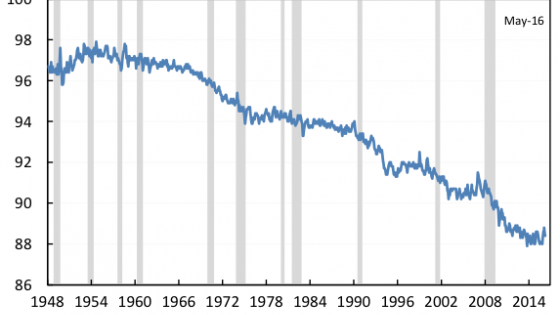

The share of men between the ages of 25 and 54 either working or actively seeking work—the prime-age male labour force participation rate—has been falling for more than 60 years in the US—from a peak of 98% in the 1950s to 88% today.1 In the last 25 years, the prime-age male labour force participation rate has fallen more quickly in the US than in all but one of the OECD economies, and is now the third lowest among this group. When individuals are in their prime working years, they are at their most productive; as a result, their labour force participation has outsized implications for broader economic growth, as well as for individuals’ earnings prospects and well-being.

Very little of the decline in the participation rate can be accounted for by improvements in options outside the labour market and related reductions in labour supply. These men are not increasingly relying on a spouse’s income or government income, nor are they increasingly engaged in caregiving. Instead, the evidence is consistent with reduced labour market opportunities for lower-skilled workers, a factor that is also consistent with the decline in relative wages of lower-skilled workers. Though this demand shift has happened in other OECD economies, the consequences for participation have been larger in the US, suggesting that the relative lack of support provided by US institutions has played a role.

The participation rate has fallen more in the US than in most other advanced economies and most for less-educated men

Since 1965, when the participation decline began to pick up, the prime-age male participation rate has fallen annually by an average of 0.16 percentage points, totalling an 8.3 percentage-point decline (Figure 1).

Figure 1. Prime-age male labour force participation rate

As a result of this steep decline over the past six decades, US prime-age male participation now ranks 3rd lowest out of 34 in the OECD—above only Italy and Israel—in terms of prime-age male labour force participation (Figure 2). From 1990 to 2014, the US experienced the second largest decline in prime-age male participation among OECD countries.

Figure 2. Prime-age male labour force participation rate across the OECD

However, labour force non-participation, in which someone is neither employed nor searching for a job, is just one way in which individuals can be non-employed; they can also be unemployed, which means they are currently seeking employment. Although the US has particularly low prime-age male labour force participation, historically, it has also had a lower unemployment rate relative to other OECD economies.

This partially offsets the relatively higher non-participation rates in the US, leaving the US prime-age male non-employment rate slightly lower relative to the OECD, but still higher than the median ( Figure 3). Because many other OECD economies experienced slower recoveries than the US, their non-employment rates are potentially temporarily higher than they would be otherwise, leaving the US higher ranked in the distribution on a structural basis.

Figure 3. Prime-age male non-employment rates across the OECD

The starkest divergence in participation trends is by education level. In 2015, every education group had lower participation rates than in previous decades, but the decline was steepest among those with less education (Figure 4). This pattern makes the overall decline more puzzling because the compositional shift towards higher educational attainment should have raised the labour force participation rate, all else being equal.

Figure 4. Prime-age male labour force participation by educational attainment

Assessing explanations of the decline in prime-age male participation rates: Supply, demand, and institutions

Explanations for the steady decline in prime-age male labour force participation can be classified into three categories:

- Supply driven: characterised by prime-age men choosing to reduce their labour supply for a given set of labour market conditions;

- Demand driven: characterised by fewer labour market opportunities available to prime-age men as demand for their labour falls; and

- Institutional: characterised by the design of labour market institutions and other systems.

Reductions in labour supply explain relatively little of the long-run trend; rather, reductions in demand, as shaped by institutional factors, may be more important explanations.

