen sees two directions for how this problem could be mitigated. As a first step, countries fulfilling specific economic criteria could enter a pre-qualified group for access to specific IMF credit and liquidity facilities. If this is not enough, the IMF top management could be given greater independence, so that the Fund’s lending conditions become less influenced by member countries’ politics. In a similar vein, Guillermo Calvo (2016) proposes the creation of an Emerging Market Fund (EMF) that aims at stabilising an emerging market bond index. The EMF would suffer less from stigma, because it decides unilaterally about purchases and sales and because it focuses on an asset class rather than individual countries. Maurice Obstfeld (2016) recalls that building a more comprehensive global safety net requires more cross-country fiscal risk sharing. In an online survey conducted during the panel discussion, 58% of voting Sintra participants indicated that the current global financial safety net is mis-specified and thus incapable of tackling crises effectively.

Anne Krueger (2016) concludes that the current set of international institutions and country groupings is quite good in reaching similar diagnoses of the problems in the international monetary system, but not so good in forging agreements on the right responses to them. For example, the IMF can diagnose well but often only intervene when a problem has become acute and a country is willing to approach it. The main problem, in her view, is how to induce countries to take more ownership in the pursuit of necessary reforms.

2. Availability of international safe assets

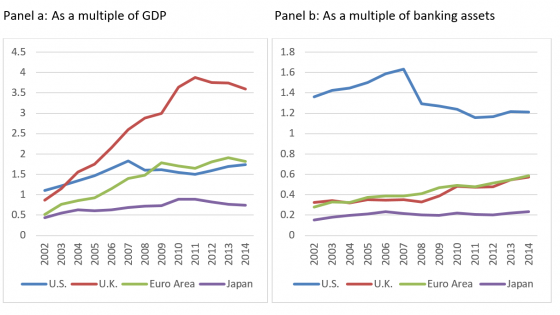

The question whether the world economy suffers from a shortage of safe assets received great attention in Sintra 2016. The two papers by Barry Eichengreen (2016) and Pierre-Olivier Gourinchas and Hélène Rey (2016) address it in different ways. Eichengreen points out that “international safe assets”, such as widely accepted high-quality debt of governments and supra-national organisations, form an important part of “international liquidity”, which allows the smooth settlement of international trade and capital flows. But as Figure 1 suggests, the global stock of safe assets as a share of GDP has declined significantly since 2009, largely because of the greater riskiness of many sovereigns, reaching levels last observed during the 1980s. Since other components of international liquidity, such as base money and gold, did not expand by as much this could be a contributing factor to the current slowdown in world trade of goods and financial services.

Figure 1. International liquidity as a fraction of global GDP

Note: International liquidity is defined as the total sum of the stocks of AAA and AA (“safe”) central government securities issued by OECD countries (abbreviated in the figure as Central Gov. Debt), debt securities issued by supranational organizations (abbreviated Multilaterals Debt), global private and public (central banks, governments and the IMF) gold holdings, and base money supplied by OECD country central banks.

Source: Reproduced from Eichengreen (2016), Chart 8.

Building on the theory of Gourinchas et al. (2014), Gourinchas and Rey suggest that an issuer of international safe assets faces the following “curse”. If the external demand for such assets increases, for example because international economic and financial uncertainties make foreign countries save more and in less risky assets, it can accommodate this by issuing more safe assets and equilibrating its external balance sheet by purchasing risky foreign assets. Alternatively, it could avoid increasing the supply of safe assets, let its currency appreciate, and thereby increase the value of the given amount of safe assets. In the former case, which amounts to offering “insurance” to other countries, it incurs the risk of future capital losses on the assets and in the latter case it hurts exports and growth; hence the curse.

