The election of Donald J. Trump as the 45th president of the United States of America on 8 November 2016 surprised most observers. Analysts and the media have commented extensively on the economic and political implications of this election. To our knowledge, however, no academic study has so far investigated which industries and firms will benefit and which will suffer under the new administration. Assessing the winners and losers from the election is interesting because there were large differences in the policies favoured by the candidates in at least four economically important areas: government spending (and the size of the deficit), taxation, trade policy, and regulation.

The election surprise and overall market reactions

On the morning of the election, Trump’s chances were 17% on Betfair, and 28% on 538Silver. With the exception of the Mexican peso, the price changes of most assets following the election were the opposite of what had been forecast in the event of a Trump victory. In a study of asset price moves during the first Presidential debate on 26 September 2016, Wolfers and Zitzewitz (2016) found a strong positive relationship between the odds of Clinton winning on Betfair and the returns on all major US equity index futures. While stock index futures fell sharply on election night as the outcome of the election became known, stock markets rose on the day following the election, and rallied strongly during the rest of the year.

Why analysing company stock reactions is helpful

It is impossible to diagnose the reasons for an overall movement in the stock market, as there is just one observation. Financial markets can, however, be used to infer market interpretations of relative gainers and losers in the wake of big events. Specifically, if the market responds optimally to a surprise the change in the market price of any asset, it will reflect both the difference in its expected discounted payoff between the two possible outcomes, and the pre-event probability of the outcome. Asset price changes capture current expectations about how a company will perform (Schwert 1981).

Capitalising on this insight, our new paper investigates the differential performance of the S&P 500 stocks to determine which factors produced relative winners and relative losers among companies when the stock market moved sharply upward after the election (Wagner et al. 2017). These results shed some light on how expectations about policy – particularly taxation, trade policy, and regulation – affected individual firms.

All assessments of industries or companies reported below, and in the paper, are relative not absolute assessments. Given that the stock market overall was up, many of the relative losers actually gained in price. They just didn’t gain as much as the relative winners.

Winners and laggards among industries

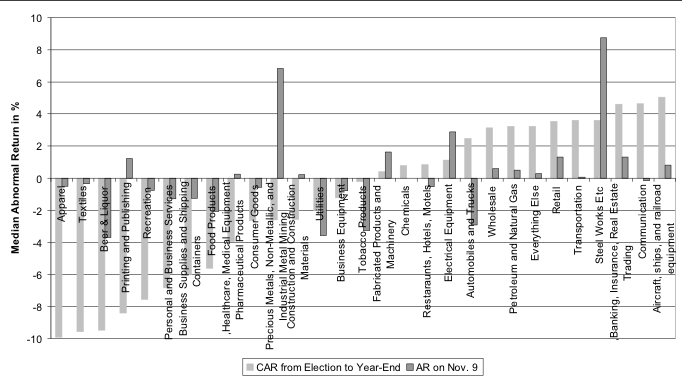

Figure 1 shows relative performance of different industries from the election to the end of the year. Heavy industry (which Trump has promised to resurrect) and financial firms (which he has said he would deregulate) performed comparatively well. At the other end of the spectrum, healthcare, medical equipment, and pharmaceuticals lost dramatically (due to the expectation that Obamacare would be dismantled, or at least significantly altered). Textile and apparel firms also performed comparatively poorly, reflecting their large dependence on imports, which Trump vowed to strongly discourage through renegotiated trade treaties and tariffs. Business supplies and shipping containers also lost, probably reflecting his tough stance on trade. Even after controlling for the rally in the broad market, several low-beta industries (beer, tobacco, food products, and utilities) were among the losers, while cyclical industries tended to be winners. Presumably, expectations of higher growth induced investors to rotate from low-risk to high-beta industries.

The cumulative abnormal returns for several industries from the election to year-end differ substantially from the immediate response after the election. In Figure 1 they are shown in dark grey. For example, apparel and textiles, which are the worst performers during the overall period, dropped only modestly on the day after the election. In contrast, markets seem to have been initially over-optimistic about prospects for the steel industry (which had been one of the hot-spots in the campaign), and they barely reacted at the outset to the prospect of deregulation of the financial industry. There are various explanations for this delayed-reaction phenomenon. Most plausibly, the market’s assessment about the strength or likelihood of some of the incoming administration’s future policies changed after the election, or took more time to be incorporated into prices because processing the information on these policies was more difficult.

Figure 1 Median abnormal returns among S&P 500 firms after the election, by Fama-French 30 industries

Growth and corporate taxes

Turning to policy areas, we find evidence that growth prospects, and expectations of a corporate tax cut, were viewed positively by the stock market. If the market believes that Trump is good for the aggregate economy, companies that are more strongly exposed to the (US) economy (‘high beta’) will do better. Investors flocked to high-beta equities after the election.

