The late, great scholar of crises, Rudi Dornbusch, put it aptly: “In a very rich country you can afford to do very bad things for very, very long.” (Dornbusch and Fischer 2003). The Eurozone is in the process of finding out just how long “very, very long” means.

Despite the recently-announced €100 billion European Financial Stability Facility (EFSF) loan to Spain and the recent Greek elections, the Eurozone periphery may soon need a new large-scale rescue operation. Two likely events may force such rescue operation to avoid a panic:

- Deposit flight, and

- The need to rollover government debt.

Without institutional reform, however, the next rescue package will simply be another link in a continuous process of backstop measures undertaken since 2007.

According to some commentators, the Eurozone has been saddled in a bad equilibrium because the ECB waited too long before using its Big Bazooka and has refused to act as a lender of last resort. They believe that if the next rescue operation were only big enough, the Eurozone drama would come to a happy end (see for instance De Grauwe 2011, Tabellini 2011, and Wyplosz 2011).

We disagree. What ails the Eurozone is neither the ECB’s lack of monetary expansion nor the multiple equilibria syndrome, but rather the tragedy-of-the-commons.

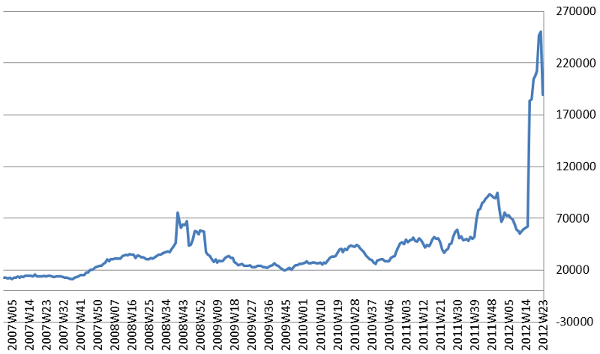

Figure 1. Central bank loans to banks (bn €)

Notes: GIIPS = Greece, Ireland, Italy, Portugal, Spain; GNFL = Germany, Netherlands, Finland, Luxembourg.

Far from waiting too long to act as a lender of last resort, the ECB has presided over a continuous and ongoing expansion of central bank credit to private banks in the periphery. Since 2007, it has increased more than 1000% in Greece, Italy, Ireland, Portugal and Spain (GIIPS for short), as shown in Figure 1. This is massive and unprecedented in the post-war history of Europe.

Without institutional reform to eliminate the tragedy of the commons from the Eurozone architecture, the next rescue package will simply be another link in a chain of difficult decisions forced upon the ECB and European authorities by the urgency to avoid a crisis. Unfortunately, such a rescue package will exacerbate the tragedy of the commons and further delay reforms.

The tragedy-of-the-commons concept has been used to explain the overgrazing of the Commons in the middle ages, the overfishing of the oceans, capital flight, etc. Anywhere property rights are not strictly enforced, agents tend to overuse the common-pool resources, paying attention to the average, rather than the marginal cost that their actions place on society (Tornell and Velasco 1992).

The Eurozone’s version of the tragedy of the commons

Today, we can see the tragedy of the commons transpiring in the Eurosystem, where the ECB and the 17 national central banks share a common pool of money demand. The Eurosystem is not a unitary textbook decision-maker.

- Interest rates are set in a centralised fashion by the ECB’s governing board, but

- Each national central bank has de facto power over the expansion of central bank credit to banks in its jurisdiction.

Generally, a private bank can borrow from its national central bank as long as the bank (i) is financially sound and (ii) has eligible collateral. What opens the door to the tragedy of the commons is the way in which these conditions are implemented:

- Supervisory powers reside with national authorities, not with the ECB in Frankfurt.

Thus, the decision of whether a bank is financially sound or not is made by the country’s regulatory authority, not by the ECB. This is a small, but important distinction.

- Eligibility criteria for collateral have been relaxed significantly.

Before the 2008 crisis there was a minimum rating of A-. In October 2008, it was reduced to BBB- and by July 2011 was completely abolished in Greece, Ireland, and Portugal. Finally, in November 2011 the ECB allowed seven national central banks to “accept as collateral performing credit claims that do not satisfy ordinary eligibility criteria.” In Italy, for instance, “leasing and factoring companies, including those without a banking license, will be considered as valid providers of pledge.” France will start to accept residential mortgages as well as dollar-denominated assets. Spain will accept some foreign loans not subject to Spanish law, “subject to individual legal assessment.” Ireland and Portugal will accept unsecured consumer loans and mortgages.

