Automation, digitalisation, and artificial intelligence (AI) are progressing rapidly worldwide: robots increasingly substitute for humans in many assembly line tasks; 3D printers are used in the production of customised parts and medical implants; and AI-based models and devices are used to quickly diagnose disease, develop medical remedies, write reports, code, and generate inspiring ideas (The Economist 2014, Ford 2015, Brynjolfsson and McAfee 2016, Hu 2023).

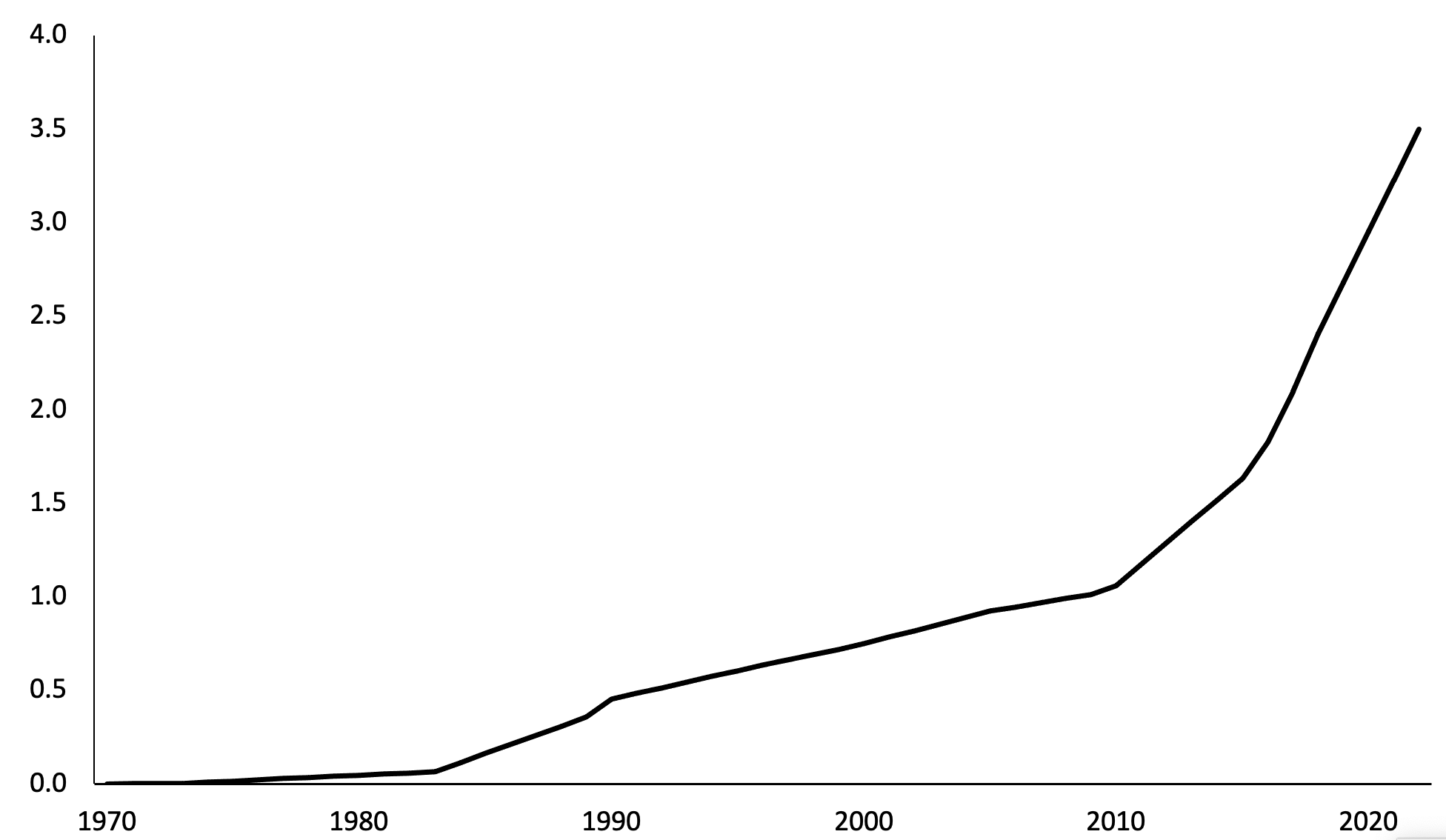

Figure 1 illustrates the growth in automation based on one frequently used data source: the International Federation of Robotics (2016, 2017, 2018, 2022). The number of industrial robots