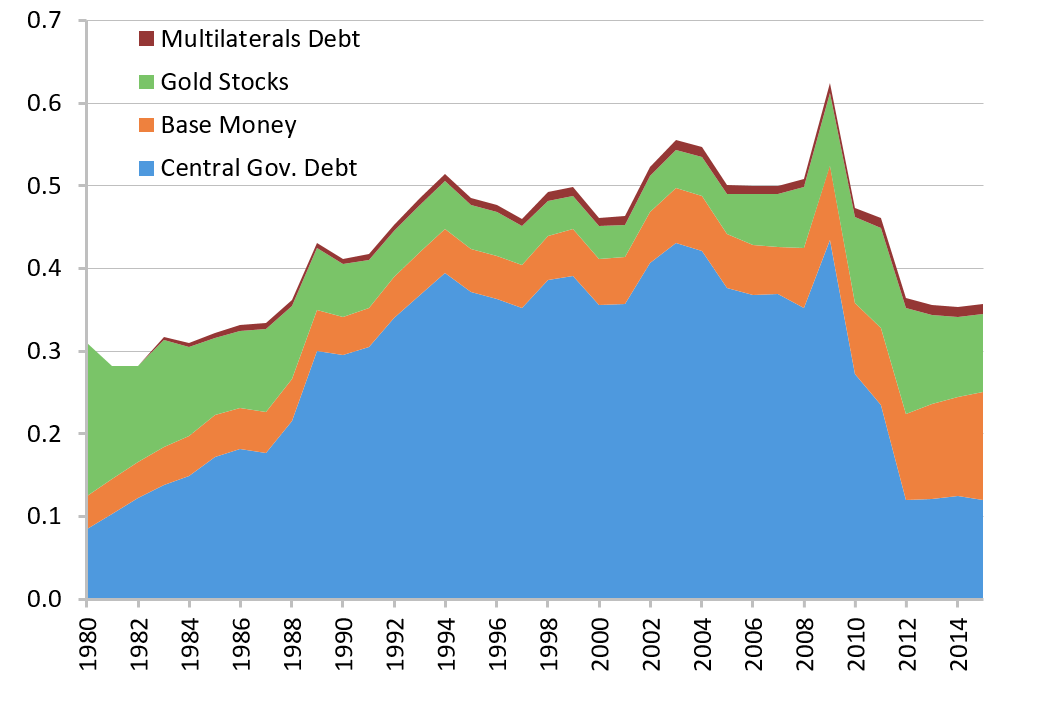

Gourinchas and Rey’s Sintra paper adds that the curse is more pronounced for a small, for example regional, issuer of safe assets. This is illustrated in Figure 2, where the blue curve lies above the one for a large country. For a given appreciation of the exchange rate, the foreign exposure (relative to its size) it needs to acquire for meeting a surge in the international demand for safe assets is significantly larger than for a large issuer. And vice versa, for a given foreign exposure (relative to size) the exchange rate appreciation needed for containing the external demand for safe assets is much larger than for a sizeable issuer. The authors discuss (outside the model) various reasons why small safe asset providers would prefer exchange rate appreciation to too much foreign exposure.

Figure 2. Illustration of the trade-off between foreign asset and exchange rate risk for large and small countries providing international safe assets

Note: The vertical axis measures a country’s change in net exposure to risky assets from the rest of the world relative to its population. The horizontal axis measures an increase of a country’s real exchange rate. The solid blue curves illustrate the trade-off between the two risks for countries whose populations are large (lower one) or small (higher one) relative to the rest of the world, respectively. These curves are drawn assuming unchanged risk aversion and global uncertainty. The dashed red curves are indifference curves for both types of countries. Indifference curves closer to the origin reflect higher country utility. Point A describes the optimal changes of the exposure to risky foreign assets and in the real exchange rate for a large country and point B the same for a small country. Point C describes the optimal change of risky foreign asset exposure for a small country with a fixed exchange rate. The figure is an illustration of the qualitative relationships in the model by Gourinchas et al. (2014)

Source: Reproduced from Gourinchas and Rey (2016), Chart 12.

In Gourinchas and Rey’s view, this suggests that also core Eurozone countries or Switzerland contribute to a shortage of international safe assets, whereas the US – which incurred large losses on its foreign assets during the crisis – does not. Eichengreen (2016) agrees but adds that in order to solve the problem also China would need to issue more international safe assets. Adair Turner (2016), however, warns that debt levels are already very high around the globe, with private debt having moved to the public sector and debt in advanced economies to China (see also Section 5 below). Benoît Cœuré added that proposals for issuing more public debt in Europe would also need to devise a fiscal policy framework that ensures that the resulting assets remain safe.

