Central bank communication as a policymaking tool has been gaining increasing traction. Numerous studies have explored its influence on market trends and policy decisions in advanced economies (AEs) (Blinder 2018, Coenen 2017, Coibion at al. 2020, Haldane et al. 2020). Meanwhile, the evolution of emerging market (EM) central banks’ communication has remained a less studied area. A few recent cross-country papers started to bridge this gap (Gonzalez and Tadle 2022, Armelius et al. 2020, Luangaram and Wongwachara 2017) have. Our research builds on, and extends, this research over a longer time horizon that includes the post-pandemic inflation period, and also compares EM central bank performance with that of the US Federal Reserve and the ECB, which act as comparators.

During and after Covid, monetary policy in EMs has generated a new wave of research and policy interest. Thanks to their strengthened monetary policy frameworks, many EM central banks managed to avoid the traditional monetary policy procyclicality trap during the pandemic (Rawat and Ye 2020) and successfully experimented with unconventional monetary policy tools like quantitative easing (Ribakova et al. 2020, Nagy Mohácsi 2020, Sunel and Mimir 2021). At the same time, changes in global risk perceptions and their effects on short-term market rates in EM continued to create monetary policy challenges (De Leo et al. 2023).

In our recent paper (Evdokimova et al. 2023), we analyse monetary policy statements of 22 EM central banks over the last two decades. We find that their initial reaction to post-Covid inflation was on average more appropriate than in the AE comparators, and their monetary policy has performed better than in the past in dealing with the fallout from the global financial tightening from 2022 onwards. Our analysis covers transparency, statement readability, sentiment analysis, topic decomposition, and forward guidance practices, employing a range of methods from simple dictionary-based approaches to advanced machine learning tools and ChatGPT.