1. Supply-driven explanations

One explanation for declining male labour force participation could be increased reliance on spouse’s income; as women’s labour force participation rose over the last 50 years, their incomes could potentially make nonparticipation more affordable for their husbands. However, less than a quarter of prime-age men who are not in the workforce have a working spouse, and that figure has declined (Figure 5).

Figure 5. Share of prime-age men with spouse in the labour force

Rising reliance on government assistance, another oft-cited hypothesis, also does not appear to be consistent with the data. Access to programmes like welfare and food stamps has become more limited for non-participating men, and receipt has fallen as a result.

Disability insurance may be an important alternative income source, since Social Security Disability Insurance (SSDI) receipt rates have been rising among prime-age men. However, from 1967 until 2014, prime-age male SSDI receipt rose from 1% to 3%, not nearly enough to explain the 7.5 percentage-point decline in the labour force participation rate over that period.

CEA quantifies two counterfactual scenarios (Figure 7) – one based on the causal impact of SSDI on participation, and one in which we assume SSDI recipients participate at the same rate as workers who report a disability but do not receive SSDI. These counterfactuals suggest that SSDI increases may have contributed at most 0.3 to 0.5 percentage points to the 7.5 percentage-point decline.

Figure 6. Possible effects of disability on prime-age male labour force participation

Time use data suggest that non-participating prime-age men are, on average, not dropping out of the labour force to specialise in home production or to invest in skills to improve their future labour market opportunities. Rather, non-participating men spent almost twice as much time on leisure activities as prime-age men overall. Moreover, detachment from the labour force dramatically increases the likelihood that a prime-age man lives in poverty; more than 60% of nonparticipating prime-age men had incomes below 200% of the Federal poverty line in 2014.

2. Demand-driven explanations

A significant weakness of labour supply explanations is that they cannot account for both falling workforce participation and lower relative wages. If less-educated men who have seen the steepest declines in participation were simply choosing to work less, this should raise the relative wages of the less-educated men who choose to continue participating in the workforce. But the opposite has happened – less-educated Americans have suffered a reduction in their wages relative to other groups, suggesting that the demand curve for less-skilled labour has shifted, simultaneously reducing employment and wages.

Many studies have identified declining labour market opportunities for low-skilled workers and related stagnant real wage growth as the most likely explanation for the decline of prime-age male labour force participation, at least for the period in the mid-to-late 1970s and 1980s.2

This labour demand shock would result in firms paying lower wages to their workers, some of whom are unwilling to work at these wages and drop out of the labour force. CEA analysis finds that state-level labour force participation rates for prime-age men are associated with the absolute and relative levels of wages. Interpreting this as a demand shift is consistent with both inequality and participation being affected by a common shock, like technological change or globalisation.

3. Institutional explanations

All advanced economies have faced similar changes in technology and globalisation, but the US has seen a larger decline in prime-age male labour force participation rates than just about any other advanced economy, along with a larger increase in inequality. This suggests that these changes cannot be explained by supply and demand factors alone but must also depend on institutional differences between different countries and how they have processed their common demand shock.

US labour market institutions in international context

The US has the types of flexible labour markets that traditional economic prescriptions recommend for a well-functioning labour market. The US has the lowest level of labour market regulation, the fewest employment protections, the third-lowest minimum cost of labour, and among the lowest rates of collective bargaining coverage among OECD countries. In the US, as displayed in Table 1, governments and institutions (such as labour unions) place relatively few barriers in the way of employers who want to change who they employ and what they pay.

Table 1. Labour market flexibility

While these factors suggest that labour force participation in the US should be higher, other features of the US labour market push in the opposite direction, particularly a low level of ‘supportiveness,’ as shown in Table 2. The US spends much less on ‘active labour market policies’ such as job-search assistance and job training than every other OECD country except Chile and Mexico. These policies provide better incentives for individuals in other countries to stay attached to the labour force by providing more support during unemployment and making re-employment more likely through skill-building. The US also provides fewer subsidies for childcare, has a higher tax wedge on secondary earners, and is the only advanced economy to not provide paid leave.