3. Low equilibrium interest rates, imbalances and growth

Gourinchas and Rey further suggest that the “savings glut” driven by the above international shortage of safe assets can explain the gradual re-increase of global current account imbalances observed since about 2009 and extremely low real interest rates. Drawing on previous theoretical work by Caballero et al. (2016), they express concern that with interest rates reaching levels at or close to their lower bounds these imbalances could be particularly pernicious. First, they can emerge without growth picking up. Second, the savings by surplus countries can no longer be accommodated by declining interest rates leading to incentives for attracting a larger share of world demand via competitive exchange rate devaluations (“currency wars”).

Even worse, Gourinchas and Rey exploit an empirical relationship between consumption-wealth ratios and short-term interest rates for an (in-sample) prediction that the low-rate environment could carry on for quite a while (up to 2021). An online survey conducted during the following panel suggested that large and about equal shares of the Sintra participants expected real long-term interest rates in advanced economies to remain very low for the next two to five years or more than five years, respectively. Shang-Jin Wei (2016) provides evidence about another driver of low interest rates that will not disappear any time soon, namely that more and more people in the world live in countries with declining or stagnant populations.

4. External adjustment, international monetary policy spillovers and coordination

Much of the Sintra 2016 discussions also revolved around the functioning of the international adjustment mechanism. Maurice Obstfeld (2016) argued that unconditional plots of exchange rates and current accounts seem to lead some observers to the wrong conclusion that the two are not linked. IMF research suggests that real exchange rate depreciations still lead to measurable expansions of net exports, albeit with substantial cross-country variation. Moreover, floating exchange rates still buffer domestic output shocks, even in the major emerging market economies. Current accounts and exchange rates are driven apart by large and complex gross portfolio flows in and out of countries, which may be worrisome in themselves for financial stability reasons. But this does not mean that no sensible adjustment mechanism is operating.

Various speakers, however, felt that floating exchange rates do not seem to insulate emerging economies enough from large capital in and outflows, so as to allow for an independent monetary policy that can firmly stabilise domestic inflation or output (e.g. Eichengreen 2016, Vines 2016, Wei 2016). In other words, the “holy trinity” or “international trilemma” that would allow an independent monetary policy with free capital flows and a floating exchange rate does not operate in a pure way. Proponents of such a “2.5 lemma” view (Wei 2016) or of a full breakdown of the traditional trilemma implication advocate the admissibility of capital controls for regaining domestic monetary control or the necessity of macroprudential policies for limiting the financial stability risks.

One of the triggers of capital flows can be diverging (conventional and unconventional) monetary policies. To limit spillovers and exchange rate “warfare” (Vines 2016), a few Sintra participants felt that central banks should explicitly coordinate their monetary policies (also Catherine Mann). Mario Draghi (2016) suggests that formal coordination between central banks is not necessarily needed. For example, the empirical evidence suggests that the net spillover effects of monetary policies during the crisis have been positive. But with the global inflation and output gap components becoming more important, national monetary policies need to be consistent. The necessary alignment of national policies can be achieved by a shared diagnosis of the root causes of the challenges that affect all countries and a shared commitment to found domestic policies on that diagnosis. Draghi further elaborates that in a globalised world, policymakers have not only to think about the composition of policies within their jurisdictions but also about the global policy mix, which includes domestic monetary policies being properly aligned so that their effects are maximised. In another online survey, a very large share of the voting participants felt that international monetary policy spillovers are a concern for international stability. About half of them, however, thought that not much can be done given the national mandates of central banks and the other half thought that they could be mitigated by central banks coordinating their policies.

5. Progress with international regulatory reform

The gist of the discussion on international financial regulatory reform was that important progress has been made but there is still a lot to do going forward. Two thirds of the voting Sintra participants ticked the answer in another online survey that the progress in regulatory reform so far was a partial success. Many speakers made suggestions where further steps would be desirable. Moreover, several speakers suggested a shift from a pure financial stability focus in regulation and supervision to one including also the productivity of what is being financed and the effects on growth (e.g. Claessens 2016, Buch et al. 2016).

