Strong credit growth has preceded many historic episodes of financial instability, which is why academics and policymakers alike are preoccupied with identifying and measuring excess credit as precisely as possible (Taylor and Schularick 2009). A commonly adopted measure, proposed by Borio and Lowe (2002), is the credit-to-GDP gap indicator. This is estimated as the deviation of the credit-to-GDP ratio from its long-run trend. The ratio provides credit volume normalisation allowing credit demand and credit supply to grow in line with the economy’s size. The deviation of the ratio from its trend accounts for possible changes in the ratio’s long-run level.

Owing to the credit-to-GDP gap’s status as the single best early warning indicator, it has become an integral part of international macroprudential policy (BCBS 2010). However, a growing body of literature has emerged highlighting important critiques of the credit-to-GDP gap computed according to the Bank for International Settlements/Basel Committee on Banking Supervision guidelines. In a recent study (Jokipii et al. 2020), we assess the relevance of these critiques for the case of Switzerland to assess the reliability of the BIS gap as a measure of excess credit for policy purposes.

Impact of GDP variability on the gap’s signal

Critics have argued that simply dividing credit by nominal GDP in order to normalise credit can be problematic. Since policy relevant gaps are estimated in real time, GDP variability derived from regular statistical revisions or shocks can considerably affect the gap’s signal (Edge and Meisenzahl 2011).

In Switzerland, GDP revisions occur regularly and for several reasons.1 At times, they can be significant and can extend backwards affecting several years. Hence, any indicator that employs Swiss GDP in its function (e.g. the credit-to-GDP gap) is subject to considerable regular volatility.