worldwide was negligible until the early 1990s, but has since increased steeply, by a factor of eight. After the global financial crisis of 2007–2009, the growth rate of the number of robots increased markedly to about 10–15% per year (International Federation of Robotics 2022). Most recently, the number of users of AI-based models has skyrocketed. ChatGPT, for example, surpassed 100 million active monthly users in January 2023, just two months after its launch (Hu 2023).

Figure 1 Worldwide stock of industrial robots (in millions of units)

Notes: International Federation of Robotics (2016, 2017, 2018, 2022) with authors’ interpolations for the years lacking data.

While automation, digitalisation, and AI tend to raise productivity and per capita income (Graetz and Michaels 2018), they also raise several concerns. The first apprehension has to do with the potential for automation technologies and AI to replace human labor, and the associated fears of technological unemployment (Arntz et al. 2017, Frey and Osborne 2017, Abeliansky et al. 2020). A second concern relates to the role of automation and digitalisation in raising inequality levels. Because the corresponding technologies typically complement high-skilled workers but substitute for low-skilled workers, upward pressure is placed on the wages of the former and downward pressure on the wages of the latter, leading to greater wage inequality (Acemoglu and Restrepo 2018, Lankisch et al. 2019). Recent research suggests that AI increases the productivity of low-skill workers proportionately more than the productivity of high-skill workers (Brynjolfsson et al. 2023) in terms of comparable tasks. Nevertheless, AI is used predominantly for tasks that are on average more skill-intensive (see e.g. Marr 2023) such as coding and debugging, language translation, and summarising research results. Humans are, as yet, not perfectly substitutable in these tasks, but are still required for appropriate and effective prompting, and for revising the output produced by AI. This stands in contrast to the use of industrial robots and 3D printers, which are able to perfectly substitute for (predominantly low-skilled) workers. As a consequence, even if AI reduces the performance gap within given tasks, it could still increase inequality at the aggregate economic level.

The third concern has to do with the negative impact of robots, 3D printers, and AI on the labor share of income and its corresponding positive impact on the capital share (Eden and Gaggl 2018, Prettner 2019, Guimarães and Gil 2022a). This is because robots, 3D printers, and AI have properties resembling labour in the production process, and capital in terms of ownership. Thus, their use transfers income from workers to capital owners and thereby reduces the labor income share. A final concern relates to the high electricity requirement of automation – in particular of AI. Because most countries still use fossil fuels intensively in electricity production, this implies a potentially negative impact of automation, digitalisation, and (especially) AI on the efforts to mitigate climate change (Creutzig et al. 2022). Recent estimates by Patterson et al. (2021) and Luccioni et al. (2022) suggest that the training of the large language model GPT-3 required close to 1,300 megawatt-hours of electricity, and led to more than 500 tonnes of carbon dioxide equivalent emissions.

These potentially negative aspects have led to calls for the implementation of ‘robot taxes’ (Dill 2017, Guerreiro et al. 2022, Gasteiger and Prettner 2022). In this context, however, several drawbacks of such a tax should be considered. Most immediate is the issue of what defines a robot and should therefore be used to delineate the tax base. The definition of an industrial robot, which replaces human labor alongside an assembly line, may be clear – but it is definitely unclear for algorithms that replace human labour in targeting ads to customers, in writing texts, or in coding. In addition, because the use of robots, 3D printers, and AI raises productivity, a robot tax that impedes their general adoption would be associated with a loss of per capita income and a reduction in living standards (Prettner and Strulik 2020). Policymakers might instead consider an automation tax, which would only be paid by a firm if and when it automated the production of a task and replaced a worker with a robot (i.e. the automation tax is not paid by firms investing in robots upon entry). Results suggest that a robot tax may have a much more negative impact on employment and wages than an automation tax (Guimarães and Gil 2022b), yet machines are usually not able to replace workers in all tasks, making the assessment of the replacement of workers by machines blurry in practice. Moreover, it might be difficult to distinguish an automation-related job separation from other sorts of separations.

