According to conventional wisdom, capital flows are fickle (e.g. Bluedorn et al. 2013). They are fickle more or less independent of time and place. Having reached this conclusion, analysts then go on and rank different capital flows according to their volatility. Here the consensus is that foreign direct investment (FDI)-related flows are least volatile, while bank-intermediated flows are most volatile. Other portfolio capital flows are somewhere in between – within this intermediate category, debt flows are generally considered to be more volatile than equity-based flows.

This conventional wisdom is a distillation of the experience of earlier decades. Yet the structure and regulation of international financial markets continue to change. Chinese outward FDI has risen relative to other sources of FDI, for example, raising the question of whether FDI is equally stable regardless of its source. South-South FDI flows have risen more generally. Bank-intermediated flows have fallen as large global banks have deleveraged and curtailed their cross-border operations in response to tighter regulation. Asian bond markets have grown relative to bond markets in other regions. Corporate bond markets have grown relative to sovereign bond markets. International investors have become active in equity markets worldwide.

All this raises the question of whether the conventional wisdom still holds. Some authors suggest that it may not. Blanchard and Acalin (2016), for example, argue that FDI is now as volatile as portfolio capital flows.

In a new paper, we revisit these questions, focusing on emerging markets (Eichengreen et al. 2017). We ask how the magnitude and volatility of various capital flows compare. How have they evolved? What are the observable empirical correlates of different flows?

We analyse trends in capital flows since the 1990s, including in the post-Global Crisis era. While previous studies have mainly utilised annual data largely for reasons of availability and convenience, we work here with quarterly data. This allows us to analyse capital flows at business cycle frequencies and around country-specific sudden stops and global stops, events that are hard to pinpoint using annual data. We consider the principal emerging markets, 34 in number.

Magnitude, persistence and volatility of capital flows

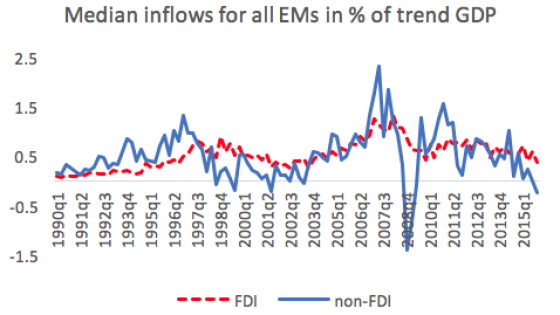

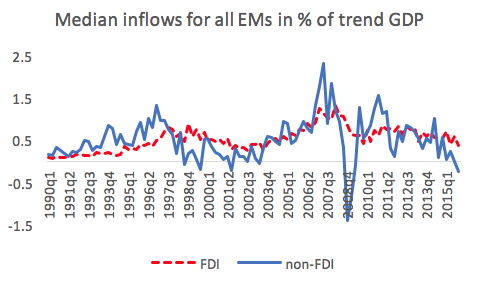

On average, FDI and non-FDI inflows are roughly equal in magnitude. Median average annual flows to an emerging market economy are, respectively, 2.6% and 2.4% of GDP annually (unweighted averages for the 34 sample countries). Within non-FDI flows, other (mainly bank-related) flows are the largest, followed by portfolio debt. The relative magnitude of other flows has declined and that of portfolio debt has increased since the Global Crisis. Portfolio equity flows remain relatively small, averaging 0.2% of GDP over the entire period and just 0.16% a year in the last five years. Outflows are smaller than inflows on average (these being emerging markets).