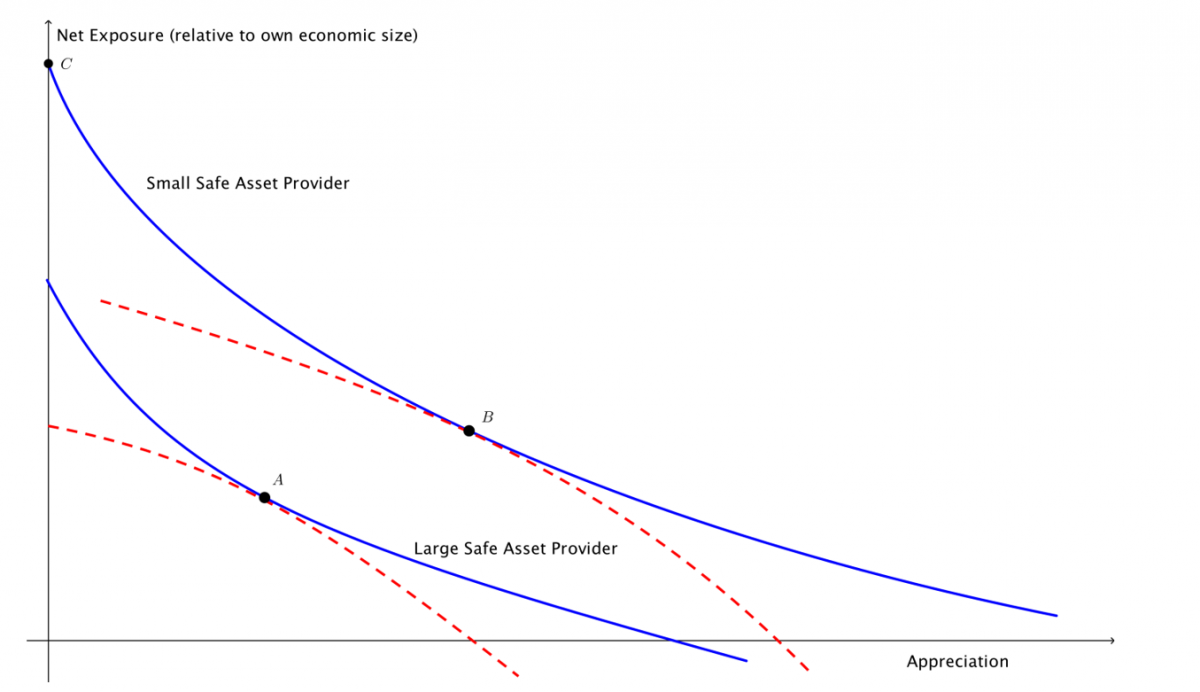

Darrell Duffie (2016) summarizes that in his assessment out of the four core elements for reform that the Financial Stability Board uses “making financial institutions more resilient” has made very good progress but “ending too-big-to-fail”, “making derivatives markets safer” and “transforming shadow banking” fall still well short of their goals. One important improvement Duffie sees in the derivatives sphere is “trade compression”. Under the pressure of capital, liquidity and (soon-to-be-implemented) margin regulations intermediaries have an interest in enhancing their counterparty exposure risk management. New companies (“compression utilities”) emerged that initiate trades based on algorithms cancelling redundant derivatives positions of their customers. Figure 3 shows that the global gross market value of outstanding over-the-counter derivatives positions (of which a large share are from interest rate swaps) has now halved since its peak in 2007. Since trading volumes have remained relatively steady, Duffie associates most of this reduction with compression trading.

Figure 3. Global gross market value of over-the-counter derivatives in billion US dollars

Note: Global OTC derivatives include interest rate, foreign exchange, equity-linked and commodity contracts (forwards, swaps and options) as well as credit default swaps, as collected by national central banks and/or statistics offices of 13 advanced countries from major derivatives dealers in their respective jurisdiction. Gross market values represent the cost of replacing open contracts at the prevailing market prices (without netting or taking collateral into account). They supply information about the potential scale of market risk in derivatives transactions and of the associated financial risk transfer taking place.

