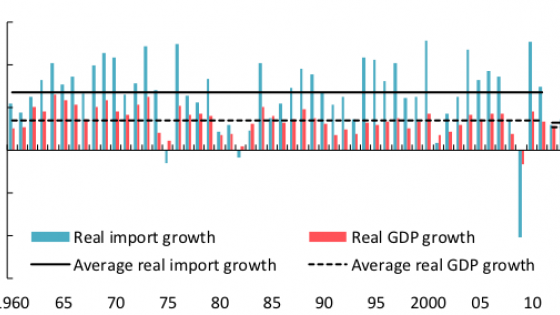

Growth in the volume of global trade reached a post-crisis low of 2.4% in 2016 – significantly below the pre-crisis average of 7.6%. Cyclical factors – such as weak global demand, low commodity prices, and slower growth in China – have all contributed to the trade deceleration. In addition, structural factors have lowered trade’s responsiveness to global output expansion (Aslam et al. 2017, Constantinescu et al. 2016, Hoekman 2015, IMF 2016, World Bank 2016).

The maturing of global value chains is one of the key structural factors contributing to the recent trade slowdown. Global value chains often involve numerous cross-border operations, conducted either intra-firm (that is, between firms related through ownership or control) or between unaffiliated firms at ‘arm’s length’. A firm’s decision between arm’s-length and intra-firm transactions has its roots in the underlying motivation for vertical integration and foreign direct investment. Firms choose to internalise transactions if the cost of performing these through the market is higher than internal costs. In particular, contract enforcement imposes costs when contracts are incomplete (Grossman and Hart 1986). When contracts are incomplete and their enforcement is costly, firms may prefer vertical integration and internal ownership of assets (Hart and Moore 1990, Antras 2015).

Based on the findings of our recent study of a unique dataset of US trade (Lakatos and Ohnsorge 2017), in this column we document that arm’s-length trade accounted disproportionately for the overall post-crisis US trade slowdown. Specifically, compositional effects combined with a higher income and real exchange rate elasticity of arm’s-length trade contributed to the strong pre-crisis growth and the steep post-crisis slowdown of arm’s-length trade compared to that of intra-firm trade.

First, arm’s-length trade depends more heavily than intra-firm trade on sectors with rapid pre-crisis growth that boosted arm’s-length trade pre-crisis, but that have languished post-crisis. Second, arm’s-length trade is also more concentrated in emerging market and developing economies, where output growth has slowed sharply from elevated pre-crisis rates. Finally, these compositional effects were compounded by a higher elasticity of arm’s-length trade to demand and real exchange rate movements compared to intra-firm trade. Results suggest that the income elasticity of arm’s-length exports is about one-fifth higher, while the real exchange rate elasticity of arm’s-length exports is one-tenth more pronounced than that of intra-firm exports.

The evolution of arm’s-length and intra-firm trade since the crisis

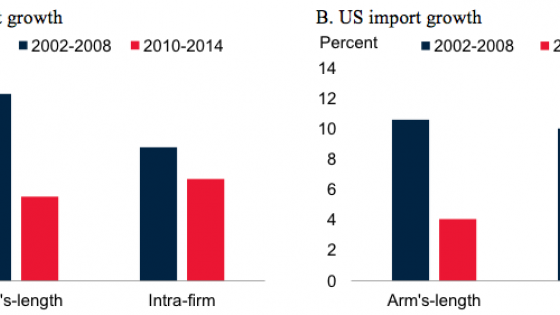

Trade data from the US Census Bureau show that arm’s-length trade accounted disproportionately for the overall post-crisis US trade slowdown. This reflected a higher pre-crisis average and a weaker post-crisis rebound in arm’s-length trade growth compared with intra-firm trade. During the crisis itself, the US data suggest a broad-based trade collapse in which intra-firm and arm’s-length trade contracted to similar degrees. By 2014, however, intra-firm trade growth had returned close to its pre-crisis average (4.3% of exports and 5.0% for imports). In contrast, arm’s-length trade growth remained significantly below its high pre-crisis average. Its growth slowed to a post-crisis annual average of 4.7% compared to 11.3% during 2002-08 (Figure 1).