Figure 1 FDI and non-FDI capital inflows

FDI and non-FDI capital inflows

Components of non-FDI capital inflows

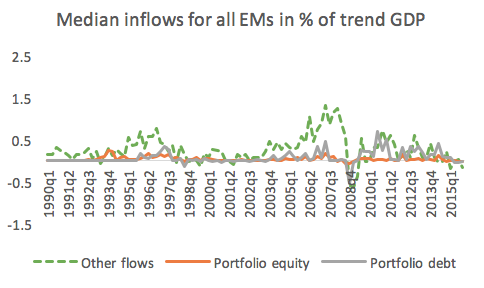

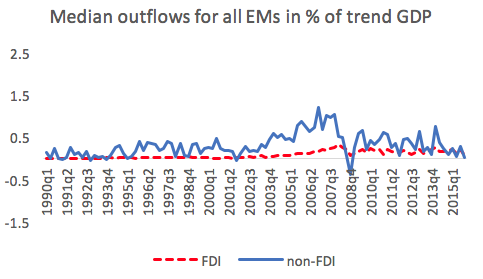

Figure 2 FDI and non-FDI capital outflows

FDI and non-FDI capital outflows

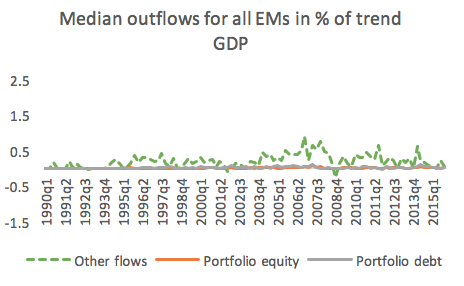

Components of non-FDI capital outflows

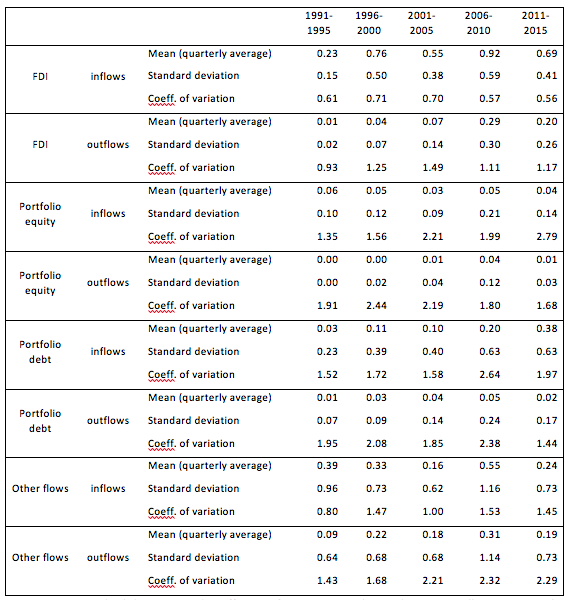

Measuring volatility by the standard deviation and coefficient of variation (adjusting the standard deviation by their mean in the same period), we find that non-FDI flows are relatively volatile. Portfolio debt flows and banking flows are among the most volatile. Non-FDI flows are more volatile than FDI flows and less persistent.

In Table 1, we compare successive five year periods. Portfolio debt inflows rose in 2006-10 and again in 2011-15. Less widely appreciated, FDI outflows from emerging markets rose strongly in 2006-10. Other (mainly bank-related) flows also increased in 2006-10. As for the volatility of flows, the results reveal few changes on the inflow side. Capital inflows into emerging markets are volatile, but not increasingly so. What is new is the growing volatility of outflows from emerging markets, bank-related outflows after the turn of the century, and FDI outflows after 2005 and especially after 2010. That outflows are a growing source of capital account volatility in emerging markets is not adequately appreciated in the literature, in our view.

Table 1 Trends in the magnitude and volatility of capital inflows and outflows

Note: Mean, standard deviation and coefficient of variation are the median across all countries in the sample during respective time period. All capital flows are expressed as % of annual trend GDP.

Stops and flights

Following Eichengreen and Gupta (2016), we classify an episode as a sudden stop when total capital inflows (FDI, portfolio equity and debt, and other inflows by non-residents) decline below the average of the previous 20 quarters by at least one standard deviation, when the decline lasts for more than one quarter, and when flows are two standard deviations below their prior average in at least one quarter. The sudden-stop episode then ends when flows recover to at least the prior mean minus one standard deviation. Analogously, we define an episode of capital flight as a sharp increase in gross outflows by residents. A period qualifies when total capital outflows exceed the average of the previous 20 quarters by at least one standard deviation, when the increase lasts for more than one quarter, and when outflows are two standard deviations above their prior average in at least in one quarter. Capital flight episodes then end when capital outflows decline below the prior mean plus one standard deviation.

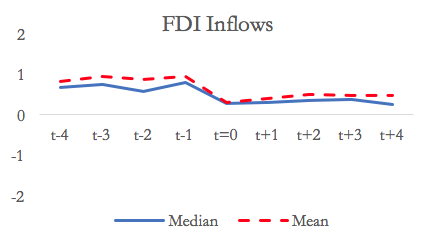

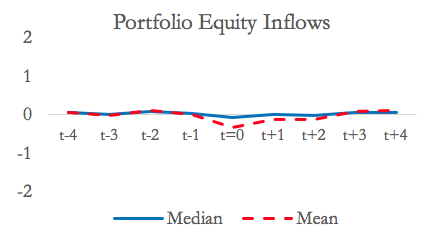

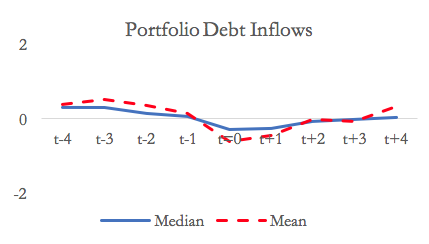

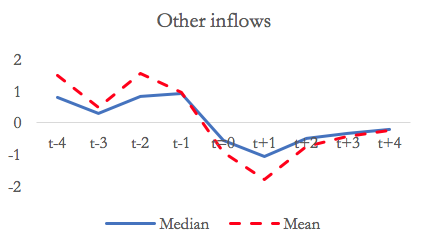

We summarise the behaviour of capital flows around country-specific stops and flights. Portfolio equity, portfolio debt and other inflows all turn negative during sudden stops. The decline in inflows is sharpest for other flows and mildest for FDI. The panels of Figure 3 document these points further. They show that while FDI inflows decline, that decline is small relative to other types of flows, and FDI inflows remain positive during sudden stops. In contrast, average portfolio equity and debt inflows turn negative in sudden stop periods. Although the initial drop is sharp, inflows recover and are back to pre-crisis levels within four quarters. Other flows also turn negative, and recover much more slowly than portfolio equity and debt flows.