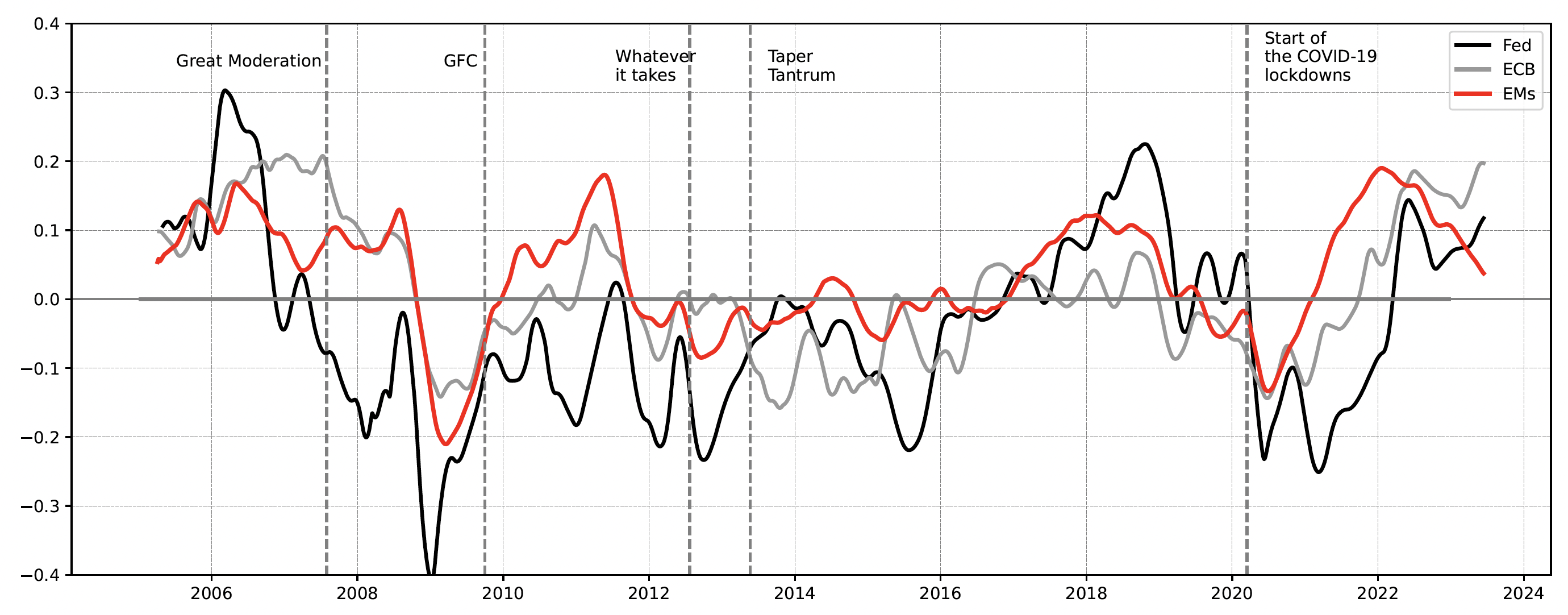

Our sentiment analysis allows us to assess the degree of hawkishness/dovishness of AE and EM central banks. Once we convert the text to data, we observe the following (Figure 1):

- Outside crisis periods such as the global financial crisis of 2008-9, before the pandemic EM central bank statement sentiment moved along with the Fed (though naturally more hawkish given higher EM inflation), reflecting the latter’s central role in the global financial cycle (Rey 2015).

- During the pandemic in 2020 through early 2021, we see highly synchronised monetary policy communication of the Fed, the ECB and EM central banks. In addition to EMs’ improved policy frameworks, this also reflected the safety impact of currency swap and repo operations offered to virtually all emerging markets by the Fed and the ECB (to emerging Europe) from 2020 on.

- EM central banks had started to react to rising inflationary pressures from the spring of-2021, about a year earlier than did the Fed and the ECB. Our topic decomposition shows that both EM and AE central banks noticed the rising inflation simultaneously in early 2021. However, AE central banks kept referring to it as “transitory” for about a year and delayed policy action. In contrast, EM central banks were quick to recognise and communicate concerns about the risks of more persistent inflation, knowing from experience that supply side shocks that lead to demand-supply imbalances can too generate sustained inflation and that inflation expectations can quickly de-anchor when prices rise rapidly and the distinction between ‘first-round’ and ‘second-round’ effects blurs. This concentrated their policy attention to rapidly rising short-term rather than longer-term inflation expectations – the traditional focus of central banks. AE central banks appeared more relaxed about the inflation surge even when short-term inflation expectations rose in their economies and remained more concerned about the sustainability of post-pandemic recovery or, where their mandate required, their employment goals. This made them stick to their dovish forward guidance for some time and keep quantitative easing in place. EM central banks, in contrast, have used forward guidance in a less committal and more pragmatic way, which helped them to react to incoming new inflation data.

Figure 1 Sentiment score of the monetary policy statements, 2006-2024

Note: Higher = more hawkish; lower = more dovish.