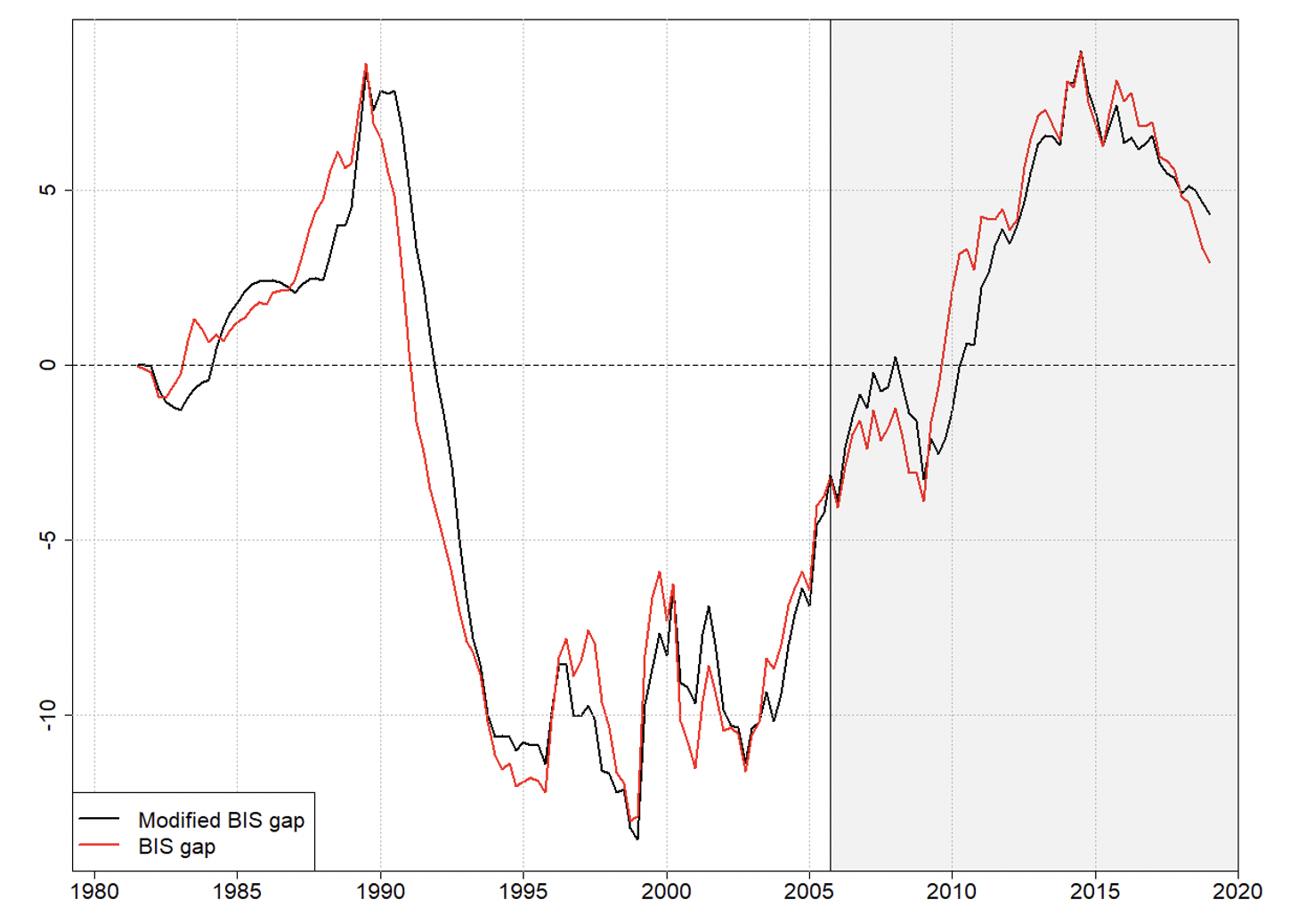

The impact of GDP variability on the Swiss BIS gap is measured by comparing it with an alternative gap measure (hereafter the modified BIS gap), which limits GDP volatility by replacing nominal GDP in the denominator with a ‘smoothed GDP’2 series. Despite its ability to downplay the importance of GDP movements, the modified approach comes with its own drawbacks. Smoothing is achieved by applying a two-sided filter to GDP which uses all available information to provide estimates that are more precise. As such, past estimates are revised each time new information becomes available. These frequent movements of past gap signals can complicate both interpretation and communication.