This murkiness raises questions as to whether potential alternatives to a robot (or an automation) tax exist that could achieve similar outcomes without such drawbacks – or would at least minimise them. In the following section, we propose a tax-subsidy scheme that may help alleviate automation-driven inequality and automation-driven emissions by linking them through one consistent policy response.

Solving two problems using one tax

One potential way to ensure a sustainable digital transformation is to link the negative economic and environmental consequences of automation and digitalisation by imposing a higher tax on carbon dioxide emissions and using some of the proceeds thereof to fund schemes for those who suffer negative consequences during the transition. Such schemes could include (1) retraining those who lose their jobs because their skills become obsolete; (2) ensuring more generally that the education system does not leave any children behind with inadequate skills for contemporary labor market success; (3) providing (possibly temporary) public employment for displaced workers who struggle to find new jobs (e.g. Kasy and Lehner 2023, who evaluate such a guaranteed job programme implemented in the Austrian municipality of Gramatneusiedl); and (4) providing social security benefits in terms of unemployment insurance and health insurance for those who cannot get retrained or re-employed for various reasons (see Prettner and Bloom 2020 for an overview on the effects of different policy responses to automation).

If the proceeds are used to reduce distortionary taxes, the effects of such a policy may resemble the double dividend of environmental taxes (Goulder 1995, Bovenberg 1999). The difference is that, in this case, the proceeds of the tax would be used to mitigate increases in inequality – thereby reducing resistance to the adoption of new technologies – and to foster the skill level of the population through education and re-training (e.g. Peralta and Gil 2021, who show that a direct subsidy to low-skilled workers displaced by automation is roughly neutral in terms of economic growth). Both the tax and the subsidy are expected to be beneficial to long-run economic growth.

To summarise, the crucial advantages of a tax-subsidy scheme that links the negative environmental externalities of automation and digitalisation with the undesired inequality effects are as follows:

- The negative pollution externalities of the increasing use of robots and AI could be internalised.

- Those who suffer due to automation and digitalisation during the transition could be compensated (at least partly) by the proceeds of such a tax, which should help contain a further rise in inequality.

- The problem of defining a robot to designate what is being taxed – and all associated bureaucratic complications in executing robot taxation – do not occur.

- The resistance to new technologies that are beneficial on average and at the aggregate level could be reduced, with corresponding long-run benefits for economic growth and development.

- As a consequence of all the previous items, overall living standards could be raised.

- In addition, and in contrast to a pure robot tax, a higher emissions tax would provide an additional incentive to switch from polluting sources of electricity generation to cleaner technologies, thereby fostering their adoption and innovation.

Overall, a tax-subsidy scheme along the lines proposed here could be an important instrument to ensuring a sustainable digital transformation that keeps both emissions and inequality in check.

Conclusions

Automation and digitalisation improve productivity and living standards, but tend to have negative social side effects by creating ‘losers’ from the transformation and negative environmental side effects by increasing emissions due to higher electricity demand. To compensate the losers, robot taxes have been proposed. Even if these taxes could be implemented from a practical perspective, which is highly uncertain, they reduce efficiency and living standards by slowing the adoption of technologies that rely on automation and digitalisation. To overcome this problem and foster a sustainable digital transformation, we propose a policy response that links its two negative side effects – increasing inequality and higher emissions. The environmental externalities from the transition to automation and digitalisation could be internalised by a higher tax on emissions, while the proceeds of this tax could be redistributed to compensate the losers from the transition. Implementing such a scheme would also be helpful for reducing resistance to the new technologies, increasing the skill level of the population, and fostering a transition to cleaner electricity production. All these effects would be in line with the goal of ensuring a sustainable digital transformation. Thus, it is important to start this discussion and to evaluate the effects of such a proposed tax-subsidy scheme quantitatively. Of particular significance is the question of the appropriate size of such a tax and its fiscal impact.

References

Abeliansky, A L, E Algur, D E Bloom, and K Prettner (2020), "The Future of Work: Meeting the Global Challenges of Demographic Change and Automation", International Labour Review 159(3): 285–306.

Acemoglu, D and P Restrepo (2018), "The Race between Man and Machine: Implications of Technology for Growth, Factor Shares, and Employment", American Economic Review 108(6): 1488–1542.