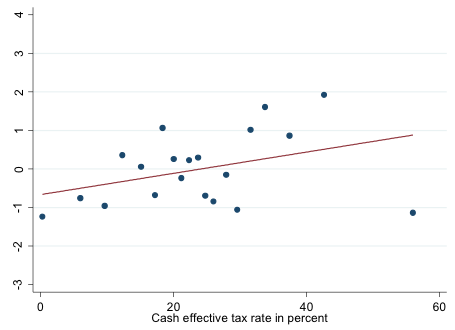

While the details of the administration’s tax plan remain hazy, it is clear that President Trump wants to cut corporate taxes, currently at 35%. Had Hillary Clinton won the election, corporate taxes might have been trimmed, but not cut to the level that Trump has proposed (15%). The analysis reveals that companies currently paying higher taxes performed much better after the election surprise. Figure 2 illustrates this using binned scatter plots. Here, stocks were sorted into 20 equal-sized bins by their cash-effective tax rate. We then computed the average abnormal stock return in each of the bins. A substantial portion of the overall reaction was already reflected in stock prices on the first day.

Figure 2 Binned scatter plot of cash-effective tax rate against abnormal returns of S&P 500 firms from 9 November to 31 December 2016 (top panel) and abnormal returns on 9 November 2016 (bottom panel)

Foreign operations

How did the market vote on predominantly domestic stocks compared to those substantially oriented to the world economy?

There are several expectations about policy that suggest that stocks with a domestic focus should have performed better. First, market participants may simply have higher expectations for US growth versus foreign growth. Second, domestic stocks are less at risk of trade wars that bring retaliation by other countries. Third, Trump’s infrastructure plan would naturally benefit domestically-focused firms. Fourth, Trump’s expansionist fiscal policies, particularly severe cuts in taxes, should foster inflation. Domestic profits would increase; exports would be hurt. On the other hand, the VAT-flavour of the Republican tax plan may help make US companies more competitive abroad. If so, that would relatively favour internationally oriented stocks.

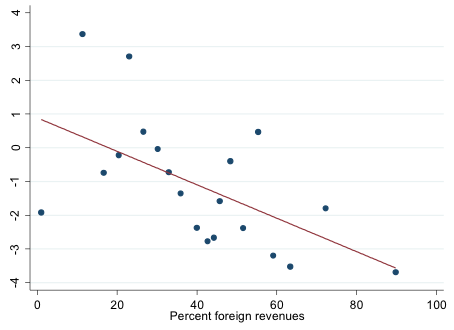

The stock market’s reactions clearly imply negative expectations of the anticipated policy impact on internationally-oriented firms, as Figure 3 shows. Interestingly, the negative relationship between foreign revenue and stock returns was strong not only on the day following the election, but persisted until the end of the year. Potentially the two effects underlie the observed returns. The first – faster US GDP growth – was recognised early by markets, while the second – negative spillover effects from more restrictive trade policies – needed some time to be incorporated into prices.

Figure 3 Binned scatter plot of Percent foreign revenues against abnormal returns of S&P 500 firms from 9 November to 31 December 2016 (top panel) and abnormal returns on 9 November 2016 (bottom panel)

Looking ahead

As expected, company stock reactions to the election reflect expected benefits and costs for shareholders. Investors clearly expect US corporate taxes to be cut dramatically (resulting in relative advantages for companies that had been paying high taxes). Similarly, companies with high interest expenses suffered, for two possible reasons: deductions lose value when taxes are slashed, and some Trump/Republican plans threaten interest deductibility.

The market reflected shareholder beliefs that the proposal to make capital investments immediately deductible may not survive, or may not be consequential. Given Trump’s public opinions on tariffs and trade restrictions, and the potential for retaliation, investors turned US companies with significant non-US revenues into relative losers.

It is important to emphasise that these responses were based on conjecture. Investors will have a lot of new information as the Trump presidency progresses. Elements of the short-term expectations about policies and their effects on company fortunes, whether for the day after the election or the seven weeks that followed, may flip when the policies are actually implemented. Whatever our politics, we can predict one thing with confidence about the initial days of the Trump presidency: there will be significant policy surprises, and significant changes in company stock prices, in the near and not-so-near term.

References

Schwert, G W (1981), "Using financial data to measure effects of regulation", The Journal of Law and Economics 24, 121-158

Wagner, A F, R J Zeckhauser and A Ziegler (2017), "Company stock reactions to the 2016 election shock: Trump, taxes and trade", Working paper.

Wolfers, J and E Zitzewitz (2016), "What do financial markets think of the 2016 election?", Working paper.