How the marginal and average cost diverge for national central banks

To see how the combination of local supervisory power and relaxed collateral rules sets the stage for the tragedy of the commons, consider a bank that has a capital shortfall and can’t access the market. Most likely, the country’s regulatory authority will have an irresistibly strong temptation to avoid declaring this bank insolvent and having the country incur 100% of the bailout costs. Instead of being the purveyor of bad news, the national central bank has the alternative of extending credit to the insolvent bank – by printing money – and passing the likely costs onto others, the Eurozone.

The continuous and on-going central bank credit expansion in the Eurozone’s periphery has been facilitated by several non-standard policy instruments:

- All-you-can-borrow central bank tenders

- The Target2 clearing system

- Three-year Long Term Refinancing Operations (LTROs)

- Emergency Liquidity Assistance programs (ELAs )

- The ESFS and the soon-to-be-ratified European Stability Mechanism (ESM).

Full-allotment tenders: Before the financial crisis, the total amount of credit that the Eurosystem would extend to banks was set by the ECB’s governing board. But “full allotment tenders” were introduced in October 2008, for MROs, and May 2009, for LTROs. Under these tenders, rather than fixing the total quantity of credit to be tendered, the ECB announces an interest rate and “solvent banks” can borrow as much as they want from their national central banks, against eligible collateral and applicable haircuts.

TARGET2: Via Target2 – introduced in November 2007 – the national central bank’s of the Eurozone’s periphery have effectively been able to borrow from other central banks. Target2 is a platform for international transfers in Europe. In this way periphery national central banks can print more money than they could were they limited by the money demand in their jurisdictions. The part of the printed money that is wired to other countries is recorded by the ECB as TARGET claims and TARGET liabilities. By the Target mechanism, the domestic pool of money demand is extended to become the Eurozone-wide pool of money demand for each country, thereby generating a common-pool problem (Sinn 2011).

As Figures 1 and 2 reveal, there is a striking correspondence between the increase in Target2 liabilities and the expansion of central bank credit across the periphery countries: both have surpassed €800 billion.

Figure 2. Net target balance with the Eurosystem (bn €)

Notes: GIIPS = Greece, Ireland, Italy, Portugal, Spain; GNFL = Germany, Netherlands, Finland, Luxembourg.

LTROs: In November 2011, the Target2 channel reached a limit because the national central banks in creditor countries were no longer able to significantly reduce further credit to their domestic banks. To overcome this limit, the ECB issued €1000 billion cheap loans with a three-year maturity via two full-allotment tenders in December 2011 and February 2012. This non-standard policy – often referred to as the Big Bazooka – lead to a nearly €500 billion increase in the stock of central bank loans to banks (Tornell and Westermann 2011).

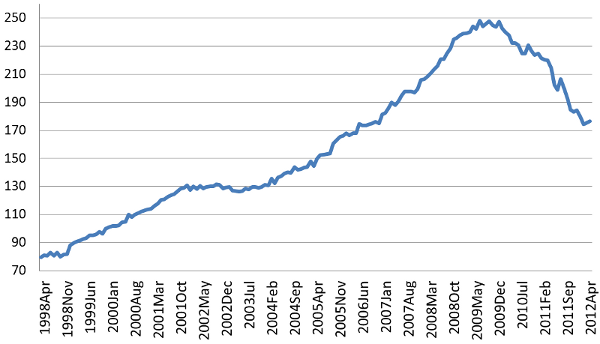

Emergency Liquidity Assistance (ELAs): These programmes have been used when banks run out of collateral. Under an ELA, a national central bank can issue credit not against collateral, but only against a government guarantee. Formally, a national central bank issues such credit at its own risk. The ECB classifies ELAs under “other claims” As can be seen in Figure 3, the other-claims item in the ECB balance sheet has increased sharply in April 2012 to €240 billion, a more than 300% jump in a single month.

Figure 3. Other claims, including ELAs (bn €)

Each of these non-standard ECB policies, in isolation, has succeeded in stemming a particular funding crisis. However, with few exceptions, these ECB policies have not been accompanied by structural and fiscal reforms.