Source: Bank for International Settlements, OTC derivatives statistics at end-December 2015, May 2016. Reproduced from Duffie (2016), Chart 5.

Omitting other areas of achieved progress for brevity, here is a selection from his list of important further reforms:

- limiting/controlling the termination of financial contracts in the run-up of the resolution of large systemic institutions;

- resolution rules for central clearing counterparties (including a global stress-testing framework);

- regulation of foreign exchange derivatives markets; and

- limiting fire-sale risks by shadow banks.

Duffie also adds a fifth reform category to the list, where the picture is mixed, namely improving trade competition in financial markets. In this area he sees room for further improvements in pre-trade transparency through all-to-all limit order books for asset classes with high enough trading activity and for a reduction in fragmentation originating from multiple multilateral trading platforms.

Adair Turner (2016) warns that the biggest macroeconomic problem today is the debt overhang trap. Whilst financial systems are now significantly more resilient than before 2008, it has not yet been fundamentally addressed how much debt they should generate and what type of debt (e.g. more corporate or housing debt). So far, the total global debt-to-GDP ratio has not declined but moved between private and public parties and is now higher than ever. He proposes that—in addition to changing tax incentives for stabilizing capital flows, as suggested by Barry Eichengreen above—a macroprudential approach should be adopted to quite explicitly limit ever-increasing debt levels and leverage. Hyun Shin (2016) adds that also a distinction between short-term “runnable” debt and long-term stable funding needs to be made in prudential policy.

Related to the debt-overhang problem, Charles Goodhart (2016) points out that the reform of housing finance is a sizeable omission in the regulatory agenda. Despite its historical role in financial crises, not much has been done to tame the boom and bust cycle of credit-financed real estate. In fact, housing finance remains privileged in specific aspects of regulation and taxation. As part of his macroprudential approach to limiting the build-up of debt overhangs, Adair Turner (2016) suggests to introduce minimum risk weights of 50% and 100% for residential and commercial real-estate lending, respectively, in capital requirements. He regards the feature of the Basel approach that allows banks to determine risk weights with the help of their internal models as a “profound intellectual mistake”. Defaults among real-estate borrowers tend to be extremely low, which makes it individually rational for banks to attach low risk weights. But history has shown that real-estate lending can do considerable macroeconomic harm in bad times, precisely because the borrowers who try to serve their mortgages reduce consumption or investment. Interestingly, Stijn Claessens (2016) displays evidence that in the UK and the US, household credit (of which a large share is real-estate borrowing) relative to GDP is larger than corporate credit to GDP, whereas in the Eurozone and Japan it is the other way around. He asks the question whether, besides boom-bust cycles, so much housing finance is really justified by its productivity.