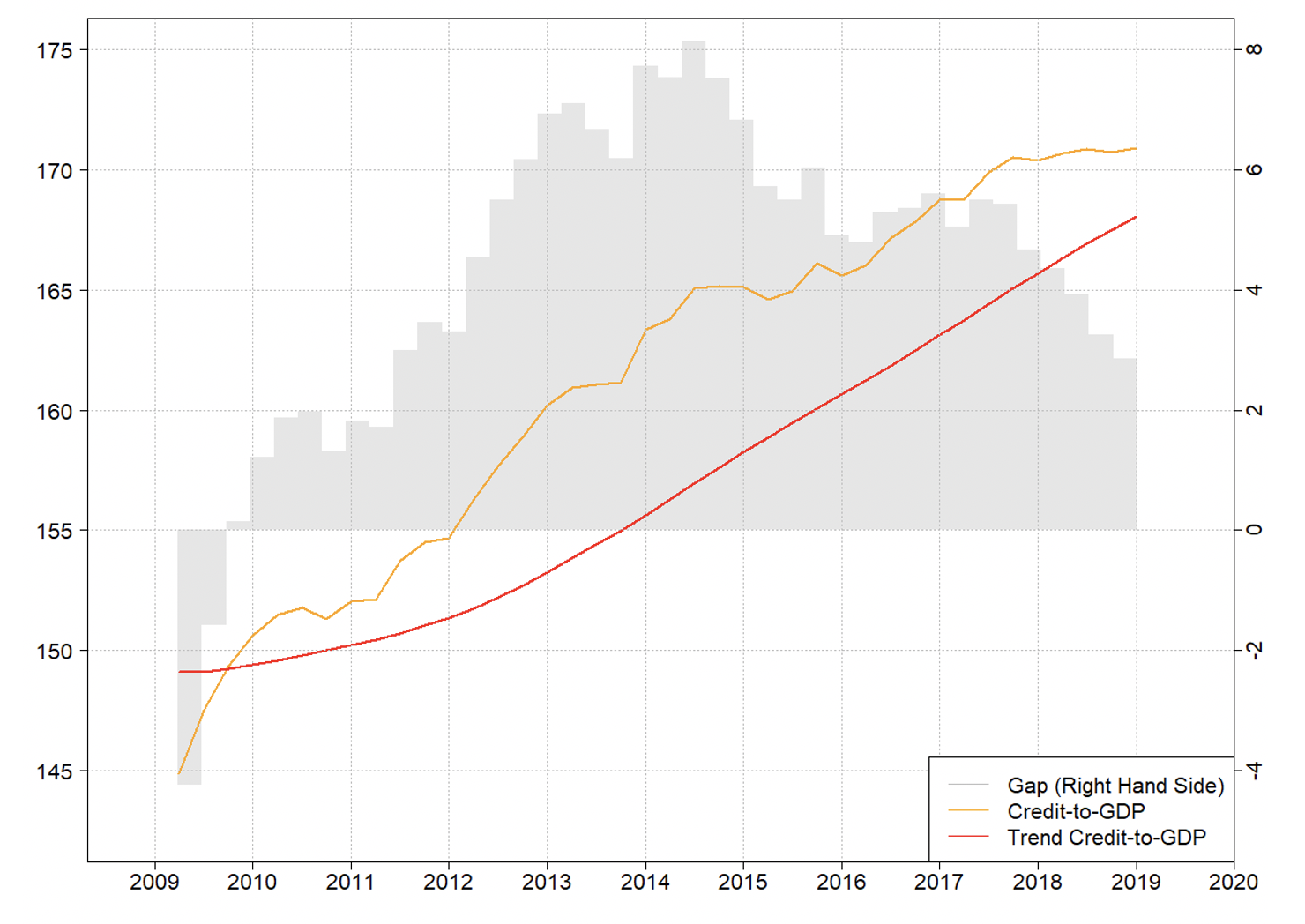

Comparing the two gaps, our findings show that the BIS gap is considerably more sensitive to GDP movements than the modified BIS gap, particularly when movements are sudden and large. However, additionally accounting for the impact of past estimate revisions (modified BIS gap), we find that the cumulative effect of GDP movements can be greater for the modified BIS gap than for the BIS gap. Finally, our assessment of gap signals over time suggests that the BIS gap’s signal consistently leads that of the modified BIS gap in the build-up phase of the cycle, highlighting its superior early warning properties (Figure 1). It therefore seems that there exists a trade-off between signal stability over time and early warning properties. Hence, we find no compelling evidence for a need to deviate from the BIS gap as a reliable early warning indicator.

Figure 1 Evolution of the BIS gap and modified BIS gap

Measurement problems associated with estimating the long-run trend component

Another critique questions the basis for estimating the long-run trend component. Critics have emphasised several measurement problems associated with using the HP filter.3 One concern4 relates to the reliability of the gap’s signal for countries that have undergone structural changes or important crises. In this case, the underlying series’ starting point can cause considerable differences in the gap’s signal (Drehmann and Tsatsaronis 2014).