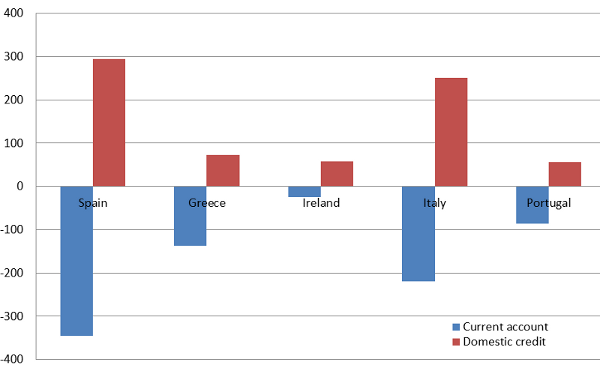

The lack of reform has been reflected in persistent current-account deficits, which record the excess of spending over income of a country. When private capital inflows reverse in a persistent way, a country should respond by reducing its expenditures, via a reduction in its fiscal deficit, consumption or investment. Historically, either the country implements the adjustment or the market forces such an adjustment on the country. This pattern, however, is not what we see in the Eurozone’s periphery. With the exception of Ireland, the current accounts of the periphery are still in deficit, almost four years since the onset of the 2008 crisis. The persistence of the current-account deficits has been made possible by the continuous expansion of central bank credit in the periphery. As we can see in Figure 4, over 2007-2011, the cumulative current-account deficit in each country is very close to the cumulative increase in central bank credit (with the exception of Ireland).

Figure 4. Cumulative current account vs. change in central bank credit since 2007 (bn €)

What is next?

On 6 June, when addressing the issue of whether a new LTRO would be effective, ECB’s president Draghi said “I do not think that it would be right for monetary policy to compensate for other institutions’ lack of action.” In Spain, the ESFS has come to the rescue and maybe the ESM, currently ratified in the parliaments of Europe, might come next. The question is whether the ECB will withstand the pressure to act if these resources turn out to be insufficient.

A run on bank deposits might force the ECB to implement another round of liquidity injection into the Eurozone’s periphery. This process started in Greece in 2010 and has recently started in Spain. In Greece, households and firms deposits have declined 30% from their peak in December 2009, as shown in Figure 5.

Figure 5: Deposits of non-MFI's in Greece (bn €)

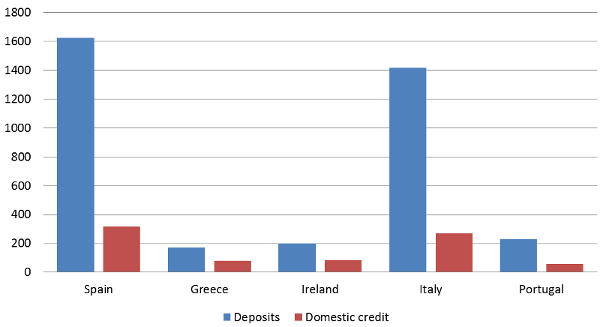

To eliminate the possibility of a run on deposits, periphery governments would need to have enough access to fresh funds to backstop a significant share of banks’ deposits. If we exclude deposits from governments and other financial institutions, as of April 2012 there were €1600 billion deposits in Spain, €1400 billion in Italy and €3638 billion across the periphery countries, in total (shown in Figure 6).

Figure 6: Deposits (excluding government) and Central Bank Credit (bn €)

The actual backstop that might be needed is likely to be lower than €3.7 trillion. However, even if it were only 20%-30% of deposits, the necessary backstop would be around €1000 billion. This number is huge compared to the €100 billion that Spain just received from the ESFS. It is also large, compared to the amount of central bank credit the countries have given so far.

In developing countries central bank credit expansions end up in severe crises rather quickly. This has not been the case in the Eurozone yet. As Rudi Dornbusch said, in very rich countries policies intended to delay adjustment can last for very, very long. More aid packages are not the solution, but might instead be the cause of an eventual deeper crisis.

References

De Grauwe, Paul (2011), “The European Central Bank as a lender of last resort”, VoxEU.org, 18 August.

Dornbusch, Rudi and Fischer, Stanley ( 2003), "International Financial Crises,"CESifo Working Paper Series 926, CESifo Group Munich.

Guido Tabellini (2011) “Why the ECB needs to care about financial stability”, VoxEU.org, 29 November.

Sinn, Hans-Werner (2011), "The ECB’s stealth bailout", VoxEU.org, 1 June.

Tornell, Aaron and Velasco, Andes (1992), "The Tragedy of the Commons and Economic Growth: Why Does Capital Flow from Poor to Rich Countries?", Journal of Political Economy, 100(6):1208-1231.

Wyplosz, Charles (2011), “They still don’t get it”, VoxEU.org, 22 August.