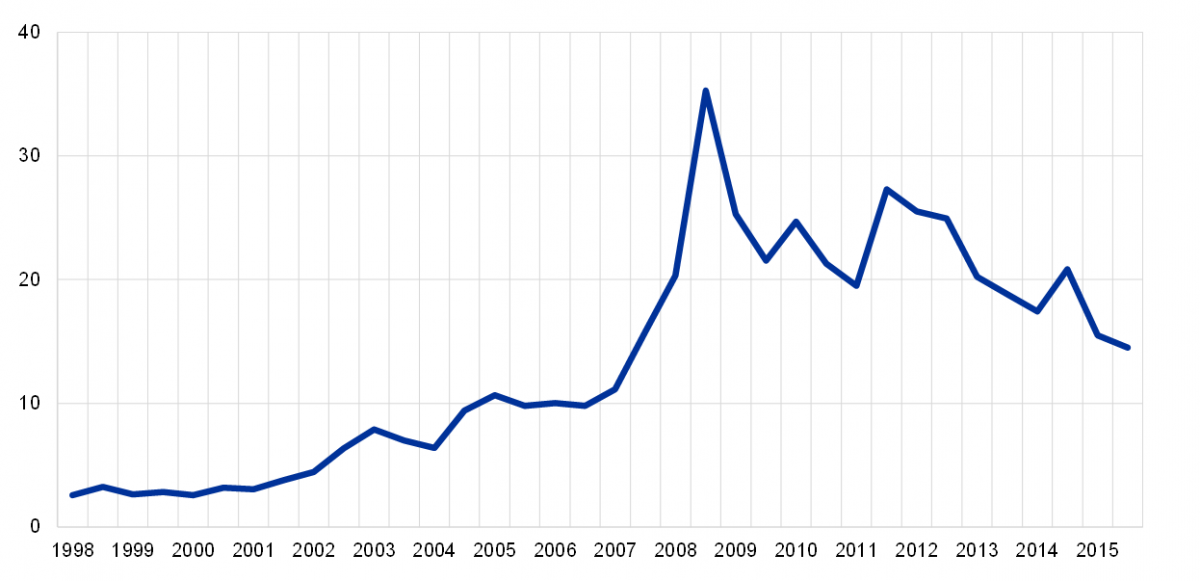

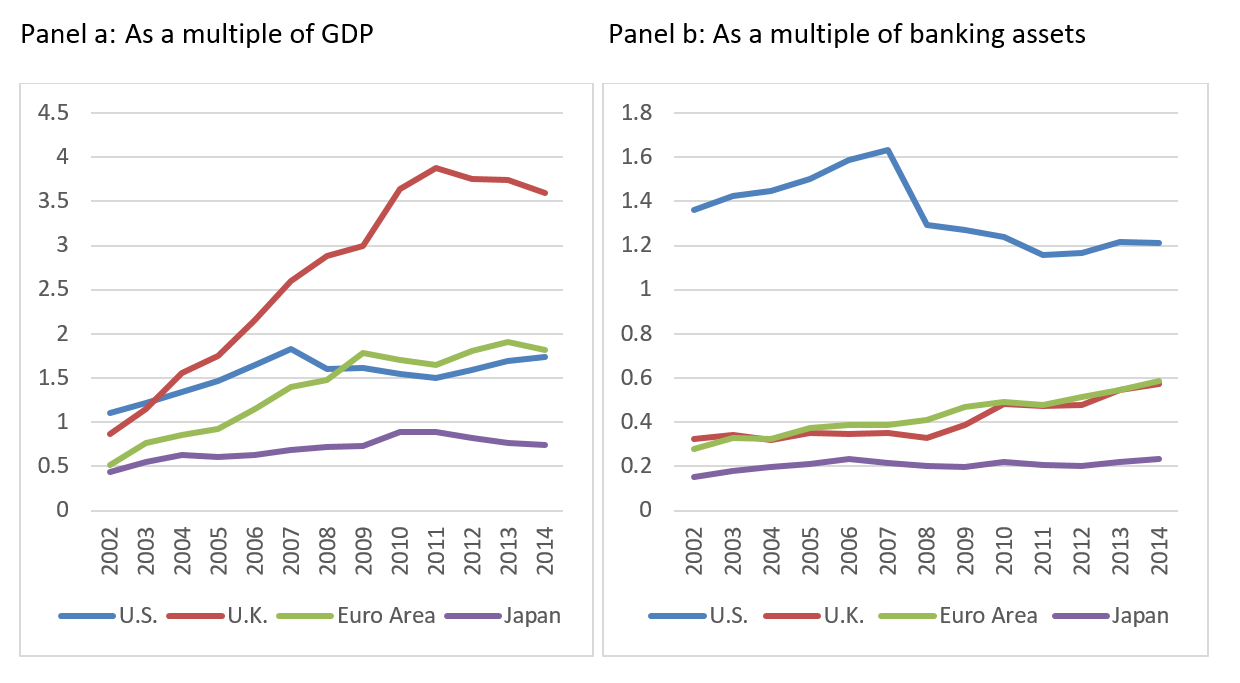

Stijn Claessens (2016) further looks at broad regulatory approaches. Recalling that the current paradigm is very much based on capital buffers and market discipline (fostered by transparency), which tends to increase the pro-cyclicality of finance and the real economy, he calls for a more decisive reversal towards structural and conduct-based regulation. The former tends to directly limit or forbid certain financial activities (such as the Vickers or Volcker rule) and the latter influences behaviour quite strongly (such as loan-to-value or debt-to-income ratios). Moreover, Claessens urges extending macroprudential policies to non-bank financial activities, rather than transferring traditional banking regulation, based on capital buffers and market discipline, to them. Figure 4 illustrates the high levels that non-bank finance (or shadow banking) has reached in the United States, the United Kingdom, Japan and the euro area.

Figure 4. Assets of non-bank financial intermediaries

Note: Assets of non-bank financial intermediaries in the two panels are defined as the total assets of the category Other Financial Intermediaries, which includes money market funds, finance companies, structured finance vehicles, hedge funds, other investment funds, broker-dealers, real-estate investment trusts and funds and trust companies. (This excludes assets of insurance companies and pension funds.) Such assets will cover a sizeable share of what is often denoted as shadow-banking activities.

Source: Financial Stability Board, Global Shadow Banking Monitoring Report, October 2015, Shadow Banking Monitoring Dataset 2015; World Bank, World Development Indicators Database. Reproduced from Claessens (2016), Charts 3a and b.

Also on general regulatory directions, Charles Goodhart (2016) suggests that the main problems of financial stability may not be solved with detailed capital and liquidity requirements á la Basel II or III but with aligning incentives and improving governance. Andrew Sheng (2016) goes even one step further by expressing concern that complex regulations micro-managing banks could lure attention away from the large sources of risk of the day and divert human resources to unregulated FinTec institutions.

