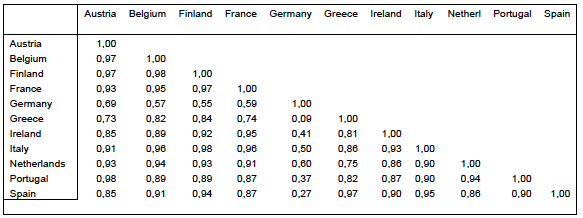

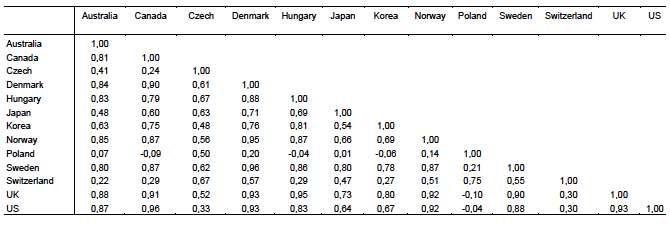

Business cycles across countries are highly correlated (Cesa-Bianchi 2016). In this column, we show this feature to be true for both the Eurozone countries and a group of industrialised countries outside the Eurozone. Tables 1 and 2 present the bilateral correlations of the business cycle component of GDP in the Eurozone and in the rest of the OECD. The business cycle component is obtained by using a Hodrick-Prescott filter on GDP data.

It is striking to see how high these correlation coefficients are. This is especially the case within the Eurozone, where we find many correlation coefficients of the business cycle components exceeding 0.9. On average, we find that the correlation coefficient is 0.82, suggesting a very high degree of synchronisation of business cycles within the Eurozone. We are aware of the fact that measuring business cycles is fraught with difficulties. However, our findings are consistent with those of others (den Haan et al. 2008).

Outside the Eurozone, we observe smaller bilateral correlations of business cycles than in the Eurozone. However, these correlations can still be called quite high, often reaching levels of 0.6 or more. The average of all the correlation coefficients in Table 2 is 0.61. Thus it appears that in the group of industrial countries outside the Eurozone, business cycles are also quite synchronised.

There exists empirical evidence that the degree of synchronisation of business cycles is influenced by the degree of trade integration. Frankel and Rose (1998) found that increasing trade integration leads to more synchronisation of business cycles. This has been confirmed by other empirical studies (Artis and Cleays 2005, Bordo and Helbling 2004).

Table 1 Bilateral correlations of the business cycle component of GDP growth in Eurozone countries (1995-2014)

Source: OECD

Table 2 Bilateral correlations of the business cycle component of GDP growth in non-Eurozone countries (1995-2014)

Source: OECD

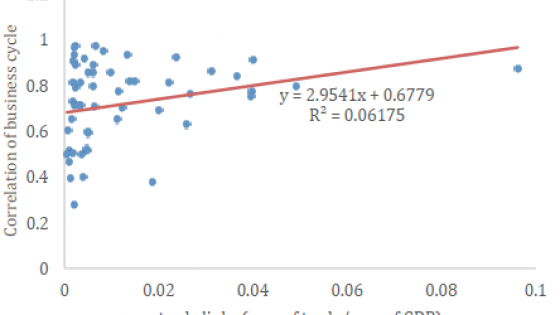

Trade integration is one explanatory factor, but it does not explain everything. This is made clear by Figure 1, which plots the bilateral correlation coefficients obtained from Table 1 with the bilateral trade flows (as a percentage of the sum of the GDPs of the pairs of countries involved). We observe that there is a positive relation between the degree of bilateral trade integration and bilateral cycle correlations. This relation, however, is weak – and explains only a small fraction of the variation in the bilateral correlations. (We obtain the same result with the other industrial countries outside the Eurozone). Clearly there are other mechanisms at work driving the synchronisation of business cycles.

Figure 1 Correlation of business cycle and trade links in 11 Eurozone countries

Source: authors’ own estimation using data from OECD and IMF, direction of trade

Mainstream macroeconomic models (both real business cycle models and DSGE models) have found it difficult to replicate the observed high synchronisation of business cycles in the industrialised world. This problem was first pointed out by Backus et al. (1992), who found that standard open economy versions of real business cycle models could not explain the high level of synchronisation of business cycles across countries (see also Canova and Dellas 1993). Open economy versions of DSGE models have experienced the same problem (Alpanda and Aysun 2014). Of course, one can solve these problems in such models by assuming high positive correlations of exogenous shocks. But this is not really an explanation, as it forces the designers of these models to admit that the high correlations of business cycles across countries are produced outside their models. This is not a very satisfactory analysis.

There have been attempts to explain the high synchronisation of the business cycles across countries by introducing financial integration into the models (e.g. Gertler et al. 2007, Devereux and Yetman 2010, Kollmann 2012, Alpanda and Aysun 2014). This goes some way in explaining this synchronisation. But again too much is ‘explained’ by introducing highly correlated exogenous financial shocks (Rey 2014).