Source: Authors’ calculation

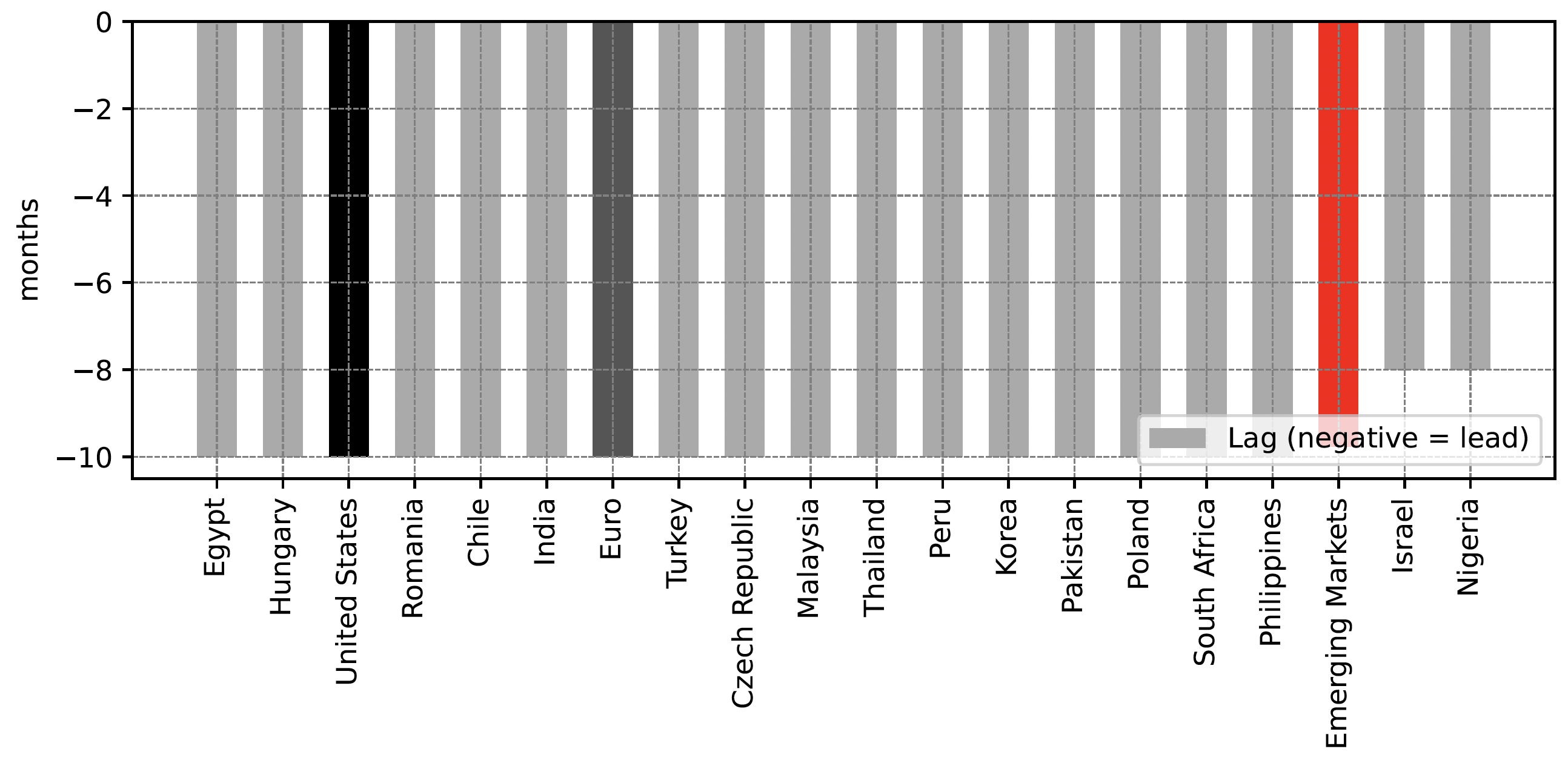

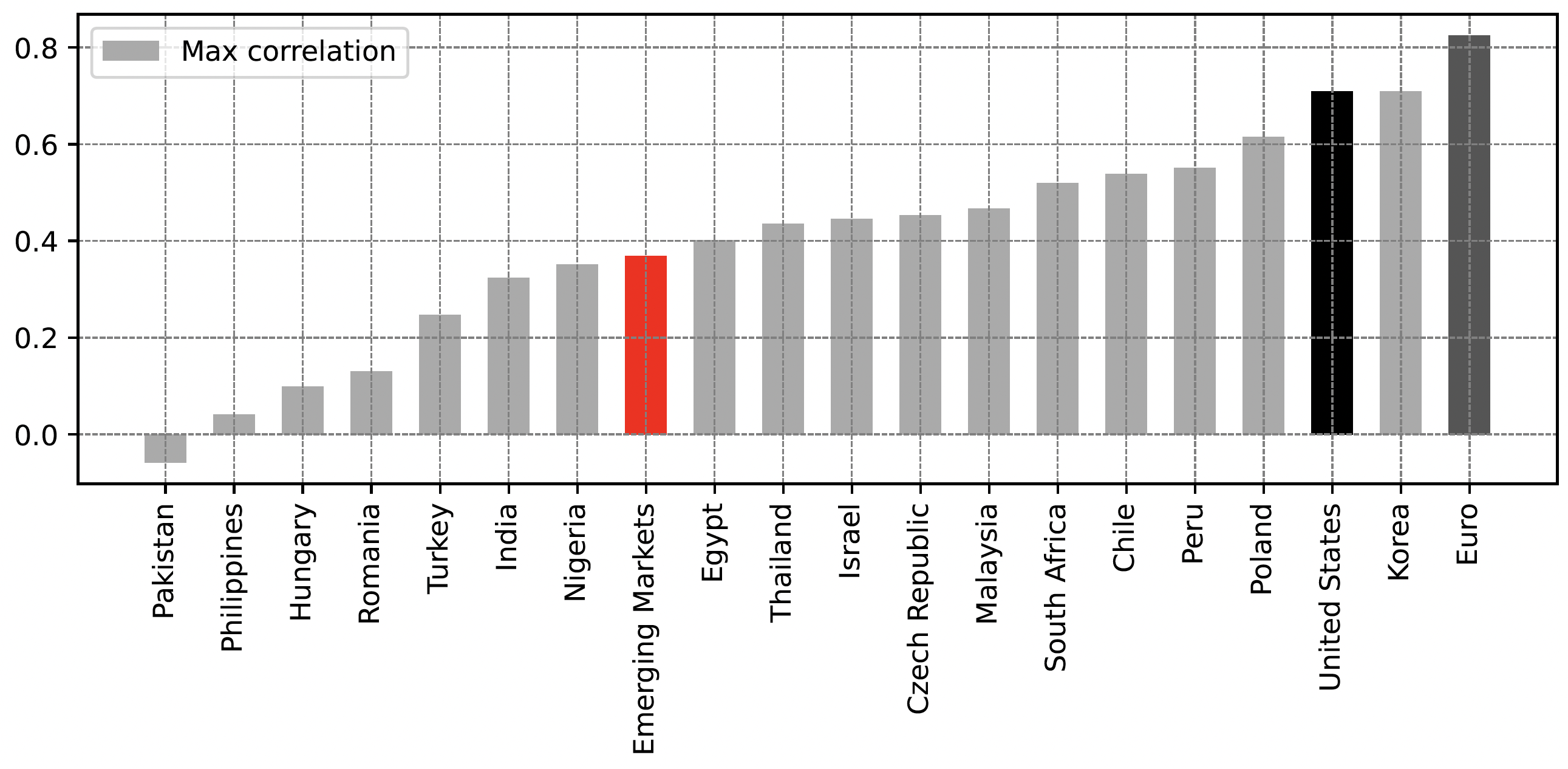

We also analyse how central bank communication relates to reality. We check if their communication is indicative of future policy rates moves and whether central banks are able to foresee inflation. We find that both EM and AE central banks typically start preparing markets and economic agents for their future moves at least eight months in advance (Figure 2a). In the case of the Fed and ECB the communication and the actual policy rate changes are very closely linked: the correlation between the two is around 70% and above 80%, respectively (Figure 2b). The EM central banks typically have a weaker link, with correlation on average not exceeding 40%. While some of this communication policy action gap may be explained by more frequent shocks in EMs, this can also weaken central bank credibility over the longer term.

Figure 2 Correlation between monetary policy sentiment score and policy rate

a) Lag at which correlation is max

Note: Negative lag=lead; lead means central banks gives notice before changing rates.

Source: Authors’ calculation.

b) Max correlation between communication and policy rate

Note: higher=stronger relationship.

Source: Authors’ calculation.

When it comes to inflation, central banks both from advanced and emerging countries appear to have limited ability to foresee it and start communicating on it in advance. The lag between the inflation component of the communication and inflation itself is mostly positive, meaning that central banks first notice the actual inflation and then start communicating on it with a 1-2 month lag. Only a few EM central banks fare better and warn of building inflation pressures (Czech Republic, Hungary, South Africa and Romania, even though with varying consistency). These results suggest ample room for improving inflation projection tools in both AE and EM central banking.

We also find that EM central banks monitor factors that are more specific to their own circumstances. Exchange rate references (even under inflation targeting) are more frequent than in AE comparators (around 6% of sentences compared to close to zero in AEs). Given that a number of EMs are small open economies with a history of financial dollarisation, the exchange rate remains important including for its role in the monetary transmission mechanism and financial stability, and thus justifies this focus even in inflation-targeting countries. EMs also traditionally focus more on supply side factors of inflation.