Figure 1. US trade growth

Sources: U.S. Census Bureau.

Note: U.S. exports and imports of goods based on data from the U.S. Census Bureau. Global data are not available.

Characteristics of arm’s length and intra-firm trade

The importance of arm’s-length trade

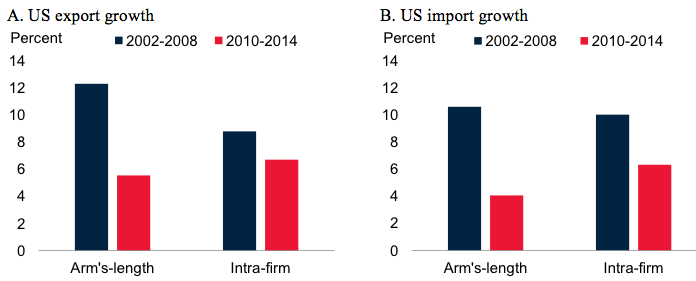

Just over half (about 57%) of total US trade is conducted at arm’s length between unrelated firms. The share of arm’s-length trade is much lower for US imports (50%) than exports (70%), for US trade in capital goods (50%) than final goods (60%), and for US trade with advanced economies (51%) than with emerging markets and developing economies (64%, Figure 2). In general, a higher per capita income of a trading partner is associated with a lower share of arm’s-length trade. The share of intra-firm trade of total US trade remained broadly stable from 2002 until the Global Crisis but subsequently increased, especially for US trade with emerging markets and developing economies.

Country composition of arm’s-length and intra-firm trade

Geographical proximity and the North American Free Trade Agreement (NAFTA) favour intra-firm transactions with two of the US’ largest trading partners – Mexico and Canada. Canada is the single largest destination of US intra-firm exports (almost one-third of total US intra-firm exports) and imports, followed by Mexico (about one-fifth of total US intra-firm exports). More than half of US imports from its main non-NAFTA trading partners (with the exception of China and Italy) are also intra-firm transactions (Figure 2).

Figure 2 US trade growth

Sources: U.S. Census Bureau.

Notes: A. US exports and imports of goods, average for 2002-14. The residual to 100% is the share of arm’s-length trade in total US goods exports or goods imports with the world, advanced economies (AEs) or EMDEs. The shares are broadly stable over the period. AE stands for advanced economies. B. Residual to 100% is the share of all other countries in total US arm’s-length or intra-firm exports or imports.

Factors contributing to the sharp post-crisis slowdown in arm’s-length trade

Compositional effects

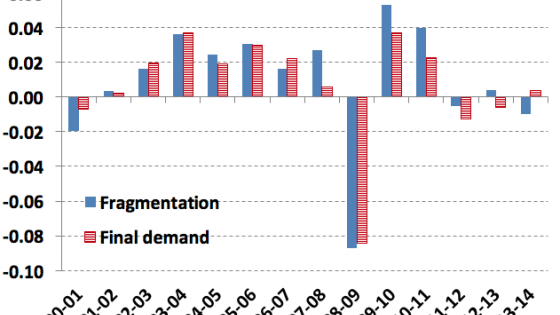

First, a greater share of arm’s-length US exports than intra-firm US exports is shipped to emerging markets and developing economies, especially the BRICS economies. Just as the rapid pre-crisis growth in emerging markets and developing economies lifted arm’s-length export growth, their sharp post-crisis growth slowdown dampened it (Kose et al. 2016, Huidrom et al. 2016). Second, arm’s-length exports and imports include a greater share of sectors that grew rapidly pre-crisis but have struggled post-crisis (textiles and apparel and machinery) or sectors that benefited from the pre-crisis commodity price boom (mining, metals, and energy). The collapse in metals and energy prices from their peak in the first quarter of 2011 has weighed on trade (Baffes et al. 2015). These compositional differences are the main reason behind the steeper-than-average slowdown in arm’s-length trade growth. Had the composition of arm’s-length trade matched that of average exports and imports, arm’s-length export and import growth would have slowed by 1.2 and 1.8 percentage points less, respectively, between the pre-crisis and post-crisis periods (Figure 3).