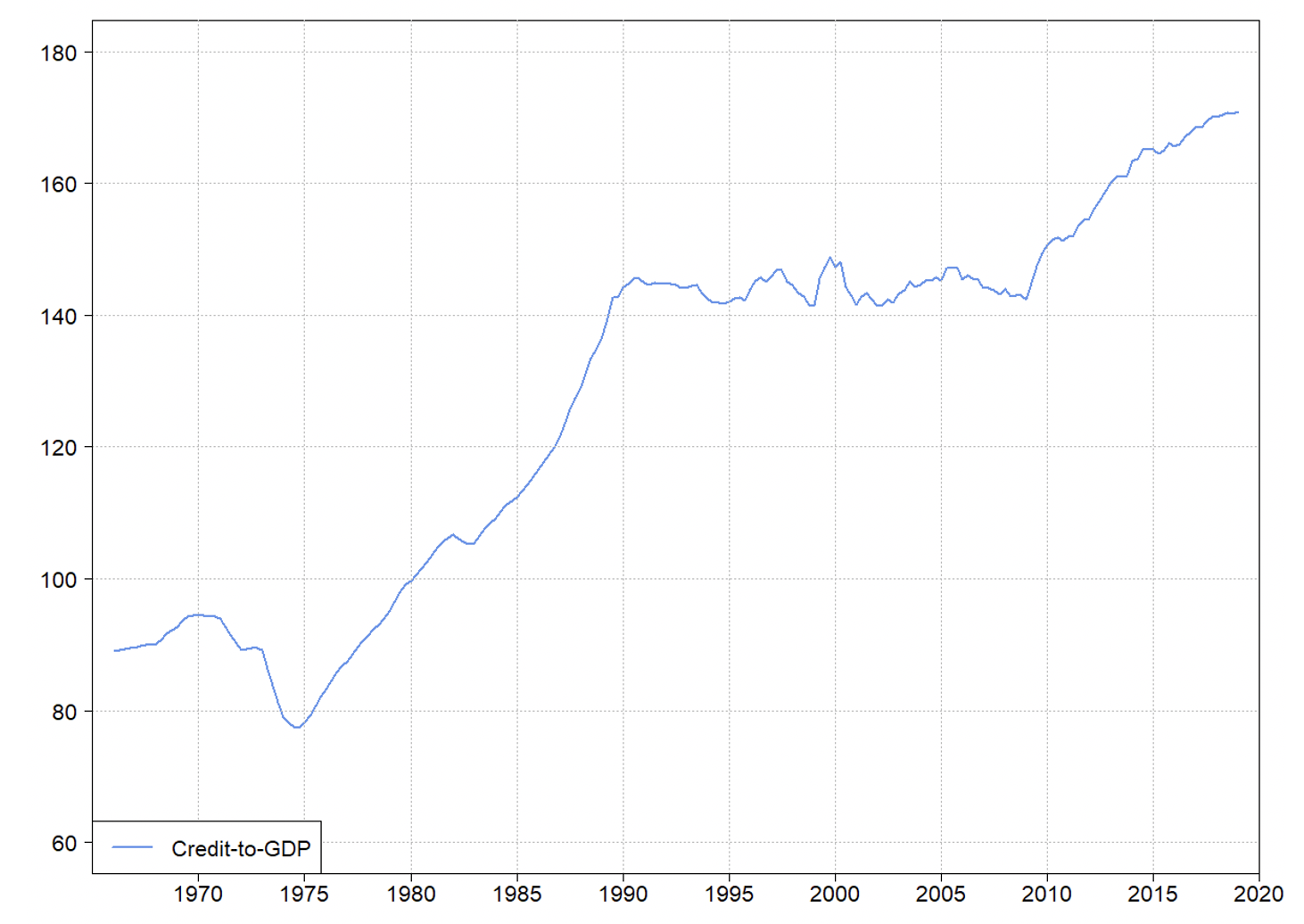

Figure 2 Swiss credit-to-GDP ratio

In Switzerland, strong credit growth in the 1970s and 1980s5 (Figure 2) coincided with the formation of a real estate and bank lending bubble. Following the bubble’s eventual burst in 1990, lending growth decreased and the development of the credit-to-GDP ratio remained relatively subdued until 2008. Since then, momentum has picked up again. As such, an important question arises as to whether the structural impact of the crisis on the credit-to-GDP ratio affected the reliability of a long-run trend, and the consequent gap estimates.