Hyun Shin (2016) compares macroprudential policy and monetary policy. Similarities include that their tightening postpones spending, limits intermediary risk taking and increases funding costs. But they are different in two important respects. First, macroprudential policies tend to be narrow, implying the risk of leakage, whereas monetary policy “gets into all the cracks” (Stein 2013). Second, macroprudential policy can act independently of global monetary policy conditions, which is why it is a candidate for limiting the side effects of volatile capital flows (see section 4 above).

6. Capital markets, stability and growth

A second direction that a number of Sintra 2016 speakers took on the international financial architecture was that it is desirable that capital markets, in particular various forms of equity markets, become more important in advanced economies other than the US and in cross-border capital flows. We already covered Eichengreen’s (2016) three policy directions for fostering equity capital flows in Section 1 above.

Turning to domestic financial structures, Stijn Claessens (2016) recalls some recent literature suggesting that more market-based and diversified financial systems experience crises less frequently and with less severe recessions than less diversified bank-based systems. Using an update of the data in Claessens et al. (2012), he provides an unconditional estimation of the duration and GDP costs of two different types of crises in 24 advanced economies, dividing the countries in two groups in which the equity-market-to-GDP ratio is above or below the sample average. It turns out that between 1960 and 2015, crises with a credit crunch (defined as the 25% most severe peak-to-trough credit contractions in the sample) display on average a much smaller cumulative GDP loss in the 12 countries with larger equity markets than in the 12 countries whose financial systems are more bank-based. For crises with equity busts (defined as the 25% most severe equity market contractions) the GDP loss in countries with larger equity markets are also smaller but the difference to countries that are more bank-based is not sizeable. In what concerns duration, credit crunches in bank-based countries are on average a little bit longer than in more equity-market based countries, whereas for equity busts the length of crises in the two types of countries is about the same. At the same time, however, Claessens cautions that market-based systems tend to show greater short-term volatility than bank-based systems. Hyun Shin (2016) shows some evidence how well developed corporate bond markets can replace bank lending when it is weak after recessions. In the general discussion, however, Jean-Claude Trichet was very doubtful that market finance is generally more stable than bank finance.