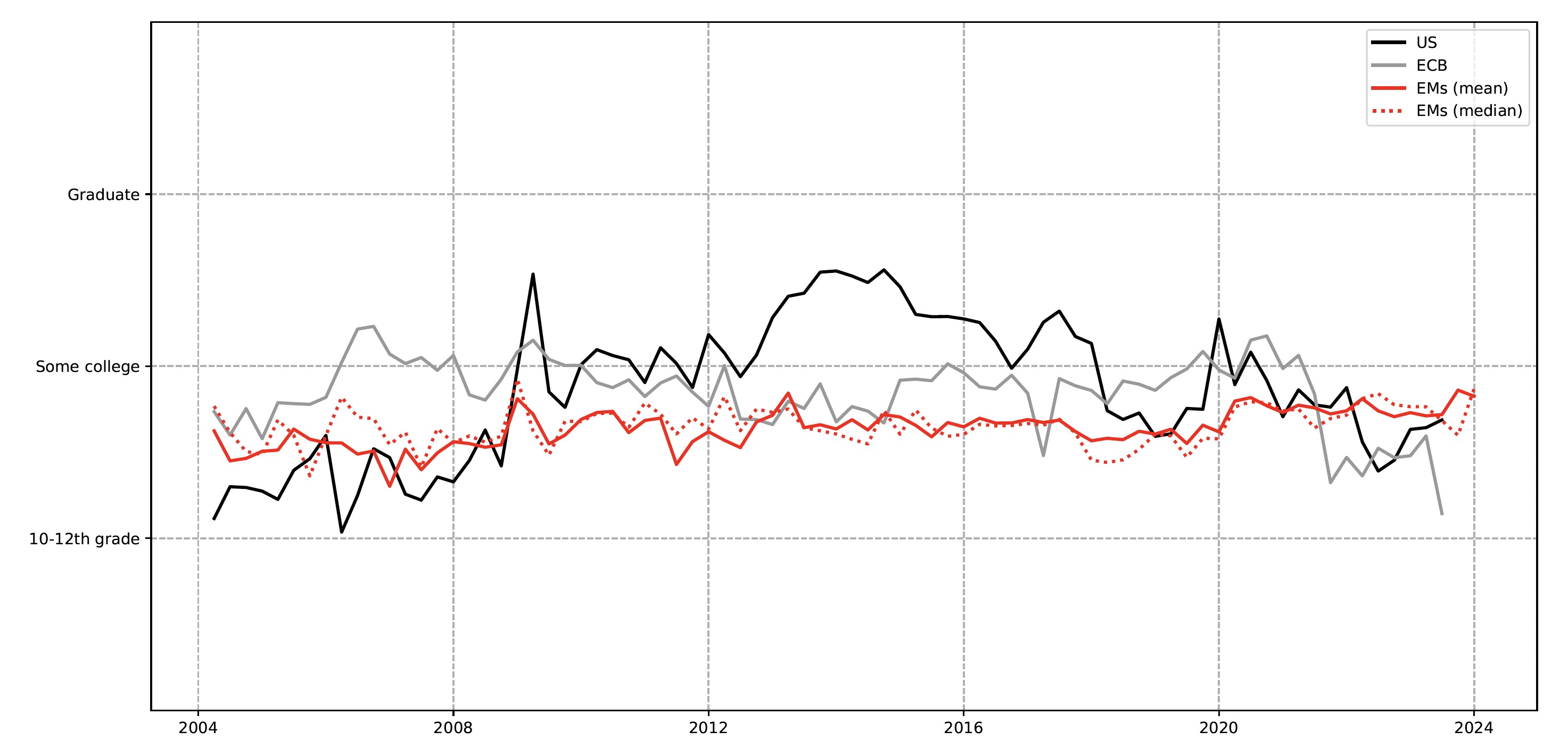

The readability of EM monetary policy statements appears to have been better than that of AEs until recently (Figure 3). Understanding the statements still requires either high school education or some college degree in EMs and even higher in AEs until recently. Since their recent policy review, the Fed and the ECB have made clear efforts to simplify their policy communication, which is reflected in their recent improvements.