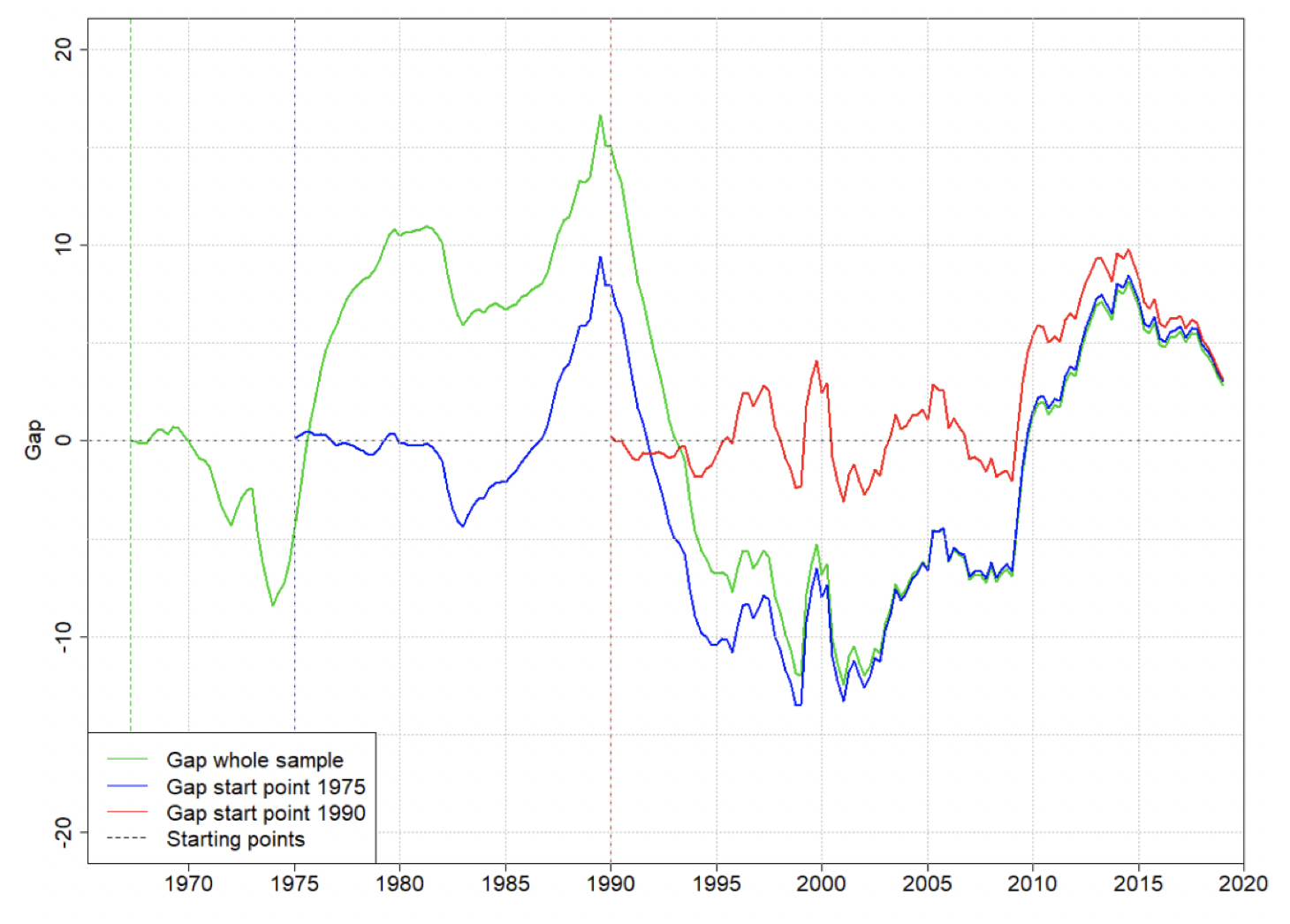

Estimating the BIS gap with varying starting points shows that the length of the series, and the point in the cycle at which the data starts, can indeed have significant implications for the gap’s signal. However, we find that, for the Swiss case, roughly 30 years of data are needed to eradicate the impact of shifts or breaks in the underlying data. As such, the structural developments that occurred in Switzerland in the 1990s no longer affect the current signal (Figure 3).

Figure 3 Swiss BIS gap estimated with varying start points

Note: The credit-to-GDP gap is estimated according to the BCBS guidelines (deviation from a one-sided HP filter with a large smoothing parameter (400,000)). The whole sample starts in 1965 (green line), and sub-samples start in 1975 and 1990 (blue and red lines).

More recently, critics have highlighted a downward bias risk associated with the gap, which, in certain situations can cause an underestimation of cyclical systemic risks (Lang et al. 2019). This criticism is based on the mechanic incorporation of part of the boom period’s credit excesses into the statistical trend estimate, with the effect becoming ever more pronounced the longer the boom phase continues. During this time, strong growth in the credit-to-GDP ratio sets the trend on a higher growth path, leading to a decrease in the gaps level, even in an unchanged risk environment. After a bust, when risks start to increase again, an inflated trend level results in a gap that stays negative for too long. While there is some evidence of downward bias in the long-lasting boom phase in Switzerland, we find that the risk of such a bias resulting solely from the HP filter is no greater than the risk of it resulting from other filtering approaches.

