Bonds are in vogue. They have enjoyed spectacular returns over the past 35 years and are seen as a hedge against all the recent political, macroeconomic, and market turmoil. Certainly demand is very high, driving down yields.

But does this preference for bonds really make sense? If one applies common techniques for evaluating performance – perhaps risk and return over a historical window of a few decades – then yes, bonds have been a fantastic investment since 1982.

However, a longer historical perspective reveals dangers that may well come to haunt bond investors, particularly those required to buy and hold bonds, such as insurance companies and pension funds.

Historical bond performance

Bonds offer nominal safety. Despite occasional expressions of concern by the rating agencies, it is fairly hard to imagine circumstances in which independent countries like the US, Japan or UK, in charge of their own currency, would choose to default on their bonds. However, developed countries historically have had fewer qualms about deflating away their debt. Therefore, it is real returns we should focus on.

Consider the real return on buying a 30-year US government bond and holding it to expiry.

If we started in 1945, we would have lost 49% of our money.1 The late 1970s were especially problematic, with losses of up to 45% coming between 1975 and 1982, as recently noted here on Vox by Naumer (2016).

Of course with more fortuitous timing, commencing investing in 1920, our investor would have more than quintupled her money by 1940, though losses after that would have reduced her real return to 3.4 times by expiry in 1950. Recent returns are even more dramatic and her wealth would have increased 11 times if she had bought in 1982 and held until expiry, with typical annual real returns of 8.5%.

The source of the dramatic differences in performance in 1920, 1940, and 1982 is inflation and the impact of the starting yield.

After WWII, the US government was heavily indebted because of war expenditures and decided to deflate the value of its debt, creating 18.1% inflation in 1946 and 8.8% in 1947. Subsequently in the late 1960s and 1970s inflation again became high over an extended period, hitting a peak of 12.5% in 1980 and with prices rising 2.8 times between 1970 and 1985.

This became a huge political issue in the US, and quite embarrassing for the political and central bank authorities. This led to President Nixon, campaigning for his second term in office, announcing that the rate of increase of inflation was decreasing; this is perhaps the only time a sitting president has used a third derivative to advance his case.

Eventually the authorities had enough and with the political mandate to kill inflation issued by President Carter, on 6 October 1979 Paul Volcker held a Saturday night news conference, dubbed the ‘Saturday day massacre’, and increased the discount rate above 13%.

Soon after, both interest rates and inflation were trending downwards, serving as the main driver for the extraordinary 8.5% annual real returns of the past 35 years.

Prospects for fixed income

For fixed-income investments to enjoy anything close to that, we need inflation to continue its decline and interest rates to follow, which appears highly unlikely due to the zero-rate bound.

OK, interest rates may fall a little more, and perhaps slightly below zero, but as yields get more and more negative, it becomes increasingly difficult to prevent investors from holding cash instead.

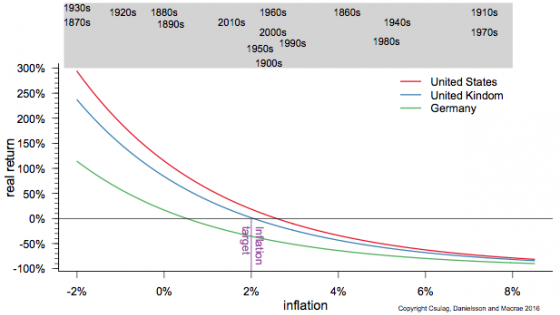

What is likely to happen? Consider the real return on 30-year US, UK, and German government bonds if held until maturity and discounted by inflation. These bonds currently yield 2.58%, 2.05%, and 0.52%, respectively.[2]

The results are summarised in Figure 1 as a function of inflation, with average US inflation rates per decade and the 2% inflation target superimposed.

Figure 1 Real returns on 30-year bonds held until maturity

Perhaps the most interesting scenario is the case where the central banks simply hit their targets. A rational buy-and-hold investor who trusts the central banks should not buy long-dated bonds. While a high degree of central bank credibility used to be important to bond holders, today this seems to be no longer the case, especially for those buying German bonds.

The only way to get decent long-term returns with current yields so low is to go back to the persistent deflation of the gold standard, because most post-war inflation rates imply losses. For example, there are only eight years in Germany with lower than breakeven inflation for our 30-year buy-and-hold investor today.

In 1980 inflation and yields were high, and indebtedness was low. In 1950 indebtedness was high and yields and inflation were low. It is clear which of these states we resemble the most at present, and consequently investors know whether the 1980s real return of +6.4% or the 1950s return of -2.4% is a more plausible forecast for the next 30 years.

Conclusion

Real safety should matter more than nominal safety. Either bond investors disagree, or they have been hypnotised by the alluring returns of the last 33 years and have failed to notice that the circumstances that gave rise to these returns no longer apply.

Some commentators argue that low interest rates are here to stay, but we see no convincing reason to agree.

While recently there has been a strong consensus on the need to stimulate developed economies and ultra-low interest rates have been the dominant policy tool, on a timescale of decades it is unlikely that either will persist. Additionally, we are very close to a hard lower bound. At best, inflation will stay around zero, but more likely it will either hit the central bank target rates or rises even higher within the next 30 years.

Perhaps bond investors clearly understand these dangers and are set to sell bonds in vast quantities at the first whiff of higher inflation. In that case, we should anticipate a very large bond crash, so large that it potentially exceeds anything we have seen over the past few decades. Such a scenario constitutes a significant systemic risk.

Alternatively, the pension funds and insurance companies who are the most likely victims of inflation rising above zero will react more slowly, and as in the 1950s, 1960s and 1970s, will take their losses in the form of ‘death by a thousand cuts’.

Either way the outlook seems rather poor. Low interest rates may have provided a short-term stimulus, but among other costs, have adverse implications implications for future systemic risk and the solvency of bond investors.

Authors’ note: We thank the Economic and Social Research Council (UK). Grant number ES/K002309/1.

References

Dimson, E., P. Marsh and M. Staunton (2002), Chapter 6 in Triumph of the Optimists: 101 Years of Global Investment Returns. 1st ed. Princeton, NJ: Princeton University Press, pp. 74-75.

Naumer, H.-J. (2016), “If you want more equality, you have to embrace the risk premium”, VoxEU.org, 8 June.

Endnotes

[1] Source: Global Financial Data (www.globalfinancialdata.com).

[2] Source: Bloomberg Terminal.