Figure 3 Flesch-Kincaid readability index

Note: Number of years of education required to understand the text. Higher = poorer readability, lower = better readability.

Source: Authors’ calculations based on Kincaid et al. (1975)

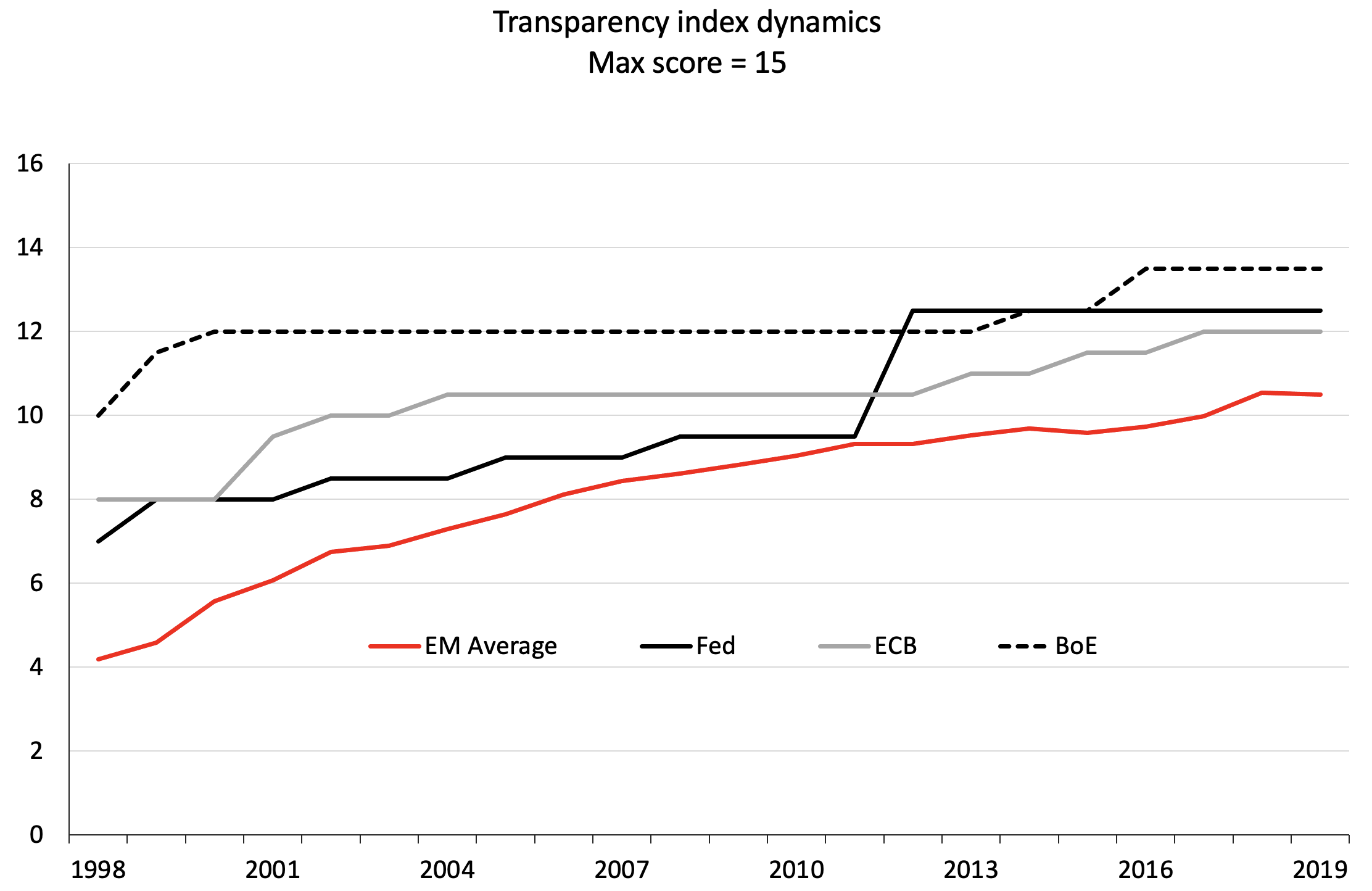

EM central banks have also greatly improved their policy frameworks, including forecasting and overall transparency. Using the updated central bank transparency index developed by Dincer and Eichengreen (2022), we calculate that some EM countries – Chile, the Czech Republic, Hungary and South Africa – have reached or even surpassed AE comparators (Figure 4).