Figure 3. Decomposition of the post-crisis trade slowdown

Sources: US Census Bureau.

Note: See Lakatos and Ohnsorge (2017) for the description of the methodology.

Higher elasticity to changes in demand and exchange rates

Econometric estimates presented in our paper suggest that arm’s-length exports are more sensitive to changes in demand and in real exchange rates than intra-firm exports. The income elasticity of arm’s-length US exports is significantly (about one-fifth) higher than that of intra-firm exports – a 1 percentage point increase in the real GDP growth of the importing county is associated with 1.5 percentage point higher growth in arm’s length exports, but only 1.2 percentage point higher growth in intra-firm exports. Similarly, a real exchange rate appreciation of 1 percentage point is associated with 3.1 percentage point lower growth in arm’s-length exports, but only 2.8 percentage point lower growth in intra-firm export growth.

Other contributing factors

Firms engaged in outsourcing tend to be smaller, less productive, less efficient in inventory management, and have more restricted access to finance than firms integrated vertically (Corcos et al. 2013). These firms are also less resilient to the severe demand and financing shocks (Altomonte et al. 2009). Heightened financial risks and policy uncertainty may also have discouraged arm’s-length transactions. Such factors may have accelerated the exit of firms trading at arm’s length during the Global Crisis and its aftermath.

Authors' note: The findings, interpretations, and conclusions expressed in column article are entirely those of the authors. They do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

References

Altomonte, C and G I Ottaviano (2009), "Resilient to the Crisis? Global Supply Chains and Trade Flows." VOXEU.org. 27 November.

Antras, P (2015), Global Production: Firms, Contracts, and Trade Structure. Princeton: Princeton University Press.

Aslam A, E Boz, E Cerutti, M Poplawski-Ribeiro and P Topalova (2017), “Global Trade: Drivers Behind the Slowdown.” VOXEU.org. 13 February.

Baffes, J, M A Kose, F Ohnsorge and M Stocker (2015), "The Great Plunge in Oil Prices: Causes, Consequences, and Policy Responses", World Bank Policy Research Note 15/01.

Constantinescu, C, A Mattoo and M Ruta (2016), “Why The Global Trade Slowdown May Matter.” VOXEU.org. 25 May.

Corcos, G, D M Irac, G Mion, and T Verdier (2013), "The Determinants of Intrafirm Trade: Evidence from French Firms", Review of Economics and Statistics 95 (3): 825-838.

Kose, M A, F Ohnsorge, and L S Ye (2016), "Emerging markets at a crossroads" VOXEU.org. 7 January.

Grossman, S J and O Hart (1986), "The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration", Journal of Political Economy 94 (4): 691–719.

Hart, O D, and J Moore (1990), "Property Rights and the Nature of the Firm." Journal of Political Economy 98 (6): 1119–58.

Hoekman, B (2015), “Trade and growth – end of an era?” VOXEU.org. 24 June 2015.

Huidrom, R, M A Kose and F Ohnsorge (2016), “Painful Spillovers from Slowing BRICS growth.” VOXEU.org. 27 February.

IMF (2016), World Economic Outlook: Subdued Demand Symptoms and Remedies. Washington, DC: International Monetary Fund.

Lakatos C and F Ohnsorge (2017), “Arm’s-Length Trade: A Source of Post-Crisis Trade Weakness.” Policy Research Working Paper 8144, World Bank, Washington, DC.

World Bank (2016), Global Economic Prospects: Spillovers Amid Weak Growth, Washington, DC: World Bank.

World Bank (2017), Global Economic Prospects: A Fragile Recovery. Washington, DC: World Bank.