Going beyond financial stability considerations, another online survey held during the conference revealed that a bit more than half of voting Sintra participants believed that both bank and market-based financial systems are conducive to growth, rather than one being better than the other. (A little less than a third felt that there is not enough evidence to judge.) Stijn Claessens (2016) recalls historical literature showing that market finance becomes more important in the process of economic development. But even among advanced economies it is only dominant in the United States. Moreover, he provides updated evidence that the contribution of bank financing to growth diminishes on average with rising per-capita income, whereas the contribution of market financing to growth increases. Further literature suggests that notably equity markets are better in promoting new sources of growth and productivity than traditional bank credit. There can also be complementarities between bank and market finance. For example, the development of capital markets can reduce the funding costs of banks or securitisation can enhance the capacity for lending. Claessens provides evidence that, in line with this hypothesis, before 1999 average per-capita GDP growth tended to be higher for a given level of bank credit (stock market capitalization) when stock market capitalization (bank credit) was larger. But this relationship vanished or turned mildly negative after 1999. It is therefore important that advanced economies’ strategies for developing capital markets pay attention to complementarities with banking.

All papers, discussions and speeches can be found in the conference e-book (ECB 2016) and video recordings of all sessions on the Sintra Forum website. Happening in the days following the referendum about the United Kingdom’s membership in the European Union, the Sintra Forum also featured a panel discussion about the economic implications of its outcome. While we could not summarize it in this post, the interested reader can find a video recording under the same link above.

References

Blinder, A (2016), "The domain of central bank independence", forthcoming in ECB, The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 7-12.

Buch, C, E Prieto and B Weigert (2016), "Financial regulatory reform", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 231-240.

Caballero, R, E Farhi and P-O Gourinchas (2016), Global imbalances and currency wars at the ZLB, mimeo., Harvard University, 10 March.

Calvo, G (2016), "Comment on “Global monetary order” by Barry Eichengreen", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 64-69.

Claessens, S (2016), "Regulation and structural change in financial systems", in The Future of the Monetary and Financial Architecture, Frankfurt am Main: ECB, pp. 188-221.

Claessens, S, M Kose and M Terrones (2012), How do business and financial cycles interact?, Journal of International Economics, 87(1), 178-190.

Draghi, M (2016), "The international dimension of monetary policy", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 13-20.

Duffie, D (2016), "Financial regulatory reform after the crisis: an assessment", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 142-183.

Eichengreen, B (2016), "Global monetary order", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 21-63.

European Central Bank (2016), The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main.

Goodhart, C (2016), "Comment on “Financial regulatory reform after the crisis: an assessment” by Darrell Duffie", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 184-187.

Gourinchas, P-O, and H Rey (2016), "Real interest rates, imbalances and the curse of regional safe asset providers at the Zero Lower Bound", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 70-109.

Gourinchas, P-O, H. Rey and N. Govillot (2014), "Exorbitant privilege and exorbitant duty", mimeo., University of California at Berkeley, February.

Krueger, A (2016), "The IMF’s power and constraints", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, 123-126.

Obstfeld, M (2016), "International monetary challenges and responses", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 127-135.

Sheng, A (2016), "Regulators should take a holistic view of the impact of radical uncertainties on the finance industry", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, 241-248.

Shin, H S (2016), "Comment on “Regulation and structural change in financial systems” by Stijn Claessens", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 222-230.

Stein, J (2016), Overheating in credit markets: origins, measurement, and policy responses, speech at the "Restoring Household Financial Stability after the Great Recession" research symposium sponsored by the Federal Reserve Bank of St. Louis, 7 February.

Turner, A (2016), "Beyond financial system resilience - the need for a new regulatory philosophy", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 249-253.

Vines, D (2016), "Comment on “Real interest rates, imbalances and the curse of regional safe asset providers at the Zero Lower Bound” by Pierre-Olivier Gourinchas and Hélène Rey", in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, 110-122.

Wei, S-J (2016), "Three challenges facing emerging market monetary policy makers," in The Future of the International Monetary and Financial Architecture, Proceedings of the ECB Sintra Forum on Central Banking, Frankfurt am Main: ECB, pp. 136-141.

Williamson, J (1977), The Failure of World Monetary Reform, 1971-1974, Sunbury-on-Thames: Nelson & Sons.