Figure 4 Central bank transparency index, 1998-2019

Sources: Dincer et al (2022) and authors’ calculations.

Overall, we conclude that emerging market central banks have come a long way in their policy and communication, catching up with leading advanced country central banks over the past two decades. There is, of course, still significant room for improvement in a number of areas that we have highlighted. Nevertheless, in several respects EM central banks have performed better than their advanced economy peers in the post-pandemic period. In particular, they communicated their divergent views on global inflation clearly and took appropriate policy actions ahead of the ‘masters’.

References

Armelius, H, C Bertsch, I Hull and X Zhang (2020), "Spread the Word: International Spillovers from Central Bank Communication", Journal of International Money and Finance 103(C).

Blinder, A (2018), “Through a Crystal Ball Darkly: The Future of Monetary Policy Communication” AEA Papers and Proceedings 108: 567-571.

Coenen, G, M Ehrmann, G Gaballo, P Hoffmann, A Nakov, S Nardelli, E Persson and G Strasser (2017), “Communication of Monetary Policy in Unconventional Times”, ECB Discussion Paper No. 2080.

Coibion, O, Y Gorodnichenko and M Weber (2020), “Does Policy Communication During Covid Work?”, NBER Working Paper No. 27384.

Dincer, N, B Eichengreen, P Geraats (2022), “Central Bank Transparency Data for 1998-2019 and Trends in Monetary Policy Transparency: Further Updates”, International Journal of Central Banking 18(1): 331–348.

De Leo, P, G Gopinath and S Kalemli-Ozcan (2023), “Monetary policy cyclicality in emerging economies”, VoxEU.org, 14 April.

Evdokimova, T, P NagyMohacsi, O Ponomarenko and E Ribakova (2023) “Central Banks and Policy Communication: How Emerging Markets have Outperformed the Fed and ECB”, Peterson Institute for International Economics Working Paper No. 23-10.

Gonzalez, M and R C Tadle (2022), “Monetary Policy Press Releases: an International Comparison”, BIS Working Paper 1023.

Haldane, A, A Macauly and M McMahon (2020), “The 3 E’s of Central Bank Communication with the Public.” Bank of England Staff Working Paper 847.

Kincaid J P, R P Jr Fishburne, R L Rogers, B S Chissom (1975), Derivation of New Readability Formulas(Automated Readability Index, Fog Count and Flesch Reading Ease Formula) For Navy Enlisted Personnel, Naval Technical Training Command: Research Branch Report No. 8

Laungaram, P and W Wongwachara (2017), “More Than Words: A Textual Analysis of Monetary Policy Communication”, PIER Discussion Paper No 54, Puey Ungphakorn Institute for Economic Research.

Nagy Mohácsi, P (2020) “The Quiet Revolution in Emerging-Market Monetary Policy”, Project Syndicate, August 18.

Pongsak, L and W Wongwachara (2017), “More Than Words: A Textual Analysis of Monetary Policy Communication”, PIER Discussion Paper No 54, Puey Ungphakorn Institute for Economic Research.

Rawat, U and H Ye (2020), “COVID-19 in emerging markets: Escaping the monetary policy procyclicality trap”, VoxEU.org, 20 August.

Rey, H (2015), “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, NBER Working Paper 21162.

Ribakova, E, A Rebucci, A Garcia-Herrero, J Hartley and G Benigni (2020), “Credible emerging market central banks could embrace quantitative easing to fight COVID-19”, VoxEU.org, 29 June.

Sunel, E and Y Mimir (2021), “Quantitative easing in emerging market economies: Benefits, risks, and limitations”, VoxEU.org, 5 April.