Arntz, M, T Gregory and U Zierahn (2017), "Revisiting the Risk of Automation", Economics Letters 159: 157–160.

Bovenberg, A L (1999), "Green Tax Reforms and the Double Dividend: An Updated Reader's Guide", International Tax and Public Finance 6: 421–443.

Brynjolfsson, E and A McAfee (2016), The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies, New York: W W Norton & Company.

Brynjolfsson, E, D Li and L R Raymond (2023), "Generative AI at work", NBER Working Paper 31161.

Creutzig, F, D Acemoglu, X Bai et al. (2022), "Digitalization and the Anthropocene", Annual Review of Environment and Resources 47: 479–509.

Dill, K (2017), "Bill Gates: Job-stealing robots should pay income taxes", CNBC.com, 17 February.

Eden, M and P Gaggl (2018), "On the Welfare Implications of Automation", Review of Economic Dynamics 29: 15–43.

Ford, M (2015), Rise of the Robots: Technology and the Threat of a Jobless Future, New York: Basic Books.

Frey, C B and M A Osborne (2017), "The Future of Employment: How Susceptible Are Jobs to Computerisation?", Technological Forecasting and Social Change 114(C): 254–280.

Gasteiger, E and K Prettner (2022), "Automation, Stagnation, and the Implications of a Robot Tax", Macroeconomic Dynamics 26(1): 218–249.

Goulder, L H (1995), "Environmental Taxation and the 'Double Dividend': A Reader's Guide", International Tax and Public Finance 2(2): 157–183.

Graetz, G and G Michaels (2018), "Robots at Work", The Review of Economics and Statistics 100(5): 753–768.

Guerreiro, J, S Rebelo and P Teles (2022), "Should Robots Be Taxed?", The Review of Economic Studies 89(1): 279–311.

Guimarães, L and P M Gil (2022a), "Explaining the labor share: automation vs labor market institutions", Labour Economics 75, 102146.

Guimarães, L and P M Gil (2022b), "Looking ahead at the effects of automation in an economy with matching frictions", Journal of Economic Dynamics and Control 144, 104538.

Marr, B (2023), "The Best Examples Of What You Can Do With ChatGPT", Forbes, 1 March.

Hu, K (2023), "ChatGPT Sets Record for Fastest-Growing User Base – Analyst Note", Reuters, 2 February.

International Federation of Robotics (2016), "Executive Summary, in World Robotics 2016 Industrial Robots.

International Federation of Robotics (2017), "Executive Summary", in World Robotics 2017 Industrial Robots.

International Federation of Robotics (2018), World Robotics: Industrial Robots and Service Robots.

International Federation of Robotics (2022), World Robotics Industrial Robots and Service Robots.

Kasy, M and L Lehner (2023), "Employing the Unemployed of Marienthal: Evaluation of a Guaranteed Job Program", CESifo Working Paper No. 10394.

Lankisch, C, K Prettner and A Prskawetz (2019), "How Can Robots Affect Wage Inequality?", Economic Modelling 81: 161–169.

Luccioni, A S, S Viguier and A L Ligozat (2022), "Estimating the Carbon Footprint of BLOOM, a 176B Parameter Language Model", arXiv preprint arXiv:2211.02001.

Patterson, D, J Gonzalez, Q Le, C Liang, L M Munguia, D Rothchild, D So, M Texier and J Dean (2021), "Carbon Emissions and Large Neural Network Training", arXiv preprint arXiv:2104.10350.

Peralta, C and P M Gil (2021), "Automation, Education, and Population: Dynamic Effects in an OLG Growth and Fertility Model", CEF.UP Working Papers No. 2102.

Prettner, K (2019), "A Note on the Implications of Automation for Economic Growth and the Labor Share", Macroeconomic Dynamics 23(3): 1294–1301.

Prettner, K and D E Bloom (2020), Automation and Its Macroeconomic Consequences: Theory, Evidence, and Social Impacts, Amsterdam: Academic Press.

Prettner, K and H Strulik (2020), "Innovation, Automation, and Inequality: Policy Challenges in the Race against the Machine", Journal of Monetary Economics 116: 249–65.

The Economist (2014), "Immigrants from the Future. A Special Report on Robots", 27 March.