We have attempted to go further and explain the international synchronisation of business cycles endogenously in our new paper (De Grauwe and Ji 2016). We do this by developing a two-country behavioural macroeconomic model. The characteristic feature of this model is that agents have cognitive limitations preventing them from forming rational expectations. Instead, they use simple rules of thumb (heuristics) to forecast. They select those forecasting rules that perform best. It can be argued that in an uncertain environment where agents find it difficult, if not impossible, to understand the complexity of the world, it is rational to use simple heuristics and to be willing to switch to other rules when they find out their past mistakes (Kahneman 2002).

The model produces waves of optimism and pessimism (‘animal spirits’) endogenously. These animal spirits arise because optimistic and pessimistic forecasts are self-fulfilling, leading to booms and recessions, and therefore attract more agents into being optimists during booms and pessimists during recessions. Thus there is a two-way causality between animal spirits and the business cycle.

In a two-country model, this mechanism produces a synchronisation of the business cycles endogenously. We find that, even if exogenous shocks are not correlated, there is an endogenous mechanism that transforms uncorrelated shocks into positive correlations of output across countries. The mechanism that produces this can be described as follows. Small shocks in output (positive or negative) in one country set in motion a domestic and an international self-reinforcing mechanism. The domestic one comes about through the interaction between changes in the output gap and animal spirits, whereby the positive (negative) output gap creates optimistic (pessimistic) expectations. The latter then feeds back on the output gap. This is the two-way causality between the output gap and animal spirits in each country.

The international self-reinforcing mechanism starts from a shock (either demand or supply side) in one country that is transmitted through trade to the other country, where it sets in motion a self-reinforcing mechanism with animal spirits. This is then transmitted back to the first country. All this leads to the result that an idiosyncratic (uncorrelated) shock in one country leads to correlated output and animal spirits across countries.

Thus, the main channel of the international synchronisation of business cycles occurs through a propagation of animal spirits, i.e. waves of optimism and pessimism that become correlated internationally. We find that one does not need much trade to trigger this endogenous synchronisation of the business cycles. We applied empirical tests that confirmed the existence of a domestic and international propagation mechanism through animal spirits.

A monetary union matters. We find that the propagation of animal spirits and thus the synchronisation of the business cycles are stronger among countries that are members of a monetary union than among ‘standalone countries’ that have their own independent central banks. This difference occurs because in a monetary union there is a common central bank imposing the same interest rate and thereby helping in transmitting animal spirits from one country to the other.

Finally, the degree of synchronisation of business cycles is very much influenced by the intensity with which the central banks stabilise output. When that intensity is high, the central banks are able to ‘tame the animal spirits’. In so doing, they reduce the propagation dynamics of these animal spirits.

References

Alpanda, S, and U Aysun (2014), “International Transmission of financial shocks in an estimated DSGE model”, Journal of International Money and Finance, 47: 21-55

Artis, M, and P Cleays (2005), “What holds cycles together?”, European University Institute, Discussion Paper

Backus, D, P Kehoe, and F Kydland (1992), “International Real Business Cycles”, Journal of Political Economy, Vol. 100 (4): 745-775

Bordo, M, and T Helbling (2004), “Have National Business Cycles Become More Synchronized?”, in H Siebert, Macroeconomic Policies in the World Economy, Springer Verlag, Berlin-Heidelberg

Canova, F, and H Dellas (1993) “Trade interdependence and the international business cycle”, Journal of International Economics, 34: 23-47

Cesa-Bianchi, A, J Imbs, and J Saleheen (2016), “International business cycle synchronisation: The role of financial linkages”, VoxEU.org

De Grauwe, P, and y Ji (2016), “International Correlation of Business Cycles in a Behavioural Macroeconomic Model”, CEPR Discussion Paper no. 11257.

Devereux, M B, and J Yetman (2010), “Leverage constraints and the international transmission of shocks”, Journal of Money, Credit and Banking, 42: 71-105.

Frankel, J A, and A Rose (1998), “The Endogeneity of the Optimum Currency Area Criteria”, Economic Journal, 108, 1009-1025

Gertler, M, S Gilchrist, and F M Natalucci (2007), “External constraints on monetary policy and the financial accelerator”, Journal of Money, Credit and Banking, 39: 295-330

Giannone, D, M Lenza, and L Reichlin (2009), “Business Cycles in the Euro Area”, CEPR Discussion Paper 7124

De Haan, J, R Inklaar, and R Jong‐A‐Pin (2008), “Will business cycles in the euro area converge? A critical survey of empirical research”, Journal of Economic Surveys, 22 (2): 234-273

Kahneman, D (2002), “Maps of Bounded Rationality: A Perspective on Intuitive Judgment and Choice”, Nobel Prize Lecture, December 8, Stockholm

Kollmann, R (2012), “Global Banks, Financial Shocks and International Business Cycles: Evidence from an Estimated Model”, CEPR Discussion Paper No. 8985

Rey, H (2014), “International Channels of Transmission of Monetary Policy and the Mundellian Trilemma”, Mundell Fleming Lecture, International Monetary Fund, Washington DC, November

Yao, W (2012), “International Business Cycles and Financial Frictions”, Bank of Canada Working Paper no. 2012-19