Table 2. Labour market support

This simple comparison does not, by itself, explain the difference in structural performance of the US labour market for prime-age workers and the performance in other countries. But it does suggest that a successful labour market requires, at the very least, not just flexibility but also policies or institutions that both encourage unemployed workers to remain attached to the labour force and support their re-entry into the workforce.

Incarceration and criminal records

Another major difference between the US and other OECD countries is the rise of mass incarceration. Those who emerge from the criminal justice system suffer stigma, hiring restrictions, and reduced ability to work as a result.

The US has the highest share of its population in prison out of all nations, other than the Seychelles, and is nearly five times the OECD average, as shown in Figure 7.

Figure 7. Incarceration rate by OECD country, 2015

The direct effect of increased incarceration is to actually increase the reported participation rate because the official statistics omit prisoners. However, the indirect effect of increased incarceration rates is to reduce the participation rate, as these men tend to face substantially lower demand for their labour after they are released from prison and are often barred from jobs due to restrictions on hiring those who have been incarcerated.

Policies that can boost labour force participation for prime-age men

While a higher participation rate is not an end in and of itself, the reduced participation rate for prime-age men in the US presents a number of challenges, with implications for fiscal sustainability, social security solvency, and other issues. President Obama has outlined a number of policies that would help boost participation in the workforce among prime-age men, including:

- Boosting aggregate demand, including improving automatic stabilisers and investing in public infrastructure;

- Strengthening the ‘connective tissue’ in the US labour market by, for example, reforming the Unemployment Insurance system and expanding wage insurance;

- Changing Federal tax policy to help to promote work, including expanding tax credits for low-income workers3 and creating a new tax credit that would reduce the effective penalty imposed on some secondary earners;4

- Increasing workplace flexibility by increasing access to paid leave and providing more childcare assistance, as well as by reforming occupational licensing requirements;

- Reforms to education and to the criminal-justice system, as well as comprehensive immigration reform; and

- Raising the minimum wage, giving greater support to collective bargaining, and helping to ensure that workers have a strong voice in the labour market.

Authors’ note: This column is based on a new report from the Council of Economic Advisers.

References

Council of Economic Advisers (2015) Occupational licensing: A framework for policymakers.

Eissa, N and J B Liebman (1996) “Labour supply response to the Earned Income Tax Credit”, Quarterly Journal of Economics, (May 1996): 605-37.

French, E and J Song (2014) “The effect of disability insurance receipt on labour supply”, American Economic Journal: Economic Policy, 6(2): 291-337.

Hotz, V J, C H Mullin and J K Scholz (2006) “Examining the effect of the Earned Income Tax Credit on the labour market participation of families on welfare”, NBER, Working Paper No 11968.

Hungerford, T L and R Thiess (2013) “The Earned Income Tax Credit and the Child Tax Credit”, Economic Policy Institute, Policy Brief 370.

Juhn, C and S Potter (2006) “Changes in labour force participation in the United States”, Journal of Economic Perspectives, 20(3): 27-46.

Juhn, C, K M Murphy, R H Topel, J L Yellen and M N Baily (1991) “Why has the natural rate of unemployment increased over time?”, Brookings Papers on Economic Activity, 22(2): 75-142.

Kearney, M S and L J Turner (2013) “Giving secondary earnings a tax break: A proposal to help low- and middle-income families”, The Hamilton Project, Discussion Paper 2013-07.

Marr, C, C-C Huang, A Sherman and B DeBot (2015) “EITC and Child Tax Credit promote work, reduce poverty, and support children’s development, research finds”, Center on Budget and Policy Priorities.

Endnotes

[1] In this column the ‘labour force participation rate’ and other labour market variables are all for men between the ages of 25 and 54 unless explicitly specified otherwise.

[2] See, for example, Juhn et al (1991) and Juhn and Potter (2006).

[3] See, for example, Eissa and Leibman (1996), Hotz et al (2006), Hungerford and Thiess (2013), and Marr et al (2015) for evidence on work promotion through refundable tax credits.

[4] See Kearney and Turner (2013) for evidence on labour supply impacts of secondary earner penalties.