Portfolio equity and debt outflows and especially other outflows drop significantly below their average in sudden stops. This suggests that resident flows are stabilising. However, the decline in outflows during sudden stops is smaller than the decline in inflows. So even if the decline in outflows by residents partially offsets the decline in inflows by non-residents, this stabilising impact is incomplete. During periods of capital flight all categories of capital outflow increase – the increase is again largest for other flows, followed by debt outflows. It is smallest for FDI.

Figure 3 Capital inflows around country specific sudden stops

Notes: Figure shows behaviour of respective types of capital inflows, as percentage of trend GDP, around stop periods. t=0 is the first quarter of a stop period. For each period (t-4 to t+4) first the mean is calculated for different sudden stops for a given country. Solid line is the median of the country means, and broken line is the mean of the country means.

Correlates of capital flows

To analyse the drivers of capital flows, we estimate regressions where different types of capital for country-quarter pairs are regressed on global factors, such as the Federal Funds Rate and the VIX, and country specific variables such as GDP growth, capital account openness, financial sector depth, and proxies for the business environment. Regressions are estimated with country-fixed effects and robust standard errors (see Eichengreen et al. 2017 for details).

The results suggest that FDI inflows are driven mainly by pull factors, while portfolio flows are driven mainly by push factors, and bank flows are driven both by push and pull factors. Most types of flows are not strongly correlated with the federal funds rate, excepting portfolio debt inflows (an increase in the US policy rate predictably dampens portfolio debt flows). Higher global risk aversion as measured by VIX reduces non-FDI capital inflows but not FDI inflows (the coefficient of VIX is negative and significant for all non-FDI flows and largest for portfolio debt and portfolio equity flows). FDI seems to be affected more by domestic than external factors – a better investment climate is associated with larger FDI inflows. Growth and the investment climate do not appear to act as pull factors for portfolio flows, in contrast.

We ask whether the effects of these variables have changed recently, using 2003 as the year when the estimated relationship may have changed. We do not find evidence of a change in the coefficients after 2003. Dummies for different periods, before and after 2000, 2008, and 2010 respectively, similarly do not yield significant interactions with the explanatory variables.

We analysed the correlates of outflows analogously. Some of the patterns for outflows are broadly similar to those for inflows. Non-FDI outflows are higher during periods of lower risk aversion. In addition, global risk aversion as measured by the VIX is also a significant determinant of FDI outflows from emerging markets (in contrast to FDI inflows to emerging markets, where the VIX was not significant as noted above). Both FDI and non-FDI outflows are strongly correlated with median global and regional outflows.

One of our key findings is that capital outflows from emerging markets, FDI, and bank-related outflows in particular, have grown not just larger but also more volatile. We can use these regression results to ask which of the significant determinants of these outflows have themselves grown more volatile. The one determinant of outflows that is robustly significant and also become more variable over time is the VIX. The coefficient of variation of the VIX rises by more than half between 1990- 2000 and 2001-2010, although it comes down slightly in 2011-2015, it is still significantly higher than in the earlier 1990-2000 period. There is also an increase in the volatility of GDP growth, which translates in to more volatile capital outflows, in the 2006-2010 period relative to other years, although this change is not statistically significant relative to other periods.

Our findings underscore that emerging markets should treat capital flows with caution, and that outflows from emerging markets, both FDI and bank-related flows, have come to play a growing role and deserve greater attention from analysts and policymakers.

Conclusion

According to conventional wisdom, capital flows are volatile. But different flows exhibit different degrees of volatility. FDI is least volatile, while bank-intermediated flows are most volatile. Other portfolio capital flows rank in between, and within this intermediate category debt flows are more volatile than equity-based flows.

In terms of inflows into emerging markets, our results suggest that most of the patterns identified in earlier work persist. FDI inflows into emerging markets have lower volatility, are more persistent, and decline by smaller amounts in country-specific sudden stop and global stop episodes. Within non-FDI inflows, bank-intermediated flows, which rose in the mid-2000s, are most volatile, least persistent, and decline most sharply during country-specific sudden stop and global stop episodes.

But we also document important changes in the most recent decade, in particular in the behaviour of outflows. FDI outflows from emerging markets have grown and become more volatile. Similarly, there has been a significant increase in the volatility of bank-intermediated capital outflows from emerging markets. In terms of shocks to the capital account of the balance of payments, our findings underscore that outflows from emerging markets, both FDI and bank-related flows, warrant greater attention from emerging-market analysts and policy makers.

References

Blanchard, O, and J Acalin (2016), “What does Measured FDI Actually Measure?” Peterson Institute Policy Brief no. PB16-17.

Bluedorn, J, R Duttagupta, J Guajardo, and P Topolova (2013), “Capital Flows are Fickle: Anytime, Anywhere,” IMF Working Paper no.13/183.

Eichengreen, B, and P Gupta (2016), “Managing Sudden Stops,” World Bank Policy Research Paper 7639.

Eichengreen, B, P Gupta, and O Masetti (2017), “Are Capital Flows Fickle? Increasingly? And Does the Answer Still Depend on Type?” World Bank Policy Research Paper, 7972.