What does this mean for policymakers?

A thorough assessment of the Swiss BIS credit-to-GDP indicator suggests there is no need to deviate from using the BIS gap as a reliable measure of excess credit in Switzerland. However, its signal should be interpreted with caution in two particular situations: during periods of large and strong GDP movements, and during long-lasting boom phases and subsequent busts.

Our study shows that GDP variability, due to either revisions or shocks, can have a significant impact on the gap’s signal over time. However, our assessment also suggests that a trade-off exists between signal stability and early warning properties. The superior early warning properties of the BIS gap ensures enough time for authorities and banks to react when credit excesses are building up, making it an attractive indicator from a policy-making point of view.

Figure 4 Decomposition of the credit-to-GDP gap (2009-2018)

Our study also confirms the downward bias of the BIS gap in certain situations. However, the downward bias associated with the BIS gap seems comparable to that observed for other filtering approaches. In addition, it appears that the most pressing issue for the Swiss credit market has shifted from being one of excess credit growth to a credit quality issue. As a measure of excess credit, the BIS gap should not be expected to capture these risks. This emphasises the need for authorities to complement the BIS gap with other credit indicators to ensure a comprehensive assessment of whether developments in the credit market are sustainable or whether they are a source of aggregate vulnerability.

References

BCBS (2010), “Guidance for National Authorities Operating the Countercyclical Capital Buffer”, Bank of International Settlements.

Borio, C and P Lowe (2002), “Asset Prices, Financial and Monetary Stability: Exploring the Nexus”, BIS Working Papers, No 114.

Drehmann, M, C Borio, L Gambacorta, G Jiminez and C Trucharte (2010), “Countercyclical Capital Buffers: Exploring Options”, BIS Working Papers, No 317.

Drehmann, M, C Borio and K Tsatsaronis (2011), “Anchoring Countercyclical Capital Buffers: The Role of Credit Aggregates”, BIS Working Paper, No 355.

Drehmann, M and J Yetman (2018), "Why you should use the Hodrick-Prescott filter - at least to generate credit gaps," BIS Working Papers, No 744.

Edge, R and R Meisenzahl (2011), “The Unreliability of Credit-to-GDP Ratio Gaps in Real Time: Implications for Countercyclical Capital Buffers”, International Journal of Central Banking 7(4): 261-298.

Hamilton, J (2017), "Why You Should Never Use the Hodrick-Prescott Filter", NBER Working Paper, No 23429.

Jokipii, T, R Nyffeler and S Riederer (2020), “The BIS credit-to-GDP gap and its critiques”, SNB Working Paper, 20-19.

Lang, J H, C Izzo, S Fahr and J Ruzick (2019), “Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises”, ECB Working paper, No 219.

Lang, J H and P Welz (2019), “Household credit cycles and financial crises” VoxEU.org, 11 March.

Pedersen, T M (2001), “The Hodrick Presscott Filter, the Slutzky Effect, and the Distortionary Effect of Filters”, Journal of Economic Dynamics and Control 25: 1081–1101.

Swiss National Bank (2019), Financial Stability Report 2019, pp. 18-28.

Taylor, A M and M Schularick (2009), “Credit booms go wrong”, VoxEU.org, 08 December.

Van Norden, S (2011), “Discussion of ‘The Unreliability of Credit-to-GDP Ratio Gaps in Real Time: Implications for Countercyclical Capital Buffers’”, International Journal of Central Banking: 300-303.

Endnotes

1 Revisions to the Swiss credit series seldomly occur.

2 Smoothing is achieved by applying a two-sided Hodrick-Prescott (HP) filter to GDP. The two-sided filter differs from the one-sided filter in that it uses all available information to provide more precise estimates.

3 For a detailed discussion of the use of the HP filter to de-trend credit measures, see Hamilton (2017) and Drehmann and Yetman (2018).

4 See Jokipii et al. (2020) for a more encompassing and detailed discussion of the HP filter critique and their assessment from a Swiss perspective.

5 Between 1975 and 1989, average annual growth amounted to roughly 4% compared to an average annual growth of roughly 1.3% for the full sample period (1